The stock market witnessed a strong upward momentum, surging by nearly 50 points and reclaiming the 1,250 level. However, this rally was short-lived as strong resistance emerged at this level, causing the market to falter and fail to extend its winning streak.

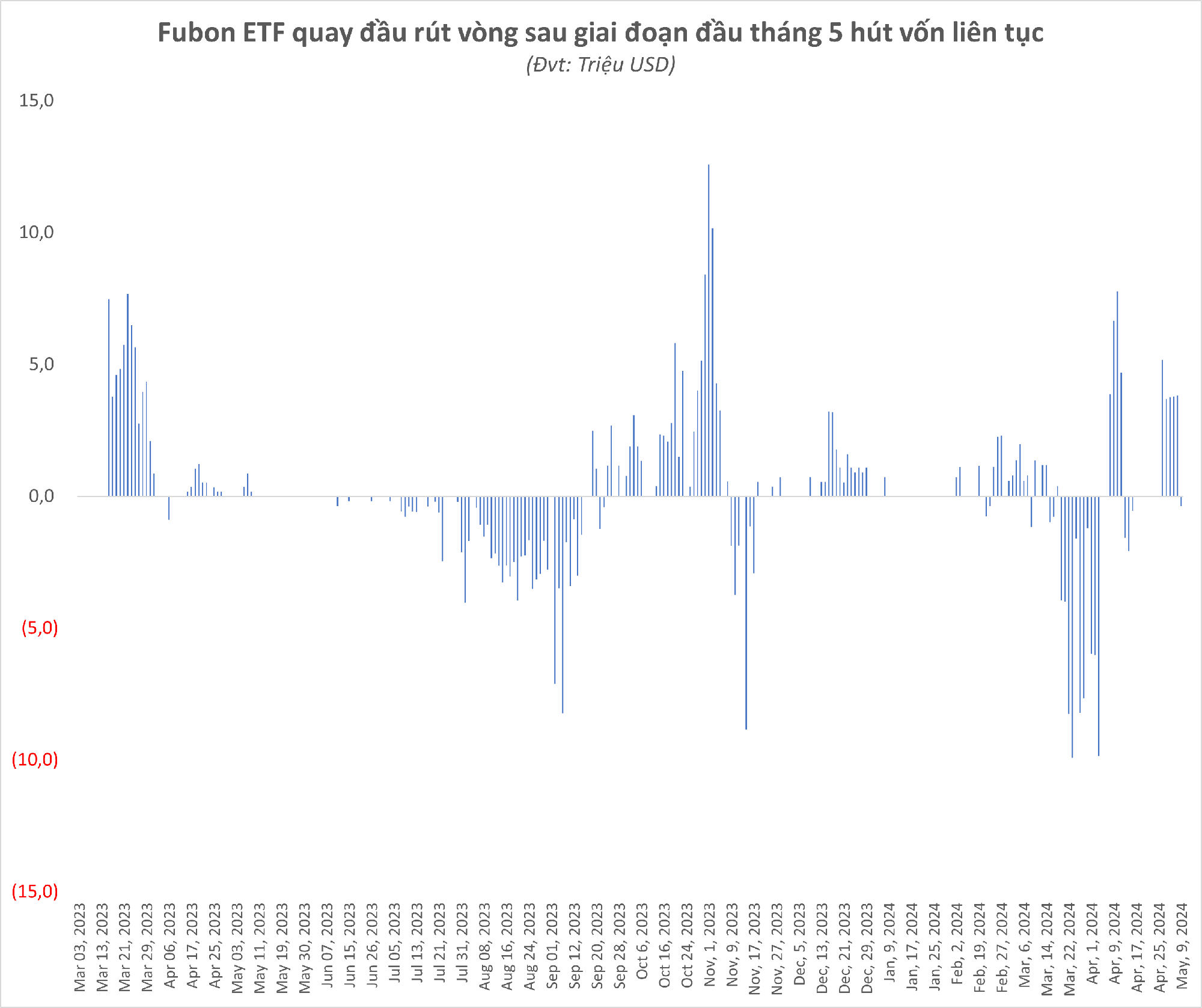

Foreign investors’ trading activities added to the downward pressure, as they aggressively sold off their holdings, resulting in a net sell-off worth thousands of billions of dong across the entire market. This selling pressure likely originated from both institutional investors and large ETFs operating in the market. Notably, the Fubon FTSE Vietnam ETF experienced unexpected outflows after a period of robust capital inflows.

On May 9, the Fubon FTSE Vietnam ETF witnessed outflows of 1 million fund certificates, equivalent to approximately 10 billion dong.

Prior to this outflow, the Fubon FTSE Vietnam ETF had been attracting net inflows since April 26, consistently for four consecutive days in early May. During this period, the ETF accumulated net inflows of over 21 million USD (approximately 524 billion dong), all of which were invested in Vietnam’s stock market.

Despite the outflow on May 9, the cumulative net inflows into the Fubon ETF since the beginning of 2024 until the end of the trading session on May 9 remained positive at 9 million USD.

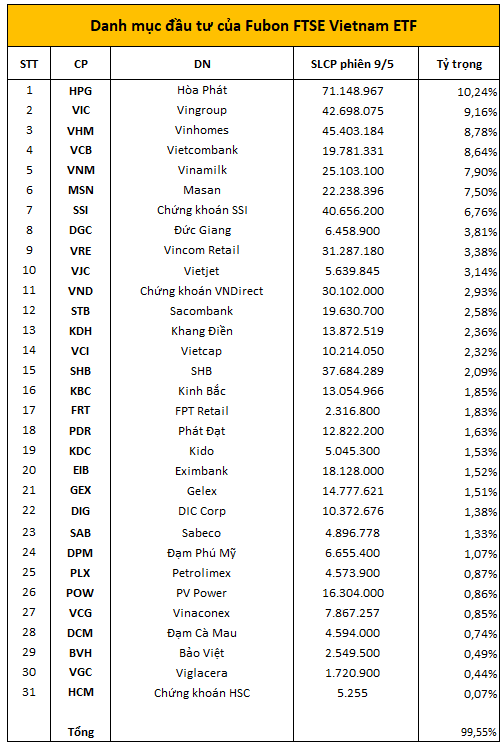

As of May 9, the Fubon FTSE Vietnam ETF’s portfolio value stood at over 26.97 billion New Taiwan Dollars, equivalent to more than 831 million USD (approximately 21.1 trillion dong). The fund invests exclusively in Vietnamese stocks, tracking the FTSE Vietnam 30 Index as its benchmark.

HPG is currently the largest holding in the portfolio, with a weight of 10.24% (holding 71.1 million shares), followed by VIC (42.7 million shares, 9.16%), VHM (45.4 million shares, 8.78%), VCB (19.8 million shares, 8.64%), and VNM (25.1 million shares, 7.9%)…