Foreign investors today net sold a large amount of VHM shares, amounting to over VND 1,105 billion, in a deal that took place after the official trading hours. This pushed the total net selling value of foreign investors today to a record high of VND 1,706 billion, marking the 27th consecutive session of net withdrawals. Even excluding this large transaction, foreign investors still net sold nearly VND 450 billion worth of shares in other stocks. With this significant sell-off, the VN-Index closed down 0.15%, ending its six-day winning streak.

Today’s trading session was similar to yesterday’s, except that the large-cap stocks failed to push the market into positive territory. The VN30-Index closed down 0.26%, with the biggest losers among the large-cap stocks being VCB, down 0.54%; BID, down 0.6%; HPG, down 0.81%; GAS, down 1.68%; and FPT, down 0.53%. On the other hand, four out of the ten largest stocks by market capitalization managed to post gains, with VHM up 0.12%, CTG up 0.92%, TCB up 0.52%, and VPB up 1.08%.

However, the performance of the blue-chip stocks improved in the afternoon session compared to the morning. At the close, the VN30 basket had 13 gainers and 16 losers (compared to only 4 gainers and 22 losers in the morning session). The VN30-Index closed down slightly by 0.26% (compared to a loss of 0.64% in the morning session). Today’s trading session felt weaker due to the lack of green on the screen.

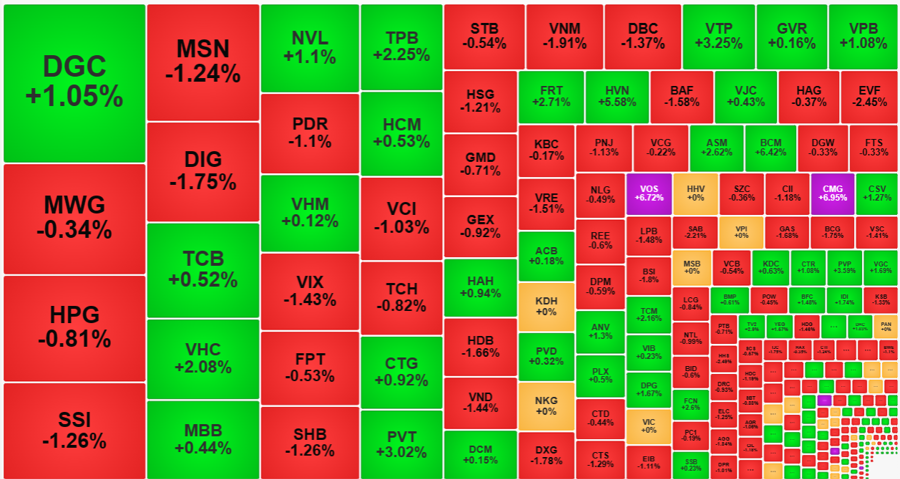

In terms of breadth, the market remained in a tug-of-war similar to yesterday. The VN-Index ended with 201 gainers and 241 losers, a significant improvement from the morning session (149 gainers and 255 losers). However, the high-volume selling in many stocks put downward pressure on the market. Out of the 50 most liquid stocks on the HoSE, with volumes exceeding VND 100 billion, 27 stocks posted losses. Notable losers included MWG (-0.34%), HPG (-0.81%), SSI (-1.26%), MSN (-1.24%), DIG (-1.75%), PDR (-1.1%), and VIX (-1.43%), all of which traded over VND 300 billion in volume.

Among the 241 declining stocks on the HoSE, 97 stocks fell by more than 1% and accounted for nearly 32% of the total trading volume on the exchange. This confirms that the deep declines were driven by significant selling pressure. It is not easy to push down the prices of highly liquid stocks by multiple price levels or more than 1% without substantial selling.

On the other side, the advancing stocks were mostly mid- and small-cap stocks, as the money flow was limited and did not favor large-cap stocks. VPB and TPB were the only two large-cap stocks that posted strong gains with high volume. Other notable gainers included DGC, up 1.05% with a volume of 881.4 billion VND; VHC, up 2.08% with a volume of 356.6 billion VND; NVL, up 1.1% with a volume of 343.8 billion VND; PVT, up 3.02% with a volume of 227.9 billion VND; FRT, up 2.71% with a volume of 139.4 billion VND; HVN, up 5.58% with a volume of 135 billion VND; and ASM, up 2.62% with a volume of 102.5 billion VND…

The weakness in large-cap stocks and the narrow range-bound movement of the market index encouraged money flow to seek safer opportunities in mid- and small-cap stocks or illiquid stocks. The best-performing stocks in this group traded with limited volume, with CMG, VNS, PSH, VOS, AGM, PVP, and FMC seeing volumes ranging from a few billion to a few dozen billion VND, but their prices rose by more than 3% to the maximum daily limit.

The weakening money flow and its shift towards mid- and small-cap stocks caused a nearly 11% decrease in liquidity on the two exchanges in the afternoon session compared to the morning. The HoSE saw a decline of over 9%. Combined, the matched-order trading volume on the HoSE and HNX in the afternoon session was 16% lower than the previous session, reaching VND 18,050 billion.

The positive sign is that the selling pressure has not spread across the board but has been concentrated in a limited number of stocks. If there were larger sell-offs, the volume would have been much higher, and the decline would have been more widespread. As mentioned earlier, the afternoon session actually saw an improvement in stock prices compared to the morning. Bottom-fishing demand remained present, with more than 39% of the stocks on the HoSE recovering by at least 1% from their intraday lows. After six consecutive gaining sessions, profit-taking is expected, but sellers are still selective in their selling prices, choosing to sell at advantageous levels rather than at any price.