The global financial markets witnessed a significant milestone as the Dow Jones closed above 40,000 points for the first time in history on Friday, May 17th.

The Dow Jones ended the week with a 1.2% gain, marking its fifth consecutive weekly increase. Similarly, the S&P 500 and Nasdaq also rose 1.5% and 2.1%, respectively, last week and are currently at all-time highs.

This performance might leave Vietnamese investors feeling a bit envious as they look at the VN-Index, which has also seen four consecutive gaining sessions and closed at its highest level in a month. Since the beginning of the year, the VN-Index has risen nearly 13% to over 1,270 points. However, Vietnam’s main stock market index still has a long way to go to reach its historical peak.

For many years, the 1,100-1,300 point range of the VN-Index has become a bit “boring” for Vietnamese investors, especially the haunting 1,200 mark. The index has been oscillating within this range like a “rollercoaster.” Unfortunately, the time spent by the VN-Index below this range has often been longer than the brief periods when it managed to climb above it.

Stark Differences in Market Composition Lead to Contrasting Performances

The comparison is only for reference as there are numerous differences between the Vietnamese and US stock markets in terms of macroeconomic context and market internals. One of the most significant differences lies in the market composition, which creates a clear divergence between the VN-Index and US stock indices like the Dow Jones, S&P 500, and Nasdaq.

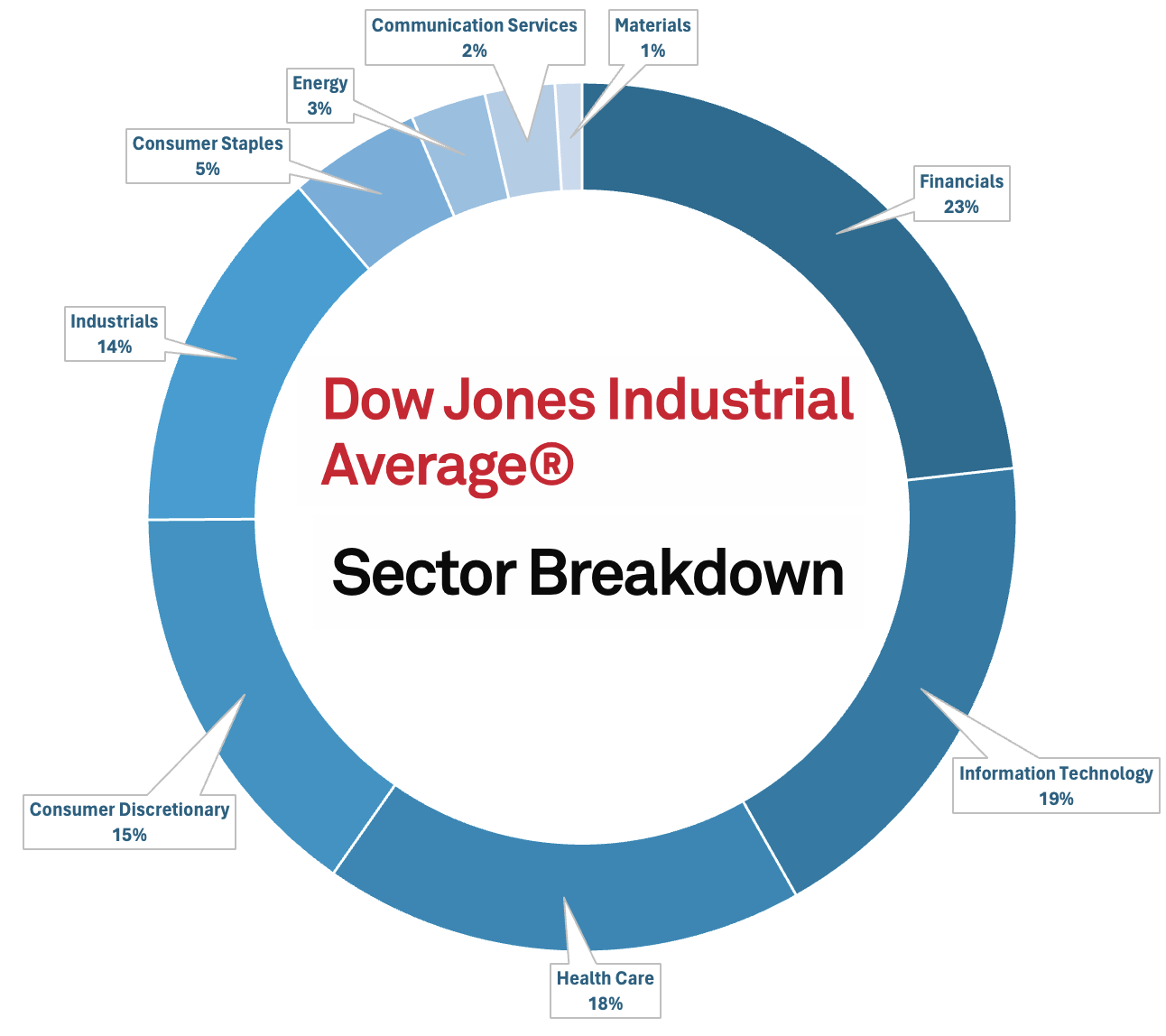

In the US stock market, the sectors with the highest weights are technology, healthcare, retail, consumer goods, and telecommunications. These sectors are considered to have strong long-term growth potential and are aligned with global development trends.

The financial sector still holds a significant but not overwhelming weight, accounting for about 13% of the S&P 500 and 23% of the Dow Jones. The real estate sector’s weight is almost negligible. These sectors are cyclical in nature and may struggle to maintain high and consistent growth over the long term in the context of the US economy.

In contrast, the Vietnamese stock market is heavily dominated by the financial and real estate sectors, which account for approximately 60% of the market. Daily trading activities are also largely concentrated in these two sectors. Excluding the US, even within the region, it is rare to find a market with such an imbalanced sector composition. Notably, these two sectors are highly dependent on monetary policy and the cycles of money injection and withdrawal.

In reality, while Vietnam has favorable conditions for real estate development, timely measures have been taken to prevent a “bubble” after a period of rapid growth. Additionally, tighter discipline in the stock market (both equities and bonds) has significantly impacted real estate businesses. This has even partly affected the prospects of the banking sector due to the pressure of bad debts and declining asset quality.

On the other hand, the “hot trend” sectors such as technology, healthcare, and retail have limited representation in the Vietnamese stock market. The technology sector accounts for only about 3%, while the retail sector makes up around 2%. Notable names in these sectors can be counted on one hand, including FPT, CMG, MWG, PNJ, and FRT. As for the healthcare sector, prominent names are mostly in the form of “private equity.”

Overall, the differences in market composition are challenging to bridge in the short term. New listings from privatization and state capital divestment are expected to contribute to a more balanced sector representation, but there are still many obstacles. There are also not many prominent private enterprises left to become potential market heavyweights.

Therefore, it wouldn’t be surprising if the VN-Index continues to oscillate around the 1,200-point mark in the future. Market differentiation is inevitable in Vietnam’s stock market, and there will certainly be stocks that consistently move higher thanks to their solid fundamentals rather than relying solely on speculative waves.