In its latest announcement, the Hanoi Stock Exchange (HNX) revealed that POM shares of Pomina Steel Joint Stock Company will officially trade on the UPCoM exchange starting May 23. The reference price for the first session is VND 2,800 per share.

Previously, all 279.67 million POM shares were delisted from HoSE on May 10, 2024, after 14 years of listing. The reason for the delisting was Pomina Steel’s violation of late submission of financial statements for three consecutive years, falling under the mandatory delisting case as stipulated in Point i, Clause 1, Article 120 of Decree 155/2020/ND-CP dated December 31, 2020. The closing price on the last trading session on HoSE was VND 2,810 per share.

Pomina Steel, established in 1999, is one of the three chains of billet and construction steel mills with a total annual capacity of 1.1 million tons of construction steel and 1.5 million tons of billets. The company was once one of the largest construction steel manufacturers in Vietnam, with a market share of nearly 30%. However, Pomina Steel’s market share has gradually diminished due to the strong rise of Hoa Phat Group.

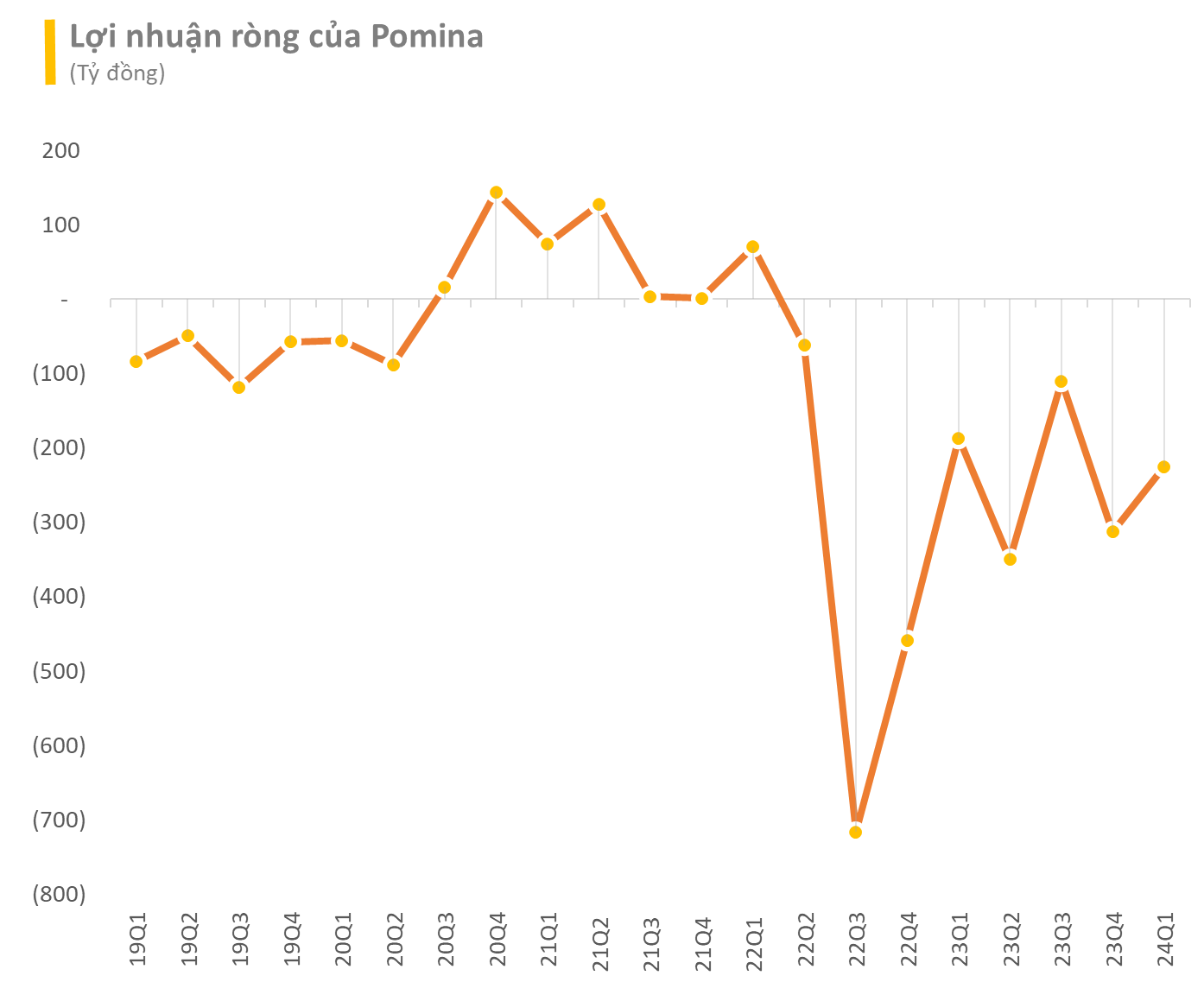

Due to the highly cyclical nature of the steel industry, Pomina Steel’s business performance has been erratic. In the past, the company experienced a prosperous period with profits ranging from VND 400 to 700 billion. However, after the boom cycle, its profits declined significantly, even incurring losses.

In 2022, Pomina Steel recorded a record loss of over VND 1,000 billion due to plummeting steel prices and extremely weak demand. The situation did not improve much in 2023, as the company incurred a net loss of VND 961 billion, far exceeding the initial plan of a VND 150 billion loss.

In late March this year, Pomina Steel requested an extension for submitting its 2023 audited financial statements until May 15, 2024. The company explained that it was actively working with investment partners on a restructuring plan to provide auditors with an assessment of its ability to continue as a going concern, along with solid evidence to support this assumption.

In the first quarter of 2024, Pomina Steel reported revenue of VND 471 billion, a 71% decrease compared to the same period last year. After deducting expenses, the company continued to incur a loss of over VND 225 billion in the first quarter.

Pomina Steel attributed the loss to the suspension of operations at Pomina 3 and Pomina 1 steel mills, which still incurred management and interest expenses. Interest expense accounted for the most significant proportion of the loss, and the company is currently seeking investors for restructuring to resume production as soon as possible.

With the continued loss in the first quarter, as of March 31, 2024, Pomina Steel’s total accumulated loss exceeded VND 1,697 billion, approximating 61% of its charter capital.