The VN-Index continued its upward momentum, surging by more than 14 points (1.15%) to 1,268.78 in the trading session on May 16. Over the past three weeks, the main index has risen nearly 8%, once again approaching the short-term peak of mid-April.

However, if we look at the broader picture, the VN-Index is still struggling within the same range and has not been able to break free to return to the 1,500-point peak of early 2022. The 1,200-point threshold alone has seen the Vietnamese market’s main index cross over nine times.

While the VN-Index remains stagnant, another index in the market has unexpectedly reached an all-time high.

Specifically, on May 16, the VN Diamond index soared by more than 41 points (1.88%) to 2,232.41, surpassing its previous peak of 2,193.18 set on April 6, 2022. From the beginning of 2024 until now, the VN Diamond index has increased by nearly 23.8%, outperforming the VN-Index’s rise of over 12%.

VN Diamond Index Hits a New High on May 16

The VN Diamond index was first introduced by HoSE on November 18, 2019. One of the biggest differences between VN Diamond and other indices is the FOL (Foreign Ownership Limit) coefficient – the limit on the percentage of shares that can be held by foreign investors. Stocks with an FOL coefficient of at least 95% are eligible for consideration for inclusion in the VN Diamond basket.

This is particularly significant for foreign investors as the Vietnamese stock market has many high-quality stocks that are difficult to access due to foreign ownership restrictions. Instead of having to trade off-exchange with a large premium of up to several percent, foreign investors can indirectly own “kin room” stocks by buying ETF certificates referencing the VN Diamond index. For this reason, it is not an exaggeration to say that the VN Diamond index is a magnet for foreign capital.

Currently, there are 18 stocks in the VN Diamond basket, including leading stocks in “hot” sectors such as technology, retail, and energy, with high growth potential, such as FPT, PNJ, and REE. These diamonds are not only attractive to foreign investors but also to domestic investors. With momentum from multiple fronts due to its high-quality portfolio, it is understandable that the VN Diamond index has outperformed the overall market.

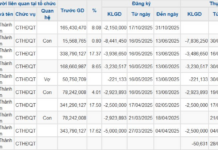

Composition and Stock Exchange Ratio for 1 Lot of ETF Referencing VN Diamond Index (Source: DCVFM Diamond ETF)

Recently, a relatively large change took place in the “diamond” index basket as MWG of The Gioi Di Dong was removed from the portfolio due to its failure to meet some important criteria, especially the P/E ratio, as its business results in 2023 plummeted.

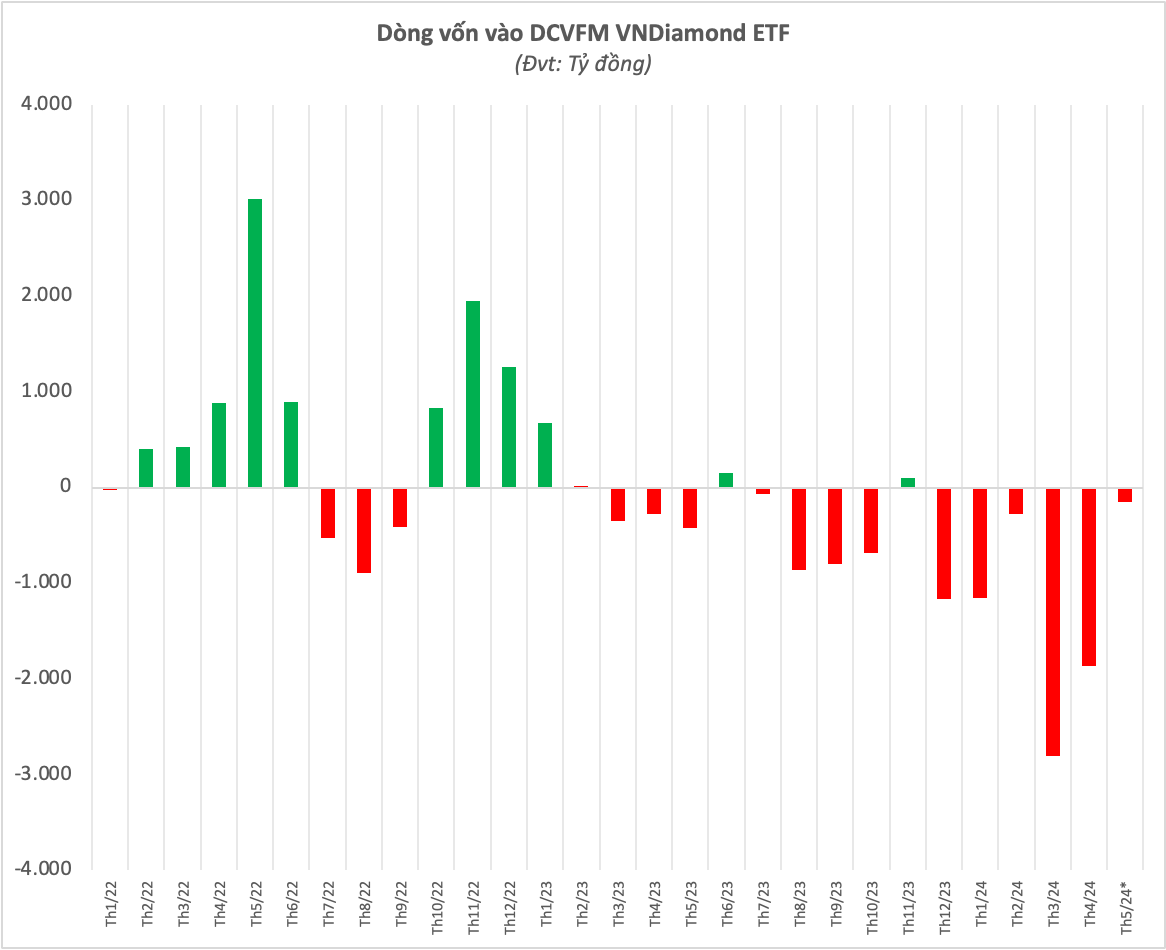

On the other hand, although the performance is still positive, the largest ETF referencing the VN Diamond index has experienced significant net outflows. The DCVFM VNDIAMOND ETF (FUEVFVND, with a scale of VND 14,100 billion) managed by Dragon Capital has recorded net outflows of over VND 6,000 billion since the beginning of the year, and there are no signs of it stopping.

In addition, there are three other ETFs in the market that also mimic the VN Diamond index, including MAFM VNDIAMOND ETF (FUEMAVND, with a scale of over VND 500 billion), BVFVN DIAMOND ETF (FUEBFVND, with a scale of over VND 50 billion), and KIM GROWTH VN DIAMOND ETF (FUEKIVND, with a scale of over VND 50 billion).