Prime Minister Pham Minh Chinh attended the Banking Industry Digital Transformation Day 2024 in Hanoi, along with Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong and representatives from various ministries, government agencies, local authorities, commercial banks, businesses, international organizations, and economic experts.

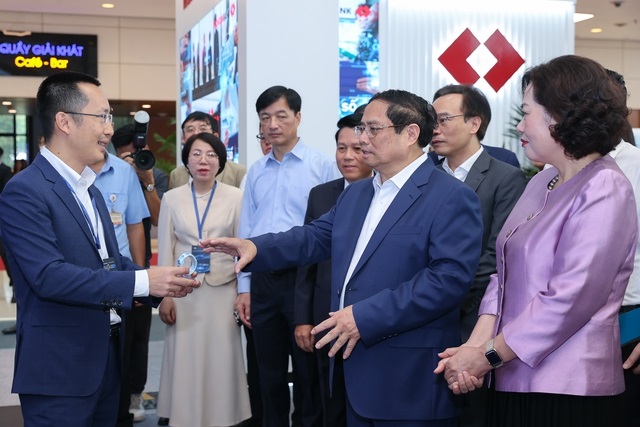

Prime Minister discussing the results of digital transformation in transactions at Military Commercial Joint Stock Bank (MBBank) – Photo: VGP/Nhat Bac

|

In his speech at the event, Prime Minister Pham Minh Chinh applauded the organization of the Banking Industry Digital Transformation Day, emphasizing its significance and reflecting the government’s determination and strong commitment to accelerating national digital transformation. This includes striving towards a digital government, digital economy, and digital society, as well as empowering digital citizens.

The Prime Minister highlighted that digital transformation is an objective requirement and a strategic choice, given top priority in the current era. The government has chosen the theme “Developing the digital economy with four pillars: information technology industry, digitization of economic sectors, digital governance, and digital data – an important driving force for rapid and sustainable socio-economic development” for the National Digital Transformation in 2024.

The primary focus is on boosting the development of the digital economy, where the banking industry plays a crucial role as the lifeblood of the economy. The industry impacts daily activities across various sectors, affecting individuals, businesses, and administrative and professional units.

“The Government and the Prime Minister always believe in and highly expect the banking industry to take the lead and pioneer in promoting national digital transformation, developing a digital economy and society, and empowering digital citizens. The banking industry has the foundation, conditions, and capabilities to fulfill this role,” affirmed the Prime Minister.

He expressed his strong agreement with the theme chosen by the SBV for the Banking Industry Digital Transformation Day 2024, “Expanding Connections and Developing the Digital Ecosystem.” This theme aligns with the Party and Government’s orientations and the goals, tasks, and solutions of the National Committee on Digital Transformation for 2024.

The Prime Minister commended the SBV’s leadership for their high awareness and resolute direction in digital transformation, aiming to transition most of the state management and credit services to a digital environment. These efforts are designed to promote socio-economic development and better serve the people and businesses.

In recent times, the national digital transformation in the banking sector has achieved several positive and outstanding results.

Prime Minister appreciated the SBV’s leadership for their high awareness and strong commitment to digital transformation – Photo: VGP/Nhat Bac

|

Firstly, cashless payment services have been widely implemented across the country, with an increasing number of users and transaction values. The proportion of adults with payment accounts has reached 87%, surpassing the target of 80% set for 2025. The average annual growth rate of cashless payments exceeds 50%; mobile transaction growth reaches over 100%; and internet transaction growth is above 50%. Nearly 49% of customers use cashless payment instruments, and the value of cashless payments is 23 times the GDP. The payment infrastructure has been maintained to ensure continuous, smooth, and secure operations, minimizing disruptions and bottlenecks.

Secondly, the SBV has actively coordinated with the Ministry of Public Security to implement Project 06 and introduce practical products and services for citizens and businesses. This includes customer authentication and identification using biometric information through chip-based ID cards, digital identity accounts, and electronic verification (VneID). Modern technologies have been applied in payments (facial recognition, one-touch payments, QR codes, etc.) and lending activities, utilizing big data and virtual reality for loan approvals for individuals and businesses. Additionally, online payment integration has been implemented for fees, charges, taxes, hospital fees, tuition fees, transportation, fuel, car rentals, and the purchase of goods and services, along with electronic invoices to prevent tax losses.

The Prime Minister shared that he had personally experienced the remarkable progress and advancements compared to the products and services he had encountered two years ago during his visit to the exhibition booths before the event.

Thirdly, there has been active progress in providing online public services in the banking sector, integrating them into the National Public Service Portal and Project 06. Over 90% of the paperwork has been handled and stored digitally. Nearly 14.6 million accounts and more than 46.2 million dossiers have been submitted through the National Public Service Portal, with approximately 26.8 million online transactions amounting to over VND 12.9 trillion. Out of 53 essential services, 41 have been implemented at levels 3 and 4. Specifically, the 25 essential services under Project 06 alone have saved nearly VND 3.5 trillion annually for the state and society.

On behalf of the Government, the Prime Minister acknowledged and praised the efforts, dedication, and achievements of the banking industry and credit institutions, along with their close coordination with ministries, sectors, and localities, especially the Ministry of Public Security. He also appreciated the enthusiastic support and active participation of the people and businesses, contributing to the success of the national digital transformation journey.

Despite these achievements, there are still several challenges and limitations in the banking sector’s digital transformation. There are policy and institutional obstacles, such as the need to amend and supplement Decree No. 73/2019/ND-CP on managing investment in information technology application using the state budget. Additionally, the Decree on the Regulatory Sandbox Mechanism in the banking sector and the new Decree on cashless payments have not yet been issued.

Digital infrastructure and platforms are struggling to keep up with the practical needs, including infrastructure for 5G commerce and large data center infrastructure. Ensuring security, safety, and information confidentiality remains challenging, and there is a need to prevent the increasing prevalence of ransomware (with nearly 2,400 cyberattacks recorded in the first quarter of 2024). The participation of businesses in developing new technologies (Fintech) is still limited, and there is a shortage of highly skilled human resources, especially in information technology.

The Prime Minister shared his hopes and encouraged the SBV and the entire banking industry to remain determined and make greater efforts to overcome these challenges, limitations, and difficulties to propel digital transformation forward.