## Vietnam’s Bond Market Faces Challenges as Maturity Dates Loom

Image source: CafeF

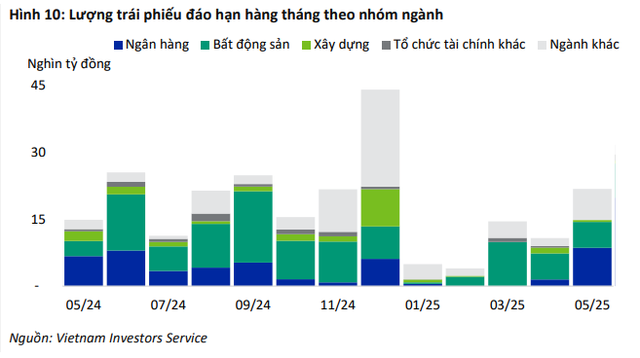

According to the latest data from VIS Rating, Vietnam’s leading credit rating agency, the Vietnamese bond market is facing a challenging period in May 2024. A total of 28 bond codes, valued at VND 15,000 billion, issued by 24 organizations, are set to mature this month. Of these, VIS Rating estimates that up to VND 4,700 billion, or 30%, are at risk of delayed repayment.

The situation is particularly concerning for certain issuers, with about VND 4,000 billion of the high-risk bonds likely to face delayed principal payments due to weak cash flows and depleted cash reserves. The remaining VND 700 billion in high-risk bonds are mostly issued by companies in the residential real estate sector, facing potential delays in repayment for the first time.

“It’s important to note that these issuers have had low or negative EBITDA profit margins over the past three years, and their sources of repayment funds are depleted,” emphasized VIS Rating.

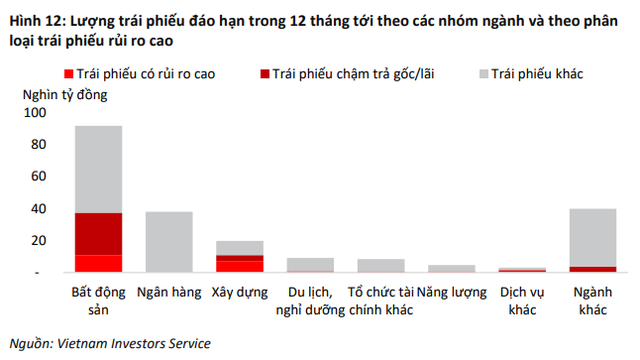

Looking ahead, approximately 19% of the circulating bonds, valued at VND 221,000 billion, will mature in the next 12 months. Of these, an estimated 10% are at high risk of delayed repayment for the first time, mainly in the residential real estate sector.

Image source: CafeF