In a recent development, CAP has announced a postponement of the cash dividend payment for the 2022-2023 financial year to July 31, 2024. The company attributed this delay to insufficient funds to meet the planned dividend payment. This decision aims to ensure a balanced cash flow without disrupting the company’s business operations.

According to the financial statements for the first six months of the 2023-2024 financial year (from October 1, 2023, to March 31, 2024), CAP‘s operating cash flow turned negative, reaching nearly VND 240 billion due to adjustments in inventory. However, the investment and financial activities provided a positive contribution, with the former generating over VND 117 billion from loan recoveries and the latter bringing in nearly VND 62 billion from borrowings. As a result, the total net cash flow for the period stood at a negative balance of over VND 67 billion.

As of March 31, 2024, CAP had approximately VND 13.5 billion in cash, representing a significant decrease of nearly 88% compared to the previous year. This reduction is attributed to the negative cash flow during the period.

CAP clarified that except for the payment date, all other details mentioned in the announcement made by the Vietnam Securities Depository (VSDC) on March 6, 2024, remain unchanged. Specifically, the record date remains March 19, 2024, and the dividend ratio stays at 50% (VND 5,000/share).

In reality, the total dividend ratio for the 2022-2023 financial year stands at 100%. This includes a 50% cash dividend (VND 5,000 per share) and a 50% stock dividend (50 new shares for every 100 shares held). With over 10.05 million shares currently in circulation, CAP is required to distribute more than VND 50 billion in cash and issue over 5 million new shares to fulfill this dividend payment.

Notably, the majority of these dividends will go to the family of CAP‘s Chairman of the Board of Directors, Truong Ngoc Bien. This group of shareholders holds a 28.32% stake in the company, with Hoang Thi Binh, Mr. Bien’s wife and a member of CAP‘s Board of Directors, owning the largest portion at 11.82%.

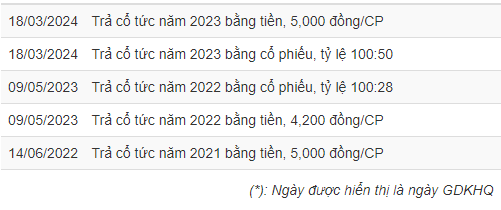

CAP, listed on the HNX since 2008, has consistently maintained a generous dividend policy. In the previous financial year (2021-2022), the company distributed dividends at a total ratio of 70%, comprising 42% in cash and 28% in shares.

|

Dividend ratios of CAP in recent years

|

CAP is a unique company on the stock exchange, being one of the few businesses engaged in the production of gold-plated paper, a traditional offering in Vietnamese culture. However, their primary revenue stream comes from the trading of cassava starch, a significant agricultural export product for Vietnam.

Despite this, CAP‘s financial performance for the first half of the 2023-2024 financial year (from October 1, 2023, to March 31, 2024) witnessed a notable decline, with a nearly 16% decrease in revenue compared to the previous year, totaling just under VND 289 billion. This downturn is attributed to challenges in the sales of cassava starch products, coupled with increased input costs and only a slight increase in selling prices. Consequently, the company’s net profit for the six-month period stood at over VND 22 billion, which is less than 40% of the previous year’s figure.

For the 2023-2024 financial year, CAP‘s Annual General Meeting of Shareholders set a minimum after-tax profit target of VND 70 billion. However, with the current net profit of over VND 22 billion for the first six months, the company has only achieved slightly over 31% of its stated goal.

Another noteworthy aspect is the decline in CAP‘s share price following the record date for the 2022-2023 dividend payment. Over two months, the stock price dropped by more than 17%, closing at VND 57,000 per share on May 31, 2024.

| Share price movement of CAP since the record date for the 2022-2023 dividend payment |