Record-breaking Business Plan

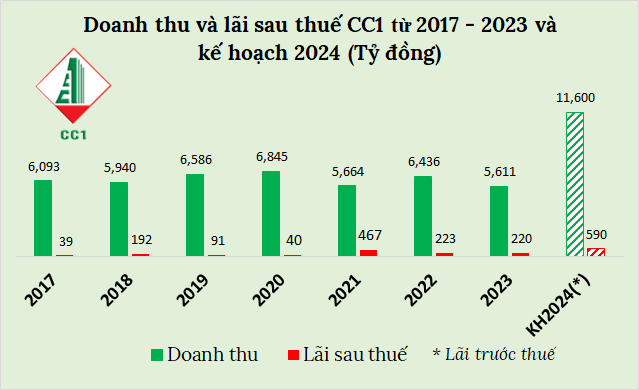

In 2024, Construction Corporation No. 1 JSC (UPCoM: CC1) has set an ambitious business plan with a target of 11,600 billion VND in net revenue and 590 billion VND in pre-tax profit, both approximately twice the amount achieved in 2023. These figures mark a record high for the company since its listing on UPCoM in 2017.

Source: VietstockFinance

|

Regarding these ambitious targets, CC1‘s leadership attributed their success in 2023 to winning 21 new bids with a total contract value of nearly 16.5 trillion VND. Among these, 14 projects (accounting for 50% of the value) were infrastructure projects, 5 projects (30%) were industrial projects, and the remaining 2 were civil projects.

For 2024, the company expects to generate revenue of 11,600 billion VND, with over 9,600 billion VND coming from construction projects won through bids in previous years. The remaining revenue will come from new construction projects expected to be won in 2024 and other business activities such as trading of materials and service operations.

Furthermore, challenges related to site clearance and material supply for most projects were resolved towards the end of 2023 and the beginning of 2024. The company’s access to multiple land and sand mines in Dong Thap, Phu Yen, Soc Trang, and Buon Me Thuot through the government’s special mechanism has helped alleviate issues with resource procurement. This remains a top priority in 2024 to facilitate the completion of the North-South Expressway project, which is currently a national key project.

As a result, CC1‘s leadership is optimistic about achieving favorable production and business results this year.

Additionally, CC1 plans to increase capital through private offerings and treasury stock issuances to supplement funds for production and business activities, as well as pay dividends in shares for 2023. Specifically, the company intends to issue over 232.2 million shares, including more than 32.2 million shares for dividend payment, with a ratio of 9% (shareholders owning 100 shares will receive 9 new shares) and 200 million shares offered privately to professional investors. If successful, CC1‘s charter capital will increase from 3,585 billion VND to 5,907 billion VND.

Clearing Bond Debt and Moving to the HOSE Exchange

Amid challenges faced by businesses in raising capital through bond issuances, CC1 allocated 2,650 billion VND to fully repay its bond debt ahead of schedule in late 2023, bringing its bond debt to zero. The company explained that this debt restructuring is part of their long-term financial strategy to focus on more efficient investments, reduce future interest expenses, and alleviate the financial burden associated with high bond interest rates and fees.

Regarding the move to the HOSE Exchange, CC1 acknowledged that 2023 was a volatile year for the Vietnamese stock market. Additionally, as the company won several large projects last year, their focus had to be on production and business operations. For these reasons, submitting an application for a exchange transfer to HOSE in 2023 was not deemed an appropriate timing.

CC1 predicts that 2024 will be a year of great potential. Therefore, the exchange transfer to HOSE this year is expected to create more opportunities and prospects for the company.

“The move from UPCoM to HOSE can help enhance the company’s business transparency, increase shareholder value, and attract foreign investors. Waiting until 2024 provides us with more time to prepare and ensure we meet all the requirements for the exchange transfer,” shared CC1‘s leadership.

In the first quarter of 2024, CC1 recorded net revenue of over 1,395 billion VND, 2.5 times higher than the same period last year, with a pre-tax profit of over 11 billion VND and a net profit of nearly 9 billion VND, showing little change from the previous year.

Compared to the annual plan, CC1 has achieved 12% of its net revenue target and has a long way to go to meet the pre-tax profit target, currently standing at only 2%.

| CC1’s Financial Performance from Q1/2022 – Q1/2024 |

CC1 targets record-breaking 2024 and plans to issue over 232 million shares to increase capital