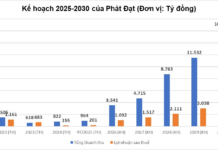

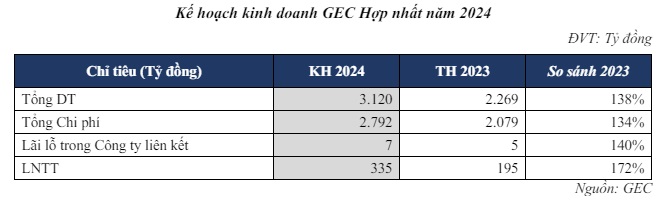

GEG’s Board of Directors aims to present an ambitious plan to the general meeting, with projected revenue surpassing VND 3,100 billion, a 38% increase from the previous year, and a remarkable 72% surge in pre-tax profits to VND 335 billion.

Source: GEG

|

A closer look reveals that an estimated VND 364 billion of this revenue is expected to come from hydropower, a 2% decrease from the previous year. On the other hand, revenue from solar power (including both farm and rooftop installations) is projected to reach VND 856 billion, marking a 6% increase. The most notable growth, however, is in the wind power segment, with expected revenue surpassing VND 1,400 billion, a substantial 57% jump.

It’s important to note that this plan is contingent upon the full recognition of revenue from the Tan Phu Dong 1 Wind Power Project (TPD1), which began operations in Q3 2023, as well as the assumption of retroactive revenue for 2023. Additionally, the projected revenue is based on the expectation that electricity prices for 2024 will be calculated at a ceiling price of nearly VND 1,816 per kWh.

However, as the negotiation of electricity prices depends on the policies and guidance of the Ministry of Industry and Trade, as well as the implementation process of EVN, the timeframe for completing and recognizing this specific revenue cannot be determined. The retroactive revenue is anticipated to be realized in 2024, and the progress of the electricity price negotiation process will undoubtedly impact the company’s 2024 business plan.

In the first quarter of 2024, GEG reported impressive results, with net profits exceeding VND 90 billion, a 40% increase compared to the same period last year. This positive outcome is attributed to the TPD1 project becoming operational. The company achieved a 41% completion of its annual plan, with pre-tax profits of VND 137 billion. However, due to the characteristic favorable wind conditions in the region during the initial quarters, there is no guarantee that the subsequent quarters will maintain this level of outstanding performance.

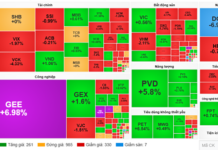

| GEG’s Business Performance |

|

|

The company’s plans for 2024 are set against a backdrop of complex and unpredictable global developments, with continued slowdowns in economic growth, trade, and investment. Domestically, while there are fundamental advantages, the economy is still facing a “negative double impact” from external unfavorable factors and internal limitations and shortcomings.

Electricity consumption is expected to continue rising, while unpredictable hydrological conditions and climate change present significant challenges for electricity supply in 2024. The Ministry of Industry and Trade also acknowledges the numerous unfavorable factors in 2024, including the absence of large-scale power sources coming online, the decline in gas supply for power generation from existing sources, delays in new gas sources, and the increased demand for coal-fired power generation, leading to a rise in coal imports.

According to the Ministry of Industry and Trade’s forecast, the total electricity production from power plants and imports for Vietnam in 2024 is estimated to be 306 billion kWh. Coal-fired power, hydropower, and gas turbines will remain crucial for ensuring the country’s electricity supply. Renewable energy sources will continue to be utilized based on electricity demand and the grid’s absorption capacity.

In terms of project development strategy, GEG’s Board of Directors aims to prioritize the completion of price negotiations for projects already in operation, including TPD1 and the VPL1 Wind Power Plant’s A7 turbine. Simultaneously, the company intends to seek investment opportunities to develop wind power projects importing electricity from Laos and rooftop solar power projects to take advantage of incentives from the government and international organizations.

Additionally, GEG plans to research and finalize the legal framework for the Tien Giang Wind Power and Hydrogen Production Project and will carefully select the optimal construction timing by considering efficient markets. The company will also explore expanding its investment portfolio and diversifying its green energy sources by participating in tenders for waste-to-energy projects.

Proposed Issuance of 17 Million Shares as a 2023 Dividend Payment

GEG’s Board of Directors has proposed a 2023 dividend payout of 5%, which can be distributed in the form of shares or cash, subject to the approval of the General Meeting of Shareholders. In the case of a share dividend, GEG plans to issue approximately 17.1 million new shares to existing shareholders holding common stock at a ratio of 5% (100:5, meaning for every 100 shares held, investors will receive 5 new shares). Convertible preferred shares will not participate in this distribution. The expected post-issuance chartered capital is over VND 4,200 billion.

Regarding the 2024 profit distribution plan, the company has proposed a 6% dividend for convertible preferred shares but has not mentioned any plans for common shares.

Bond Issuance to Raise VND 200 Billion for Debt Restructuring

Recently, GEG announced its decision to offer and issue a bond lot with a total value of VND 200 billion, consisting of 2,000 bonds with a face value of VND 100 million each. These are non-convertible, non-warrant-attached secured bonds. The proceeds from this issuance will be used for debt restructuring purposes, specifically to repay the principal or interest of the GEGB2124003 bond lot, which matures in August 2024.

Chau An

Building Peace earns over one hundred billion in Q4 2023, breaks four consecutive quarters of losses, HBC stock soars in January 30th session.

As of December 31, 2023, Hòa Bình Construction continues to incur a cumulative loss of nearly 2,900 billion Vietnamese dong.