VGP Outlines Profit Plan Amid Opportunities and Challenges

In 2024, VGP recognizes the advantages of its port location near Ho Chi Minh City’s center, along with its well-connected road, warehouse, and pier systems. However, challenges lie ahead with the port being one of the five in the city required to transition its function, limiting new infrastructure investments.

Changing legal policies on port operations and increasing natural challenges, such as annual high tides, land subsidence, and river siltation, add to the complexities.

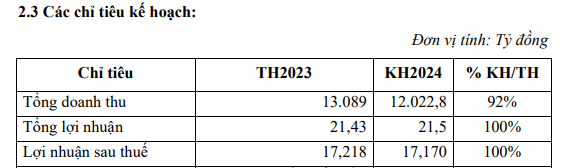

Amid these circumstances, VGP targets nearly VND 12,023 billion in total revenue for 2024, an 8% decrease from 2023. The company expects a net profit of nearly VND 17.2 billion, maintaining the previous year’s level.

Source: VGP’s 2024 Annual General Meeting Documents

|

VGP also plans to recover difficult-to-collect debts from Otrans and Vinalimex. As of the end of 2023, VGP recorded bad debts of nearly VND 29 billion and VND 14 billion with these companies, respectively.

Regarding the Phu Thuan Housing Project, VGP is working with the Department of Natural Resources and Environment to extend the land lease contract for No. 1 Nguyen Van Quy, Phu Thuan Ward, District 7. They are also coordinating with the Department of Planning and Architecture to update architectural and planning indicators in the 1/2000 scale subdivision planning scheme.

For the Kim Thanh – Lao Cai Commercial Area Project, VGP is studying deployment options for phase 2, in line with the new planning guidelines from the Lao Cai Provincial People’s Committee. As of the end of 2023, VGP recorded construction work in progress of over VND 21 billion for this project.

|

The Kim Thanh – Lao Cai Commercial Area Project received its Investment Certificate on August 15, 2007, with the first change on October 15, 2009, granted by the Lao Cai Provincial People’s Committee. The Ban Management Board of Lao Cai Economic Zone issued the second change to the Investment Registration Certificate on August 20, 2019. The project has a total expected investment of VND 75 billion. The 6-story commercial and office center is currently in operation by VGP. The remaining items will be constructed according to an appropriate implementation schedule after the detailed plan is approved. The project is still in the process of rough construction, and in 2020, VGP completed the construction of the septic tank and the exterior architecture of floors 1-2, as well as the interior of floors 1-2. Since 2020, the project has been awaiting approval of the detailed plan. |

Plan to Issue Over 7.8 Million Shares

Another critical agenda item for the General Meeting is the plan to issue shares to pay 2023 dividends and increase capital from owner equity, totaling over 7.8 million shares.

Specifically, VGP intends to issue nearly 5.9 million shares as dividends for 2023, at a ratio of 100:75 (for every 100 shares owned, shareholders will receive 75 new shares). This will be funded from undistributed post-tax profits in the audited financial statements for 2023.

Additionally, VGP plans to issue nearly 2 million shares at a ratio of 100:25, funded from the capital surplus based on the 2023 audited financial statements.

Both issuances are expected to take place in 2024 or 2025, with no restrictions on transferability. The total issuance ratio will be rounded to 100%, resulting in a VND 78 billion increase in VGP’s charter capital, intended for business operations.

Chairman of the Board of Directors Resigned After Only One Year in Office

According to the documents, the VGP Board of Directors proposed to the AGM to approve the resignation of Ms. Tran Thi Anh Tho from the position of Member of the Board of Directors. Previously, Ms. Tho had submitted her resignation, withdrawing from the position of Chairman and Member of the Board of Directors from June 5, 2024, for personal reasons.

Ms. Tho was elected to the VGP Board of Directors at the 2020 Annual General Meeting. On June 28, 2023, she was elected as Chairman. If the resignation is approved, Ms. Tho’s term as Chairman will conclude after just one year.

On the other hand, Ms. Truong Thi Hai Yen, VGP’s Chief Accountant, was introduced by Mr. Pham Ngoc Quynh, Member of the Board of Directors and Director of VGP, to be elected as a Member of the Board of Directors for the 2021-2026 term.

Previously, VGP’s leadership team also underwent changes. Specifically, on June 3, Ms. Do Thi Dung, Deputy Head of Port Operations, Secretary of the Board of Directors, and Authorized Person for Information Disclosure, was appointed as the Head of Administration for the 2021-2026 term. On the same day, Ms. Nguyen Thi Khanh Hai, a Member of the Board of Directors, was also appointed as an Independent Member of the Board of Directors for the 2021-2026 term.

Huy Khai