Vietnam’s Banking Sector: Navigating Challenges for Growth

According to statistics from the State Bank of Vietnam, as of mid-June 2024, the credit growth of the credit institution system reached only 3.79%, far from the annual target of 15%. To address this, the Prime Minister has instructed the State Bank to enhance the effectiveness of measures to improve access to credit for individuals and businesses, directing loans towards production and business activities.

Interest Rates Are Not the Main Issue

The State Bank of Vietnam attributes the slow credit growth to the lackluster recovery of domestic demand. Many traditional economic drivers, such as manufacturing and services industries, continue to face challenges. Additionally, some potential borrowers have not developed feasible production and business plans or met the loan requirements, coupled with changing consumer trends.

Commercial banks are exploring ways to inject capital into the economy, despite low absorption rates among businesses. Photo: LAM GIANG

Field reports indicate that both individual and business loan demands remain low. At a recent dialogue between the government and businesses in the banking sector in Ho Chi Minh City, Mr. Dinh Cong Khuong, Chairman of the Ho Chi Minh City Steel Enterprises Club, noted that many businesses faced challenges in their production and business operations during the first months of the year.

Some businesses that sought new loans lacked eligible collateral, while those with existing debts struggled with cash flow for repayment. “The current interest rate is not the main issue,” said Mr. Khuong, adding that his company’s loan interest rate has dropped to around 6% annually, a reasonable level compared to the end of 2023 when it was about 10%.

A recent survey by the Ho Chi Minh City Union of Business Associations (HUBA) among its members revealed that 16% of businesses lack operating capital, while 50% face challenges due to a lack of new orders. HUBA considers this the most significant difficulty for businesses today, as the absence of orders diminishes their need for loans, despite the considerable decrease in interest rates.

Notably, numerous businesses are grappling with cash flow issues. Real estate enterprises, in particular, confront a massive bond debt of up to VND 350,876 billion, with an estimated value of VND 99,700 billion to be addressed in 2024.

“Businesses need money to repay previous debts and supplement working capital for subsequent activities,” said HUBA. The association has urged the government to comprehensively address market challenges, including capital depletion and declining consumer demand. They have also recommended exploring additional financial sources beyond traditional bank loans and corporate bonds, such as real estate investment funds, housing savings funds, and securitization of real estate.

Commercial banks have acknowledged that interest rates are not the primary obstacle to credit expansion. The critical issue lies in the low absorption capacity of businesses and the economy. Bank employees have gone to great lengths to promote personal loans, especially for home and car purchases, but to no avail. Some banks have even offered grace periods of 2 to 5 years for principal repayment on home loans with tenures of 20 to 30 years, yet credit growth remains below expectations.

Intense Competition in Lending

Mr. Pham Duy Hieu, Acting General Director of ABBANK, shared that to boost credit growth, the bank has carefully reviewed its customers. For those with strong profiles, ABBANK proactively increases their credit limits. For borrowers with potential recovery prospects, the bank restructures their loans according to regulations. Only customers who cannot be restructured are subject to debt recovery.

“We are eager to increase credit growth,” said Mr. Hieu. “By making prudent choices and scoring our customers effectively, we contribute to the bank’s overall credit growth. We anticipate turning positive by July 2024 and are committed to achieving the State Bank’s permitted growth rate by the end of the year.”

Asia Commercial Joint Stock Bank (ACB) stands out as one of the few commercial banks that have witnessed a promising credit growth rate since the beginning of the year. Mr. Tu Tien Phat, General Director of ACB, revealed that as of late May 2024, ACB’s credit growth reached approximately 9.5%, surpassing the industry average.

This accomplishment is attributed to ACB’s aggressive promotion of preferential credit programs with competitive interest rates. The bank offers loans to business customers at 6-8% per annum and to individuals at around 7-8%. In the second quarter of 2024, ACB’s credit growth doubled compared to the first quarter, and the bank expects this positive trend to continue in the upcoming quarters.

“The competition in lending is more intense than ever,” remarked Mr. Phat. “As a result, to expand credit, banks cannot afford to raise interest rates significantly. If one bank increases its lending rates, customers may quickly shift their credit to another bank. Moreover, banks are now required to publicly disclose their average lending rates to ensure transparency and ease of access to credit for individuals and businesses.”

Mr. Phat predicts that lending rates will remain low for the foreseeable future, at least until the end of the year.

Facilitating Credit Growth and Managing Bad Debt

From a regulatory perspective, the Governor of the State Bank of Vietnam, Ms. Nguyen Thi Hong, affirmed that the central bank would promptly issue guiding documents for the Law on Credit Institutions 2024 to ensure its effectiveness from July 1. Additionally, they will continue to review and amend relevant legal documents to remove obstacles for the economy and enhance access to bank credit.

The State Bank will also vigorously promote credit programs totaling VND 120,000 billion for social housing development and VND 30,000 billion for the forestry and fisheries sectors.

Strict Bad Debt Control

In the first quarter of 2024, some banks experienced an increase in non-performing loans, such as Military Bank (MB), whose non-performing loan ratio rose from 1.6% to 2.48%. To address this challenge while continuing to push credit to the market, MB has implemented comprehensive solutions to tightly control credit quality. The bank has also proactively identified and monitored customers to provide early intervention support and accelerate debt recovery, aiming to maintain a non-performing loan ratio of around 1.5% and a minimum bad debt coverage ratio of 100%.

Capital for the Future

Mr. Nguyen Ngoc Hoa, Chairman of the Board of Members of the Ho Chi Minh City Financial Investment State-owned Company (HFIC) and Chairman of HUBA, shared that despite global and domestic economic challenges, the business community remains optimistic about future recovery. Last year, amid a declining market, businesses questioned the purpose of borrowing. Today, many businesses express their need for capital not only to address immediate sales and operations but also to invest in anticipating future market demands. With the current focus on green production and consumption, businesses that fail to embrace sustainability by 2025 may lose out on export and domestic market opportunities.

“HFIC has partnered with HUBA to establish a task force that provides consulting services to businesses and handles issues that arise between borrowers and lenders,” said Mr. Hoa. “We have also collaborated with banks to syndicate loans and ensure sufficient capital for investment and borrowing needs. We organize specialized sessions with units in various industries to introduce loan programs and understand their investment requirements. Additionally, we have worked with departments and branches to advise the People’s Committee of Ho Chi Minh City on a stimulus program, and we hope that the city will decide to implement it in the coming month.”

Which bank offers the highest interest rate for online savings in early February 2024?

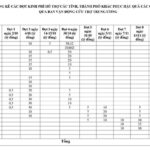

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

Overcoming Challenges in Dealing with Bad Debts

In the newly passed Revised Securities Law, securities companies (SCs) no longer have the privilege to hold collateral. Therefore, SCs need to recognize that debt collection is their responsibility, and they should be extremely strict in assessing borrowers, ensuring compliance with principles, procedures, and conditions before granting loans.