While FDI enterprises export high-value industrial goods, domestic enterprises’ exports account for a smaller proportion and consist mainly of low-tech products.

FDI Enterprises Have No Incentive to Transfer Technology

Expert Nguyen Duc Hung Linh, founder and consulting director of Think Future Consultancy, assesses that Vietnam’s economic growth relies heavily on exports, with FDI enterprises taking the lead with a 72% contribution, equivalent to 59% of GDP. FDI exports mostly comprise high-value industrial goods such as electronics, phones, and machinery. In contrast, domestic enterprises’ exports account for a smaller proportion and consist mainly of low-tech products such as agricultural and aquatic products, wooden furniture, and garments.

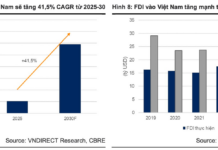

Meanwhile, the spillover effects from FDI enterprises to domestic ones remain low. The ratio of FDI enterprises’ import value to export value has consistently remained above 81% over the years. This indicates that FDI enterprises only utilize simple local production factors such as cheap labor, land, and basic utilities (electricity, water, fuel, and logistics services).

In reality, FDI enterprises have shown little interest in technology transfer or increasing localization, despite Vietnam’s numerous encouraging mechanisms.

In contrast to FDI enterprises, Vietnamese enterprises lack competitiveness. This is evident in the retail business sector. Many Thai companies have deeply penetrated and dominated Vietnam’s promising retail market.

For instance, Mr. Hung Linh emphasizes that Thailand’s CP Group has dominated the animal feed and meat industries. Other Thai “giants” have become major shareholders or even acquired leading Vietnamese companies such as Sabeco, Vinamilk, and the Big C and MM Mega Market Vietnam supermarket chains (formerly Metro Cash & Carry).

On the other hand, no Vietnamese retail company has attained a similar position in Thailand. With more capital- and technology-intensive retail businesses, such as e-commerce or ride-hailing applications, domestic enterprises will find it even more challenging to establish themselves in the domestic market.

Vietnamese Enterprises Navigate a Highly Competitive Environment

According to Mr. Nguyen Duc Hung Linh, domestic enterprises in Vietnam can be divided into two groups: state-owned enterprises (SOEs) and private enterprises. SOEs, which hold the most critical national resources, such as minerals, telecommunications, ports, and energy, fail to demonstrate a leading role. Their investment growth consistently lags behind the overall economic investment growth.

During 2017-2023, while private and FDI enterprises achieved average investment growth of 11% and 7% per year, respectively, SOEs witnessed a 1% decline. Credit access for SOEs followed a similar disappointing trend, decreasing by an average of 4% per year during 2017-2022.

Looking at SK Group, the second-largest industrial conglomerate in South Korea, we see that the group started as a textile company in the 1960s and 1970s. In the 1980s, SK ventured into the oil refining and chemical industry (SK Energy) and quickly became one of the leading companies in this field in South Korea. In the 1990s, the group expanded into telecommunications with SK Telecom and became the first company globally to provide CDMA services.

It is evident that before 2000, SK resembled a combination of Petro Vietnam and MobiFone of Vietnam. However, around 2010, SK gradually acquired Hyundai’s semiconductor subsidiary, forming SK Hynix in 2012. SK Hynix and the semiconductor business now serve as one of the group’s pillars, contributing 30%-40% to its total revenue of over $100 billion.

In the last decade, SK has been heavily investing in new energy fields. Billions of dollars have been poured into electric vehicle battery factories, hydrogen engines, hydrogen production plants, and CO2 capture facilities worldwide. The company also actively seeks opportunities in emerging markets. In 2018 and 2019, SK promptly invested $2 billion in two leading Vietnamese companies, Vingroup and Masan.

This example illustrates that when provided with abundant resources and capital, a private company can thrive and lead a country’s economy, as SK did in South Korea.

Meanwhile, Vietnam’s private enterprises are navigating highly competitive business areas. Consequently, they experience slow capital and technology accumulation, hindering their competitiveness against foreign enterprises.

An illustration of this is the private sector’s investment. Following Resolution 10/2017 on private economic development, private investment accelerated rapidly. During 2017-2019, the average investment growth of the private sector was 18%, double that of FDI (8%) and public investment (9%). The private sector was the primary driver of total investment and the economy during that period.

However, in the post-Covid era (2022-2023), private sector investment grew by only 6% annually, lower than FDI (10%) and far below public investment (20%). A shrinking output market, prolonged legal procedures, and increased business risks have caused private enterprises to delay development investments, despite their dynamism and higher efficiency compared to SOEs.

“State-owned enterprises have access to critical resources but operate inefficiently. Private enterprises navigate a highly competitive environment and face various risks, from market fluctuations to legal procedures. This is a significant reason why Vietnamese enterprises are losing on their home turf, let alone venturing into the global arena,” said Mr. Nguyen Duc Hung Linh.

Vietnam’s exports bring in over $15 billion in the first half of January

Vietnam’s exports in the first month of January 2024 reached nearly $15.09 billion, a decrease of 7.5% (equivalent to a $1.23 billion decrease in absolute terms) compared to the second month of December 2023.

Prime Minister Inspects Site, Urges Progress on Hanoi-Nhon Railway Project

On the morning of February 12th (the 3rd day of the Lunar New Year), Prime Minister Pham Minh Chinh visited the construction site of the Hanoi Urban Railway Line 3 (Nhon – Hanoi Station), bringing Tet gifts, and encouraging the officials and workers working at the underground station S12 (Hanoi Station) – the deepest part of the project.

Join the supply chain: Need more support for your business internally

The challenge of how to help Vietnam’s industrial businesses integrate into the global supply chain is still a difficult one.