At the seminar on stock market upgrading held by the Ministry of Finance, the State Securities Commission, and the Labor Newspaper on the afternoon of July 2nd, Mr. Bui Hoang Hai – Vice Chairman of the State Securities Commission – spoke about the phenomenon of foreign investors continuously selling off their holdings in the Vietnamese stock market in recent times.

Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission of Vietnam

According to Mr. Hai, foreign investors hold approximately 16% of the market capitalization of Vietnam’s stock market, equivalent to USD 46-49 billion. Despite regulations limiting the ownership ratio of foreign investors, Mr. Hai assessed that the Vietnamese market still has a high level of openness, and the percentage held by foreign investors is relatively high compared to other markets in the region.

Addressing the concerns of investors about the outflow of foreign capital from the Vietnamese stock market, Mr. Hai affirmed that this is not an issue unique to Vietnam, and this trend is also observed in some other countries in the region, such as Thailand and Indonesia.

“There are multiple reasons for this trend, including the continuous appreciation of the US dollar, high USD interest rates, and the depreciation of the VND and some regional currencies to a certain extent,” Mr. Hai analyzed. “As a result, many funds adjust their investment portfolios, opting for markets with lower risk and higher returns.”

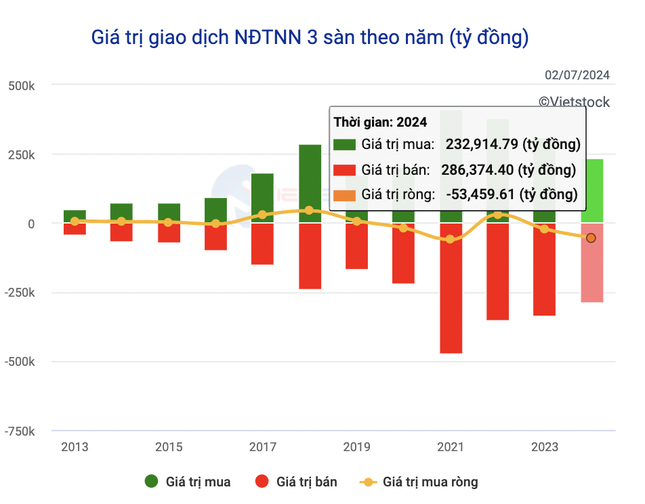

Foreign investors have sold about USD 2 billion in the first half of this year.

Mr. Hai, Vice Chairman of the State Securities Commission, also stated that with the recovery momentum in the first half of the year, the valuation of the Vietnamese market has increased. The value of foreign investors’ net selling to date is lower than the additional value of the market. “Some funds, when investing in emerging markets, have a limit on maintaining a certain allocation ratio,” he explained. “When the market value increases, this ratio is no longer guaranteed, and foreign funds have to sell. The phenomenon of foreign investors’ net selling does not cause a stir.”

Deputy Minister of Finance Nguyen Duc Chi shared that it is entirely normal for foreign investors to sell, adjust, and restructure their portfolios. Foreign investors also change their investment preferences and portfolio management strategies.

“The most important support for the stock market is the stability of the microeconomy and sociopolitical environment,” emphasized Mr. Chi. “As long as these factors remain stable, there is no reason for high-risk stocks.”

Mr. Nguyen Duc Chi, Deputy Minister of Finance of Vietnam

Regarding the goal of upgrading the market, Deputy Minister Chi drew attention to the issue of information transparency. “This responsibility first and foremost lies with the enterprises,” he said. “Companies must realize that this is not only an obligation but also in their best interest. If we want to go far and aim high, we must prioritize transparency and accuracy.”

According to experts, the compliance of listed companies in Vietnam with disclosure obligations is still limited and often only superficial, sometimes with serious inaccuracies.

Professor Dr. Tran Viet Dung, Director of the Institute for Banking Science Research at the Banking Academy of Vietnam, emphasized the crucial role of market inspection and supervision. He recommended that regulatory authorities strengthen the inspection and supervision of capital mobilization activities and the use of mobilized capital in the stock market and promptly detect and handle cases of inflated capital increases and misuse of capital.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.