The market continued its positive momentum on July 4th. The VN-Index hovered around 1,280 points, but strong selling pressure at this resistance level led to a slight narrowing of the gain, closing at 1,279.89 points. This marked the fourth consecutive session of gains.

Similarly, the HNX also edged higher by 0.45 points to 241.88, while the UPCoM inched up 0.36 points to 98.26.

The market witnessed a broad-based rally across various sectors. News from the Ministry of Industry and Trade regarding the initiation of an anti-dumping duty investigation on steel products from China and South Korea boosted steel stocks. Most steel-related stocks surged, including HSG, SMC, TLH, and even TVN and TIS, which hit the daily limit-up, while HPG was the lone decliner.

Securities stocks also painted a bullish picture, with VND, HCM, SHS, VDS, BSI, and VCI among the notable gainers. On the flip side, SSI, AGR, VIX, and CTS witnessed modest declines of less than 1%.

Banking stocks exhibited a mixed performance, with VPB, TPB, LPB, and BID among the gainers, while heavyweights like VCB and CTG, along with SHB, ACB, and MBB, underwent adjustments despite the overall positive sentiment in the market.

Real estate stocks followed a similar pattern, with VHM, KDH, VIC, DPG, and GEX ending in the green. In contrast, KBC, HHV, PDR, NVL, HBC, and DXG faced selling pressure, closing lower.

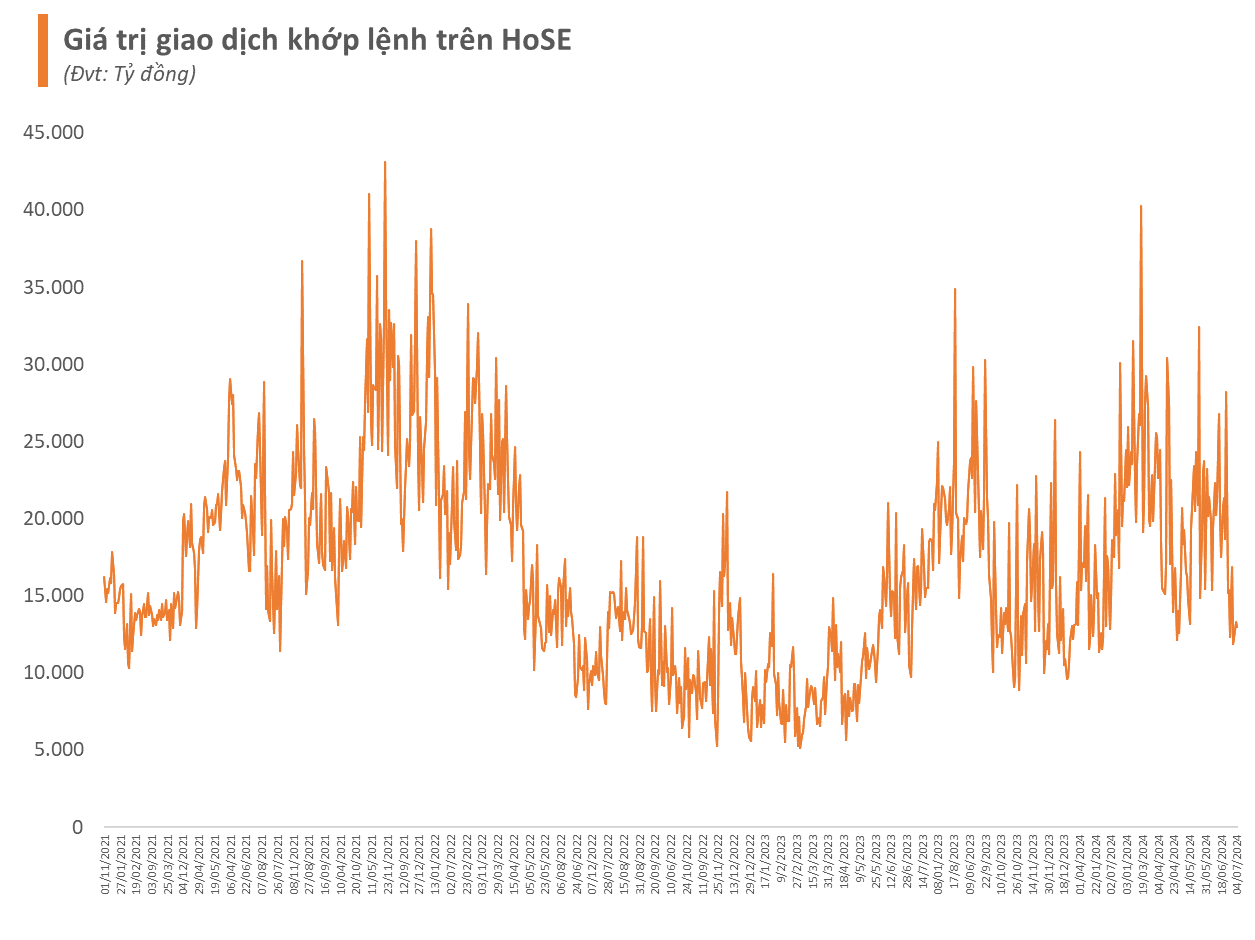

Despite the positive performance of the main index and numerous stocks, market liquidity waned. The trading value on the HOSE barely surpassed VND14 trillion, with the matched order value falling short of VND13 trillion.

This liquidity downturn has been observed over the past couple of weeks, as the main index has yet to decisively confirm its trend, making investors more cautious about committing capital. Additionally, objective factors, such as persistent net selling by foreign investors for several months, have contributed to the cautious sentiment. The net selling value on the HoSE during the first half of 2024 has surpassed VND53 trillion, indicating a potential record year for foreign capital outflows in Vietnam’s stock market.

It’s worth noting that the Vietnamese stock market is currently in a quiet period following the annual general meeting season, and before the release of second-quarter financial statements. The strong uptrend witnessed in recent times has pushed the valuations of many stocks to high levels, making them less attractive to investors, which has resulted in weakened liquidity and capital flows. Other factors, such as the delayed implementation of the KRX system and the market upgrade remaining at the expectation level, have also made it challenging for new money to enter the market.

Amid this overall liquidity crunch, money has been flowing into specific stocks, with FPT being a notable example. Trading in this stock has remained vibrant, with a transaction value of nearly VND1,100 billion in the July 4th session—the highest in the market and accounting for nearly 10% of the total value on the HoSE that day. The trading volume of over 8 million shares also placed it among the most actively traded stocks on the exchange.

The influx of money has propelled FPT’s share price higher, currently hovering at VND135,800 per share, just shy of its recent peak of VND136,100 reached in late June. This represents a remarkable gain of over 60% since the beginning of the year. FPT’s market capitalization now stands at over VND198 trillion, ranking it as the third-largest listed company in Vietnam, behind only Vietcombank and BIDV.

With the current robust liquidity, there is a high possibility that FPT will surpass its peak for the 33rd time since the start of 2024. This upward trajectory is supported by the solid financial performance of this leading technology group. In the first five months of 2024, FPT recorded a revenue of VND23,916 billion and a pre-tax profit of VND4,313 billion, representing increases of 19.9% and 19.5%, respectively, compared to the same period last year. After-tax profit attributable to the parent company’s shareholders also rose by 21.2% to VND3,052 billion, corresponding to an EPS of VND2,403 per share.

In relation to the full-year plan, with a revenue target of VND61,850 billion (~USD 2.5 billion) and a pre-tax profit goal of VND10,875 billion, the group has accomplished 39% of its revenue plan and 40% of its profit objective.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.