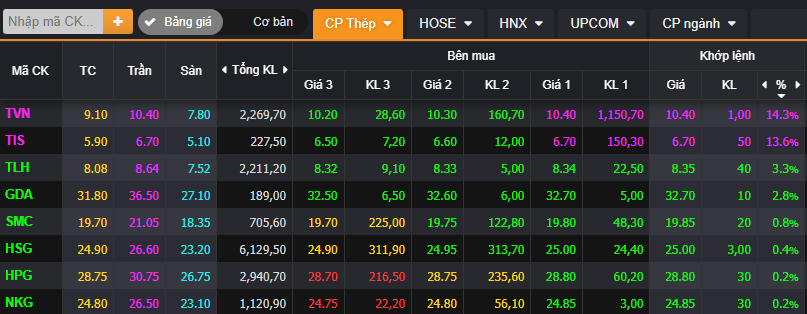

The steel industry’s stocks are on the rise, with a majority of codes turning green and some even surging to short-term peaks. Notably, TVN of the Vietnam Steel Corporation (VNSteel) witnessed a surge in its share price to 10,400 VND per share during the morning session on July 4, marking its highest point in over two years since May 2022. Compared to the beginning of 2024, TVN’s share price has climbed by nearly 63%, and if we consider the starting point of the wave approximately two months ago, the increase is over 82%.

This positive development is accompanied by a surge in trading volume, with a few hundred thousand shares traded, climbing to millions of units, and transaction values have also improved to tens of billions of VND per session.

TVN’s share price rally is noteworthy, given that the stock is on the warning list due to its financial statements for three consecutive years being audited with exceptions. Most recently, the audited 2023 financial statements also included the auditor’s exclusion opinion related to long-term loss provisions for the Renovation and Expansion Project of the Thai Nguyen Iron and Steel Project, as well as investments in Vietnam-China Metallurgy Company and the Stone Hill Iron Joint Stock Company.

Established in 1995 through the merger of production and business units in the Vietnamese steel industry, namely the Metal Corporation and the Steel Corporation, VNSteel currently operates as a joint-stock company with nearly 40 affiliated, subsidiary, and associated companies.

In fact, not only TVN but the entire steel industry has been cheered by the news that the Ministry of Industry and Trade has announced the initiation of an investigation into the application of anti-dumping duties on steel products from China and South Korea. As per procedure, the Ministry of Industry and Trade will send the Review Questionnaire to relevant units 15 days after the initiation. This will form the basis for the preliminary conclusion of the investigation. The period for determining dumping acts (POI) is from April 1, 2023, to March 31, 2024.

Additionally, the domestic steel market is witnessing a clear recovery in purchasing power against a backdrop of stable steel prices, which is expected to boost business results in Q2 2024. Furthermore, steel companies have also received supportive information and directives from the teleconference on resolving difficulties and promoting the production and consumption of cement, iron and steel, and construction materials, chaired by Prime Minister Pham Minh Chinh.

Steel stocks are showing positive signs across the board

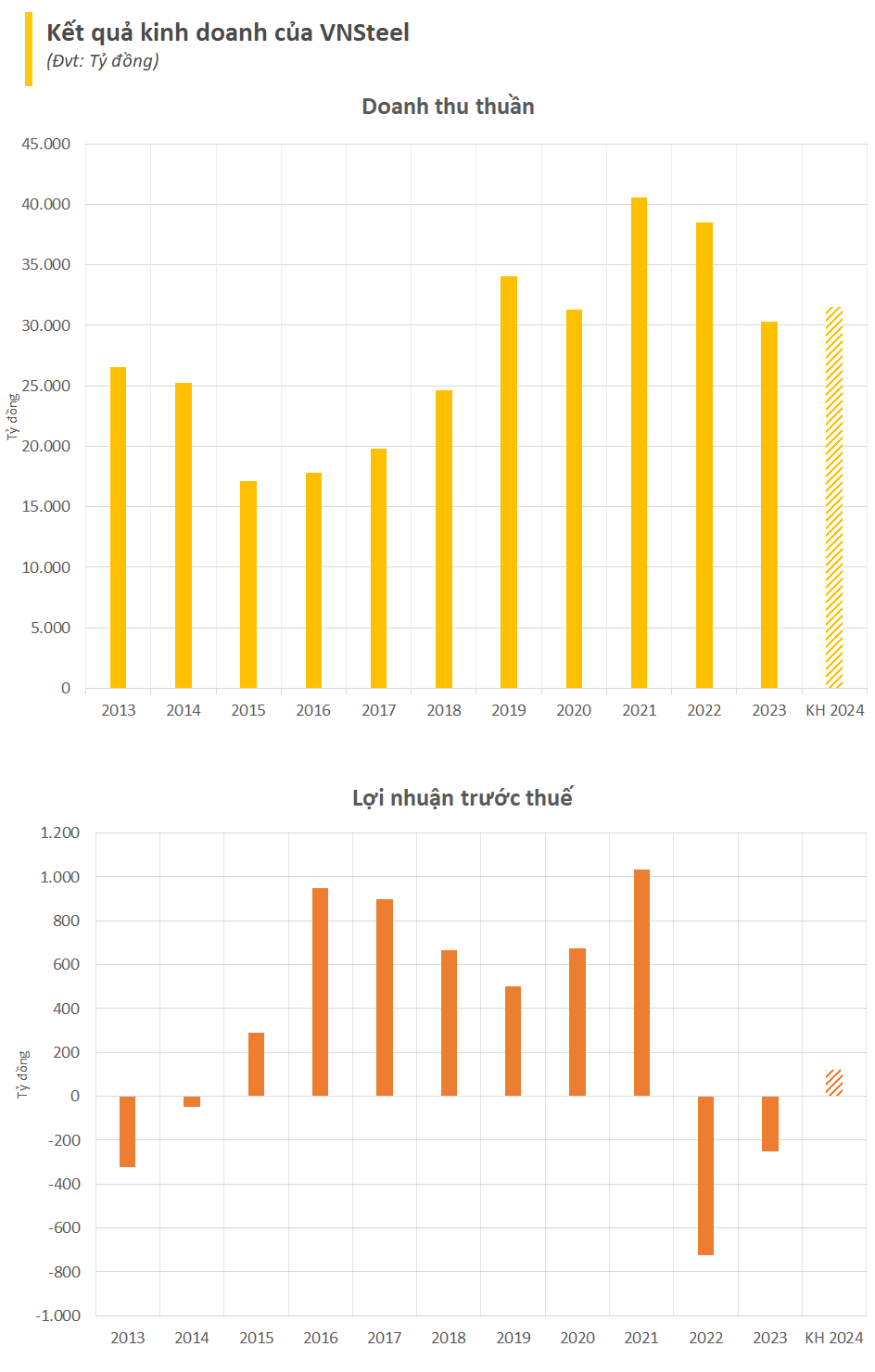

In terms of business performance, according to the consolidated financial statements for Q1 2024, VNSteel recorded net revenue of 7,513 billion VND, a 10% decrease compared to the same period in 2023. After deducting expenses, the after-tax profit was nearly 46 billion VND, of which the profit attributable to the parent company was over 36 billion VND, a decrease of approximately 44% compared to Q1 2023.

For the full year 2024, the company has set a consolidated business plan with a total revenue of 31,500 billion VND and a net profit of 120 billion VND. Thus, after just three months, the company has accomplished 44% of its annual profit target.

As of March 31, 2024, VNSteel’s total assets stood at 25,246 billion VND, an increase of 1,900 billion VND from the beginning of the year. Short-term assets accounted for 12,661 billion VND. Cash and cash equivalents were recorded at 1,166 billion VND, along with 3,424 billion VND in short-term receivables from customers. Additionally, the company had over 402 billion VND in other receivables, including 70 billion VND in dividends and profit sharing.

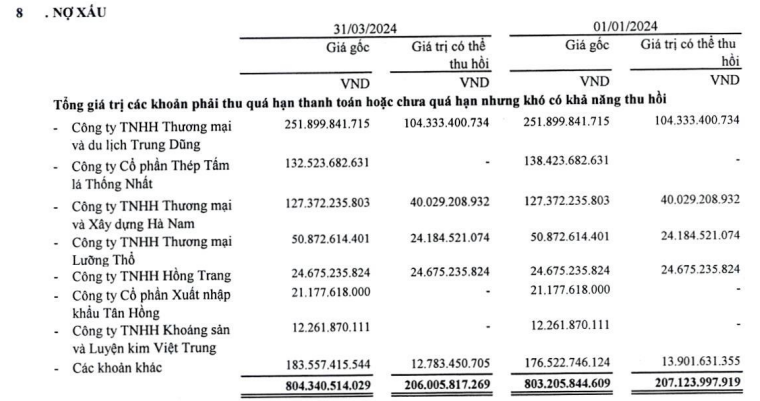

Notably, the company recorded a provision for doubtful short-term receivables of nearly 595 billion VND. VNSteel did not provide specific explanations for this item, but in the notes, there is a mention of bad debt amounting to over 804 billion VND.

As of Q1 2024, VNSteel’s total liabilities stood at 15,985 billion VND, of which nearly 80% were short-term liabilities. Over 6,800 billion VND was attributed to short-term financial debt, and the company also had long-term borrowings of over 1,714 billion VND. Shareholders’ equity reached 9,260 billion VND, including nearly 1,890 billion VND in undistributed profit.

Most recently, VNSteel’s subsidiary, Thu Duc Steel Joint Stock Company – VNSTEEL (code: TDS), finalized the list of shareholders to implement a cash dividend payout with an impressive rate of 70% (7,000 VND per share). The expected payment date is July 12, 2024. Thanks to its 65% ownership, VNSteel is set to receive nearly 56 billion VND in cash dividends. Notably, this dividend income from its subsidiary even surpasses the company’s net profit for the entire first quarter.

The State-Owned Enterprise’s Turbulent Environment: A Tale of Unexpected Turnovers and Twists

In 2022, Vinatrans hit a record-high profit of 86 billion VND. However, its earnings took a tumble in 2023, halving from the previous year’s impressive figure. Despite this setback, the company remains optimistic and has set modest goals for 2024.