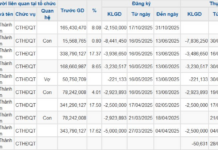

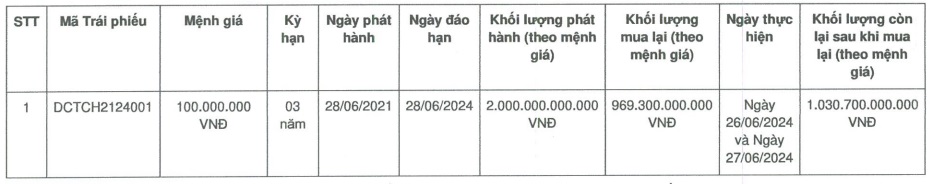

On June 26, DCT Partners spent VND 969.3 billion to repurchase a portion of the DCTCH2124001 bond issue ahead of schedule. After the repurchase, the issue had VND 1,030 billion remaining in circulation.

|

DCT Partners spent nearly VND 1 trillion to repurchase bonds ahead of maturity

Source: HNX

|

The DCT Partners bond issue comprised 20,000 bonds with a face value of VND 100 million each and a three-year term. They were issued in the form of book-entry registration on June 28, 2021. These bonds are non-convertible and do not include warrants. They are secured by the right to use and own the land lot numbered BX 920644 and the right to use land and future construction works at the Thien Binh Minh – Ho Tram Tourism Area project in Ba Ria Vung Tau province, owned by Thien Binh Minh Joint Stock Company.

The proceeds from the bond issue were intended for investment in the construction and development of the B4 apartment block (commercially known as Charm Diamond Tower), and the LK3 and LK4 commercial townhouse rows in the Song Than Complex project within the Charm Plaza 1 complex in Di An, Binh Duong. The project has a scale of 5ha with DCT Partners Vietnam as the investor.

The initial interest rate for the bond issue was 10%/year. However, on March 31, the Company decided to change the interest rate applicable from June 28, 2022, to June 28, 2023, to 12.3%/year. The interest rates for the remaining interest periods remained unchanged at 10%/year.

It is known that in 2022, DCT Partners delayed the payment of VND 32.8 billion in bond interest out of a total of VND 176.8 billion to be paid. The reason given in the document was carelessness in processing information in the transfer order, and the Company paid a fine for late interest on June 29, 2022, amounting to over VND 13.4 million. In 2023, DCT Partners fulfilled its interest payment obligations for the bond issue, although it was also a few days late, with an amount of over VND 246 billion. The company explained that the delay was due to credit tightening affecting customers’ payments and bond interest payment plans.

DCT Partners Vietnam Co., Ltd. was established in June 2008, headquartered in Di An, Binh Duong; mainly operating in the field of real estate business, ownership or leased land use rights.

DCT is a member of the Charm Group ecosystem

|

The company is a unit within the Charm Group ecosystem and is currently the investor in the Charm City Di An project in Binh Duong. The legal representative is Mr. Nguyen Huu Nghia (born in 1993), who was appointed Deputy General Director of Charm Group in late January 2024. Mr. Nghia also represents several other legal entities, such as Saigon Container Joint Stock Company, Viet Hai Joint Stock Company, and Heritage Ho Tram Joint Stock Company…

Mr. Nguyen Huu Nghia (left). Photo: Charm Group

|

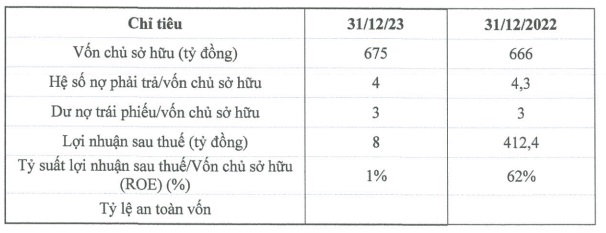

Despite spending heavily on bond repurchases, DCT Partners’ business performance is less than optimistic. In 2023, the company made a post-tax profit of only VND 8 billion, a sharp decrease of 98% from the previous year’s profit of over VND 412 billion. Owner’s equity increased slightly by 1% to VND 675 billion. ROE fell sharply from 62% to 1% in 2023.

|

Some financial indicators of DCT Partners in 2023

Source: HNX

|

The debt-to-equity ratio decreased from 4.3 times to 4 times, corresponding to a debt balance of VND 2,700 billion at the end of 2023. Most of this is bond debt, with a bond debt-to-equity ratio of 3 times.

Vietnam’s Top Corporation Generates Nearly $6 Billion in Revenue in Just 2 Months, Continues to Thrive After Setting a Series of Records in 2023

At the recent spring meeting of representative state-owned enterprises on March 3, Mr. Le Manh Hung, Chairman of the Board of Directors of Vietnam Oil and Gas Group (Petrovietnam), stated that most of Petrovietnam’s production targets for the first two months of the year have been completed, exceeding the 2-month plan by 5-30%.