On June 30, APG Securities JSC (code: APG) failed to organize its 2024 Annual General Meeting of Shareholders.

As of 9:00 am on June 30, the number of shareholders or authorized representatives of shareholders present and registered to attend was 19 delegates, holding and representing over 106 million shares, accounting for 47.57% of the company’s total voting shares. Therefore, APG’s 2024 Annual General Meeting, the first attempt, did not qualify to proceed.

The company’s Board of Directors then passed a resolution to approve the plan to organize the 2024 Annual General Meeting of Shareholders for the second time. The meeting will be held on July 21, 2024, at 132 Mai Hac De building, Le Dai Hanh, Hai Ba Trung District, Hanoi.

APG was not alone in this situation, as several other securities companies also failed to organize their annual general meetings recently.

In mid-May, Asia-Pacific Securities Joint Stock Company (APEC, code: APS) organized its 2024 Annual General Meeting of Shareholders but failed due to a lack of quorum (50%). According to the records of the meeting, only 149 shareholders attended directly or by proxy, representing 36.35% of the total voting shares of APEC Securities. Consequently, APEC Securities’ 2024 Annual General Meeting, the first attempt, could not be held.

VNDirect Securities also faced a similar issue on the afternoon of June 17, reporting that it could not hold its 2024 Annual General Meeting of Shareholders (the first time in history) due to the attendance of shareholders not exceeding 50% of the total votes (the specific ratio was not announced).

However, both APEC and VNDirect Securities successfully held their 2024 Annual General Meetings on the second attempt.

Business Performance of APG Securities

According to the company’s financial statements for Q1 2024, APG Securities recorded an after-tax profit of over VND 6 billion, a decrease of 85% compared to the same period last year. The company attributed the sharp decline in profits mainly to increased losses from the sale of financial assets and revaluation adjustments of financial assets through profit/loss.

For the full year 2024, APG plans to achieve revenue and after-tax profit of VND 390 billion and VND 239 billion, respectively, representing growth of 48% and 43% compared to the previous year’s figures.

Series of Plans to Raise Capital by Issuing Shares

According to the disclosed documents, the company proposed to pay a 2023 dividend in shares at a ratio of 9% (equivalent to the issuance of over 20 million new shares). For 2024, the dividend ratio is expected to be 5%.

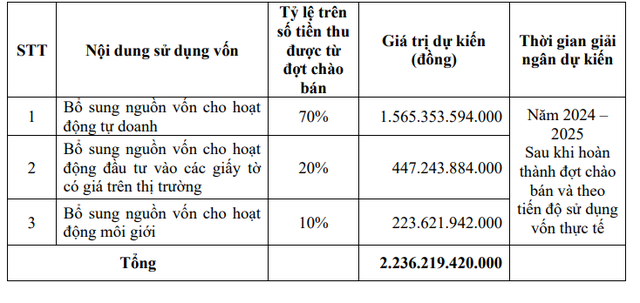

Additionally, APG also plans to present shareholders with a series of proposals to issue shares to increase its charter capital. Specifically, the Board of Directors will propose to offer shares to existing shareholders at a price of VND 10,000 per share, with the number of shares to be issued at nearly 224 million, a ratio of 1:1. The expected proceeds from this offering, amounting to VND 2,236 billion, will be allocated to proprietary trading (70%), with the remaining going towards investing in securities (20%) and brokerage activities (10%).

Proposed use of proceeds from the offering to existing shareholders

The company also plans to issue shares under an employee stock ownership plan (ESOP), with the expected volume of over 11 million shares at an issuance price of VND 10,000 per share.

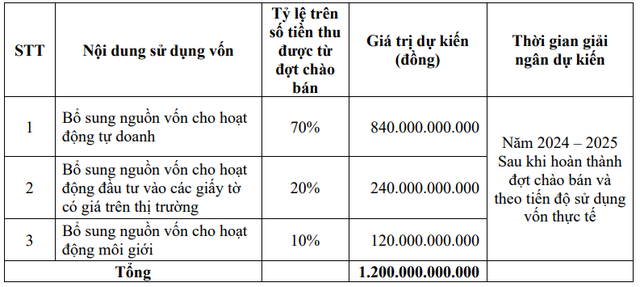

Furthermore, APG proposes to privately place shares to professional securities investors, with a maximum volume of 100 million shares. The expected offering price is VND 12,000 per share, and the offering is planned to take place in 2024. If successful, the proceeds of VND 1,200 billion will be allocated similarly to the offering to existing shareholders.

Proposed use of proceeds from the private placement to professional securities investors

If all the proposed share issuances and offerings are completed, APG’s charter capital is expected to increase to nearly VND 5,800 billion.