At the 18th Extended Conference of the Vietnam Oil Corporation – PVOIL (PV OIL, code OIL – UPCoM), the company announced that in the first half of 2024, its consolidated revenue reached nearly VND 64,000 billion, completing 154% of the 6-month plan; consolidated pre-tax profit reached VND 390 billion, completing 106% of the 6-month plan. Compared to the same period last year, OIL’s revenue increased by 49% but pre-tax profit decreased by 27%.

Regarding the 2024 plan, PVOIL sets a target of 5 million m3/ton of gasoline and oil business volume; consolidated revenue of VND 83,000 billion (built according to the planned crude oil price of 70 USD/barrel) and consolidated pre-tax profit of VND 740 billion. Thus, with the above results, in the first 6 months, OIL completed 56% of the volume target, 77% of the revenue target, and 53% of the profit target for the year.

According to the preliminary estimate for the first 6 months of Vietnam Petroleum Power Corporation – Joint Stock Company (PV Power, stock code POW), the Company’s consolidated revenue is estimated at VND 16,169 billion, equivalent to the same period and achieving 51% of the annual target.

PV Power is one of the largest power generation companies in Vietnam, holding 11% of the country’s power generation capacity. The Corporation currently manages and operates 7 power plants with a total capacity of 4,205MW, including gas, coal and hydropower plants. In 2024, the Company set a revenue plan of VND 31,736 billion and after-tax profit of VND 824 billion – this is the lowest profit level since the enterprise was listed.

Binh Son Refining and Petrochemical Joint Stock Company (stock code BSR) is estimated to have a production volume of about 2.83 million tons of products, with a revenue of over VND 55,300 billion. In the 2nd quarter of 2024 alone, the Company’s revenue is estimated at VND 24,611 billion, down 27% over the same period.

In 2024, BSR sets a target of total revenue of over VND 95,274 billion and after-tax profit of over VND 1,148 billion. Thus, in the first half of the year, BSR achieved 58% of the plan.

Another unit in the oil and gas group, PetroVietnam Transportation Corporation (PVTrans, stock code PVT) estimated that its consolidated total revenue in the first half of the year reached VND 5,200 billion, and its consolidated pre-tax profit is expected to be VND 740 billion.

In the 2nd quarter of 2024 alone, PVTrans reached about VND 2,664 billion in revenue – up 27% over the same period. In contrast, pre-tax profit decreased by 22% over the same period last year to VND 354 billion.

In 2024, PVTrans sets a consolidated revenue plan of VND 8,800 billion. Thus, after 6 months, the Company has achieved 59% of its revenue target.

Recorded by Dragon Vietnam Securities Joint Stock Company (VDSC) after a meeting with the leader of CNG Vietnam Joint Stock Company (stock code CNG), it is estimated that the Company’s pre-tax profit in the 2nd quarter of 2024 was about VND 48 billion.

Accumulated in the first 6 months of the year, gas consumption volume reached 101 million m3 of gas, completing 42% of the plan for the year. Of which, CNG consumption in the North reached 30 million m3 of gas, completing the plan for the year. The company expects actual CNG consumption in the North to reach 50 – 60 million m3 of gas for the whole of 2024.

From April 2024, CNG has changed its pricing policy for some customers: CNG selling price will be linked to Brent oil price (instead of FO oil price as before). The company orients from now to the end of 2024, the new price policy will be applied to 50% of customers.

In the group of real estate enterprises, Total Construction Investment and Development Joint Stock Company (DIC Corp., stock code DIG) announced its preliminary business results for the 2nd quarter of 2024 with consolidated revenue reaching VND 874 billion – up 439% over the same period last year; pre-tax profit reached VND 160 billion – up 815%.

Accumulated in the first 6 months of the year, the Company’s consolidated revenue reached about VND 875 billion – up 143% but pre-tax profit reached VND 40 billion – down 66% over the same period in 2023 (due to large losses in the first quarter of the year).

This year, the Company sets a target of consolidated revenue of VND 2,300 billion and pre-tax profit of VND 1,010 billion. Thus, DIC Corp. has completed 38% of its revenue plan and 4% of its profit target for the year.

The leader of DIC Corp. explained that the unsatisfactory business results in the quarter were due to the Company’s technical risks when there was a return of goods. However, the Company has recovered growth since the 2nd quarter in the context of declining interest rates, returning market confidence, and real estate products that meet the conditions for business are always in high demand.

Saigon Real Estate Total Joint Stock Company (Saigonres, stock code SGR) is expected to have a revenue of VND 86 billion and pre-tax profit of VND 2.2 billion in the first 6 months of 2024.

In the 2nd quarter of 2023 alone, the Company’s revenue was about VND 65.5 billion, nearly 3.9 times higher than the same period. On the contrary, pre-tax profit decreased by 68% over the same period to about VND 15.4 billion.

In 2024, Saigonres plans to have a revenue of VND 628 billion and pre-tax profit of VND 190 billion. Thus, the Company is still far from its profit target.

In other fields, Thuan An Wood Processing Joint Stock Company (stock code GTA) announced its semi-annual estimate with a revenue of VND 138 billion – up 12% over the same period. The burden of high costs caused GTA’s pre-tax profit to decrease by 22% to VND 5 billion.

In 2024, the Company sets a target of total revenue of VND 274 billion and pre-tax profit of VND 10.7 billion. Thus, after 6 months, GTA has achieved 51% of its revenue target and 44% of its profit target.

Or Dong A Steel (GDA), sharing at the recent Annual General Meeting of Shareholders, the Board of Directors estimated that in the first half of the year, sales volume reached 445,000 tons, up 18% over the same period. After-tax profit is expected to be VND 200 billion, equal to the same period, achieving 67% of the year plan.

The company believes that, under favorable conditions, after-tax profit in 2024 can reach VND 400 billion. The balance of inventory provision of the Company is currently at about VND 250 billion, and the Company can reverse it when the business conditions are more stable.

At the opening ceremony of the new MG Dong Nai showroom, Mr. Do Tien Dung – Chairman of Haxaco Automobile Service Joint Stock Company (Haxaco, stock code HAX) also said that the Company has recorded positive results from expanding the distribution system of MG automobiles in many provinces and cities across the country.

It is estimated that in the 2nd quarter of 2024, Haxaco recorded a profit of about VND 30 billion, of which 90% of the profit was contributed by the distribution of MG automobiles. This year, the Company targets a consolidated pre-tax profit of VND 200 billion, 4.2 times higher than the low level of the previous year (VND 48 billion).

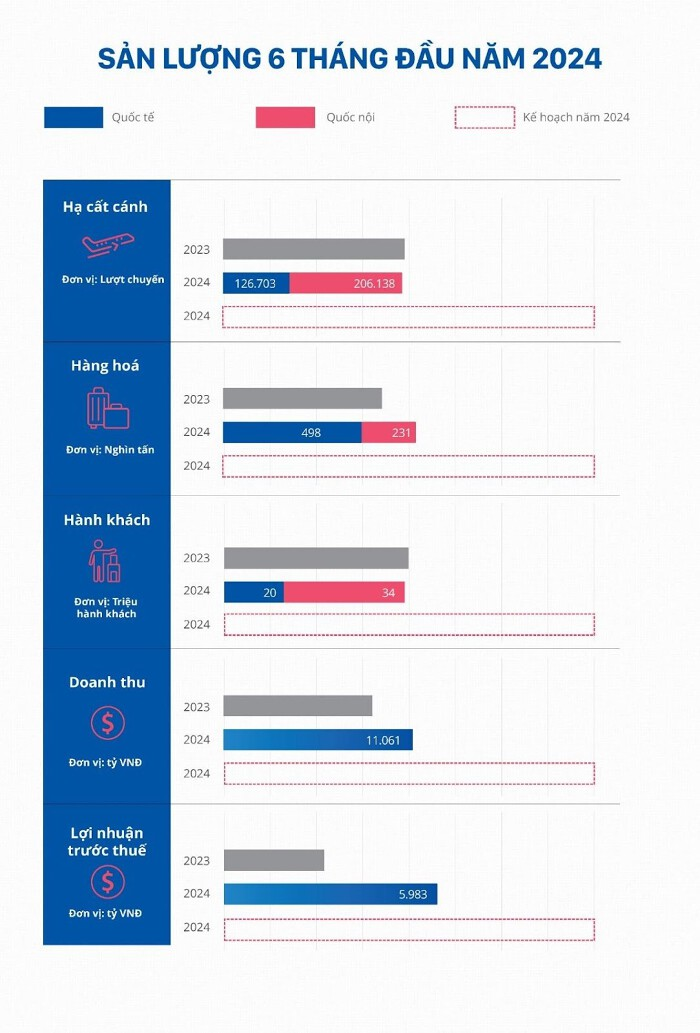

Information at the conference to review the work in the first 6 months of the year and deploy key tasks in the last 6 months of 2024, Vietnam Airports Corporation (ACV) said that the total revenue was VND 11,061 billion, up 22% over the same period, achieving 54% of the year plan. Pre-tax profit is estimated at VND 5,983 billion, up 14% over the same period, achieving 64% of the year target.

Profit from Sugarcane, Durian, and Leafy Vegetables with the Lunar New Year approaching

Good news for farmers in the Mekong Delta provinces as the prices of sugarcane, durian, and vegetables… have skyrocketed during the days leading up to the Lunar New Year, providing them with attractive sources of income.