On July 1st, the Board of Directors of CII approved the issuance and offering of corporate bonds in a private placement with a total par value of 300 billion VND.

Specifically, the total expected volume of the bond offering is 3,000 bonds, equivalent to 300 billion VND. The bond term is 36 months from the issuance date.

In terms of interest rates, it will be floating throughout the bond term. Specifically, it will be the sum of 4.85% and the reference rate.

The reference rate is defined as the average of 12-month term deposit/savings interest rates for individual customers in Vietnamese Dong announced by four banks: MBBank, VPBank, ACB, and Techcombank, at around 11:00 AM (Vietnam time) on the relevant interest rate determination date.

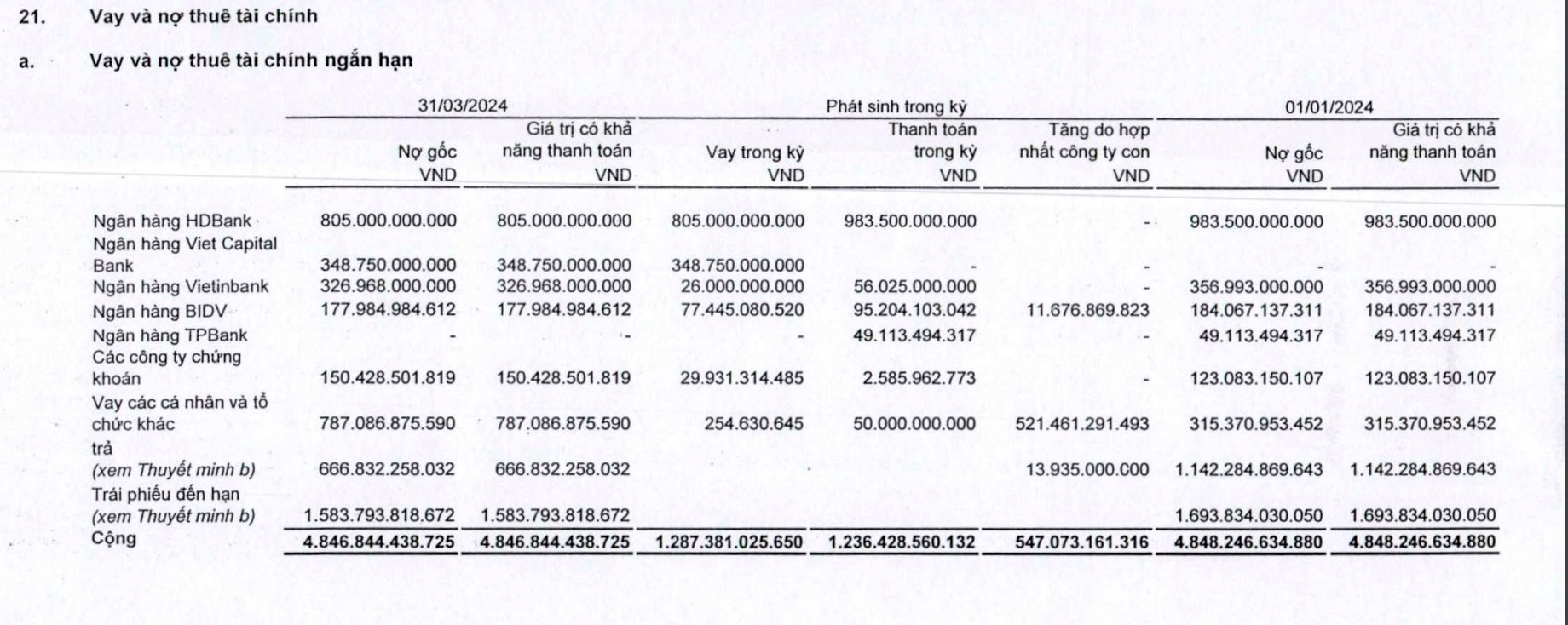

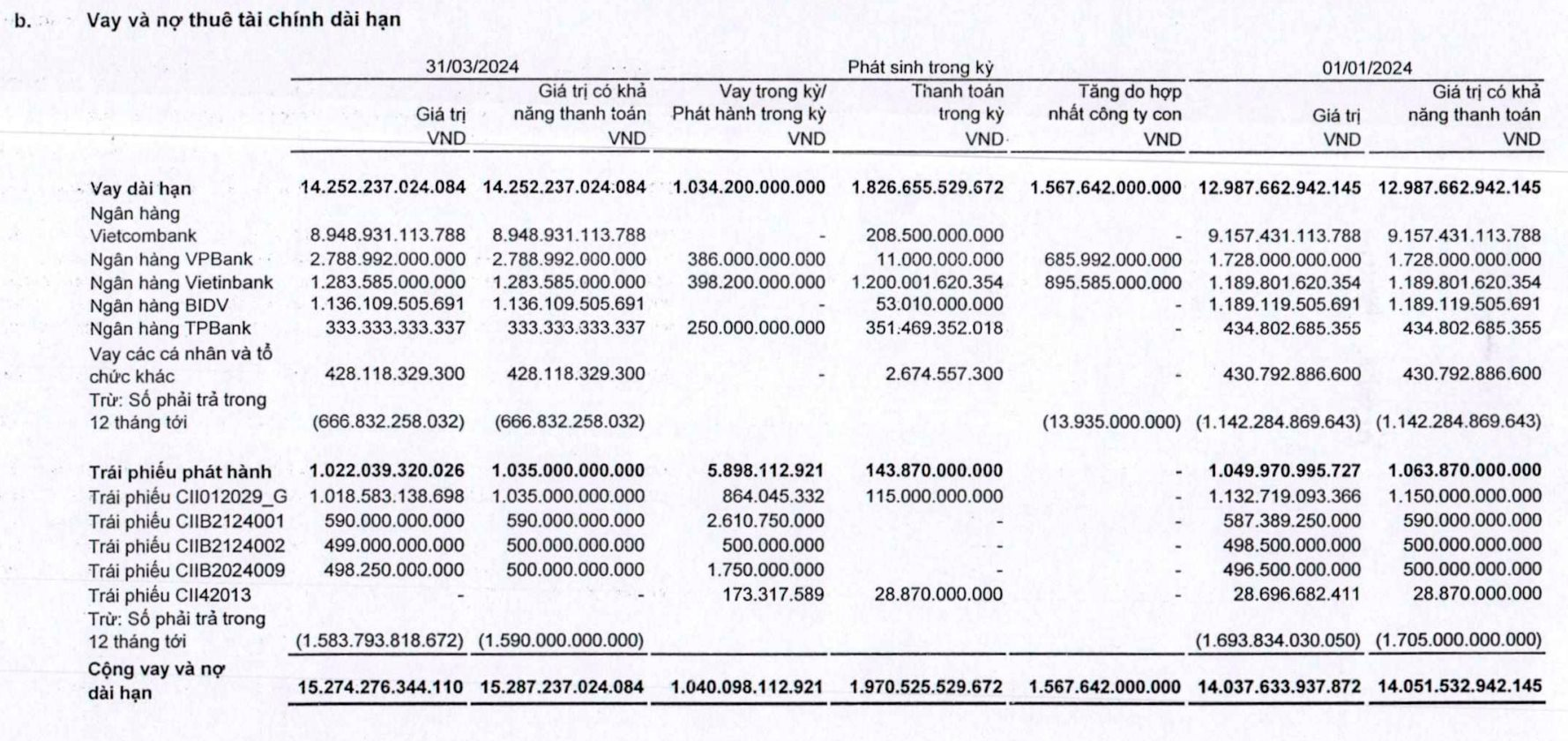

Notably, as of March 31, 2024, CII had a total debt of 26,677 billion VND, equivalent to over 1 billion USD. This includes short-term loans and finance leases of 4,846 billion VND, long-term loans and finance leases of 15,274 billion VND, and convertible bonds of 2,840 billion VND. Thus, CII’s loans and finance leases amount to more than 20,120 billion VND, accounting for 75% of the company’s total liabilities.

CII has over 20,120 billion VND in loans and finance leases, constituting 75% of the company’s total liabilities. Source: Consolidated Financial Statements of CII

Turning to the company’s financial performance, for Q1 2024, CII recorded net revenue of 878 billion VND, a 17.4% increase compared to the same period last year. Gross profit amounted to 471 billion VND, marking a significant 71% rise year-over-year.

Additionally, financial income for the period reached 471 billion VND, reflecting a notable 71% improvement.

Conversely, profit from joint ventures and associates stood at a mere 120 million VND, a substantial decrease from the 15.7 billion VND recorded in the previous year. Furthermore, other income reported a loss of over 2.3 billion VND, contrasting the profit of 4.8 billion VND in the corresponding period last year.

During this quarter, CII experienced significant increases in financial expenses, selling expenses, and management expenses, amounting to 532 billion VND (up by 145%), 24.4 billion VND (up by 55.3%), and 186.6 billion VND (up by 116.7%), respectively, compared to the same period in the previous year.

Consequently, for Q1 2024, CII posted a post-tax profit of 322 billion VND, representing a remarkable almost 9.3-fold increase compared to the same quarter last year (7.1 billion VND).

The post-tax profit attributable to the parent company’s shareholders was 259 billion VND, a 35.4-fold surge compared to the same period in 2023. This impressive growth in profitability resulted in a basic earnings per share of 752 VND, reflecting a 27.8-fold increase year-over-year.

In the stock market, as of the morning session on July 2nd, the share price of CII stood at 15,900 VND per share, a slight increase of 0.32% from the previous trading session.