Shares of Southern Basic Chemical Joint Stock Company (CSV) surged to the upper limit on July 3, reaching a peak of 29,400 VND per share and even witnessed a buying spree with more than 400,000 shares stacked at the ceiling price. As a result, CSV’s market price established a new historic peak, with its market capitalization surpassing 3,200 billion VND, reflecting a 42% increase compared to the beginning of the year.

This positive development in the stock price came immediately after the “rollover” day for dividend payout. July 2 was the ex-dividend date for CSV shareholders to be eligible for the 2023 cash dividend and receive bonus shares for capital increase.

Specifically, the company implemented a 2023 cash dividend payout at a rate of 25% (1 share receives 2,500 VND), divided into two phases. In the first phase, shareholders will receive a 10% dividend, expected to be executed on July 16. The remaining 15% dividend will be distributed later, anticipated around October 7.

Additionally, CSV plans to issue over 66 million shares at a ratio of 100:150 (for every 100 shares held, shareholders will receive 150 new shares). Following this issuance, CSV’s chartered capital will increase from 442 billion VND to 1,105 billion VND. The capital source for this initiative will come from surplus capital, other funds belonging to owner’s equity, and the development investment fund.

Apart from the dividend news, the robust upward momentum of CSV shares can be attributed to market expectations of a bottoming-out and subsequent rebound in the global caustic soda market this year, driven by a resurgence in demand.

According to a recent assessment by the Vietnam Chemical Group (Vinachem), the global caustic soda and chlorine market is anticipated to rebound in 2024 as the tight monetary policy in major economies nears its conclusion and interest rates begin to cool down. Industries worldwide are expected to recover, and Vinachem is optimistic that caustic soda and chlorine, being fundamental and essential materials, will witness continued growth in both production and consumption throughout this upward cycle.

CSV operates in the field of chemical production, offering a range of products such as caustic soda (NaOH), sulfuric acid (H2SO4), hydrochloric acid (HCl), phosphoric acid (H3PO4), and PAC. These products serve as vital raw materials for numerous essential industries, including fertilizers, paints and printing inks, pesticides, detergents, water treatment, and steel pickling.

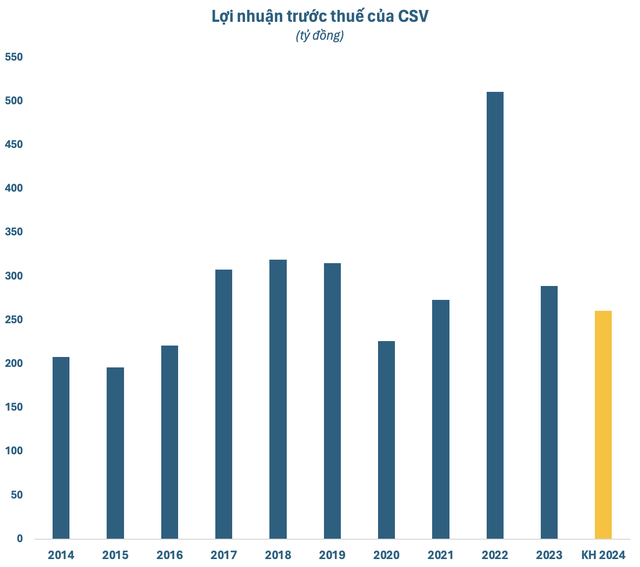

Regarding the 2024 business plan, CSV’s management has set a revenue target of 1,640 billion VND, representing a modest 3% increase compared to 2023. However, the profit before tax is projected to decrease by 10% to 261 billion VND, marking the lowest profit level for CSV in the last four years.

CSV’s leadership acknowledges the challenges posed by declining market prices for products like NaOH and HCI, as well as the intense competition faced by products like H3PO4 and H2SO4 from cheaper imports. Nevertheless, they remain optimistic due to stable raw material prices, a loyal customer base, intensified sales efforts towards TKV, and appropriate inventory levels in line with production progress.

In 2023, CSV recorded a 25% decrease in net revenue, amounting to 1,588 billion VND, while profit before tax declined by 25% and 43%, respectively, reaching 289 billion VND. Despite these setbacks, the company managed to surpass its annual profit plan by 7%.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.