In its newly released mid-year strategic report, MB Securities (MBS) expects Vietnam’s economic growth in Q3 and Q4 to reach 6.6% and 6.5% year-on-year, respectively, driven by export recovery and improved investment disbursement.

Regarding the global macroeconomic outlook, MBS Research states that global growth is predicted to stabilize at 2.6% this year. “A few central banks have eased monetary policies, and with the Fed expected to cut interest rates once or twice in the second half of the year, a more favorable environment is expected for emerging market equities, including Vietnam,” the report noted.

VN-Index to reach 1,350 – 1,380 points

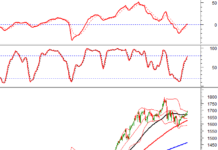

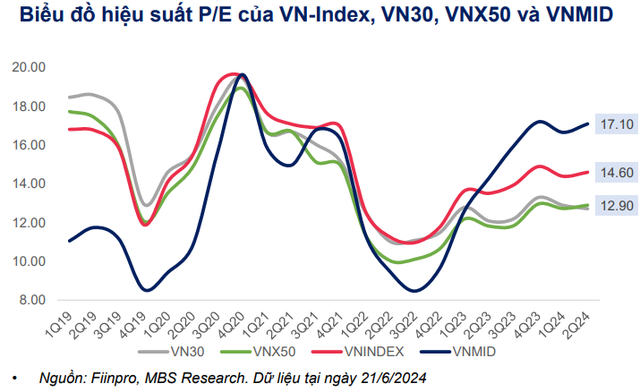

On the stock market front, the VN-Index ended June 2024 at 1,250 points, among the best-performing markets in the region. The recent surge in mid-cap stocks has pushed the VNMID valuation to 17.1 times P/E, about 17% higher than the VN-Index. Despite the market’s strong rally, MBS analysts believe there is still room for further upside.

The research team forecasts the VN-Index to reach 1,350 – 1,380 points by the end of the year, assuming a 20% earnings growth for listed companies in 2024 and a target P/E range of 12 to 12.5 times.

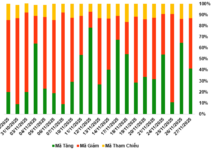

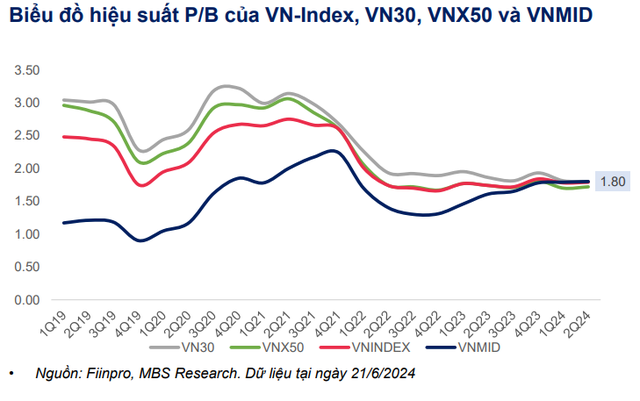

According to MBS Research, large-cap stocks offer attractive valuations regarding earnings growth potential in the 2024-2025 fiscal year compared to other segments. Currently, mid-cap stocks are trading at P/B valuations on par with large-cap stocks. In contrast, large-cap stocks (represented by VN30 and VNX50) are trading at valuations approximately 11% lower than the market average.

Market-wide earnings growth to surge in H2 2024

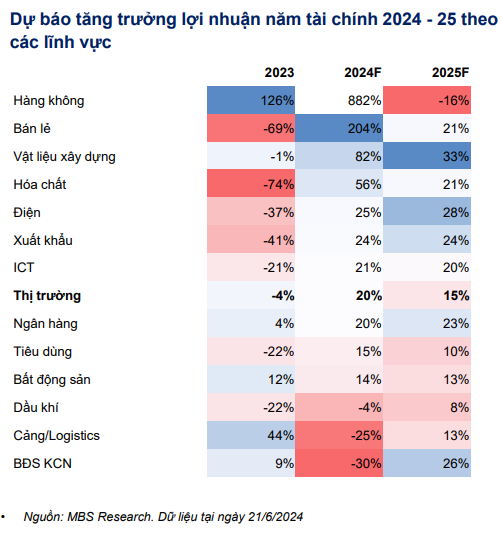

Additionally, MBS Research is optimistic about market-wide earnings growth in the second half of 2024, which bodes well for the stock market’s further expansion. Following a modest 5.3% growth in Q1 2024, MBS projects total market earnings to increase by 9.5% year-on-year in Q2 and 33.1% and 21.9% in Q3 and Q4, respectively.

For the full year 2024, the analytics team expects market earnings to grow by 20% year-on-year from the low base of 2023. Key drivers for the market’s improved earnings include robust performances from sectors such as banking, retail, construction materials, and electricity.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.