The buyers took a more active approach in the afternoon session, with slightly higher liquidity, and money flowing into large-cap stocks.

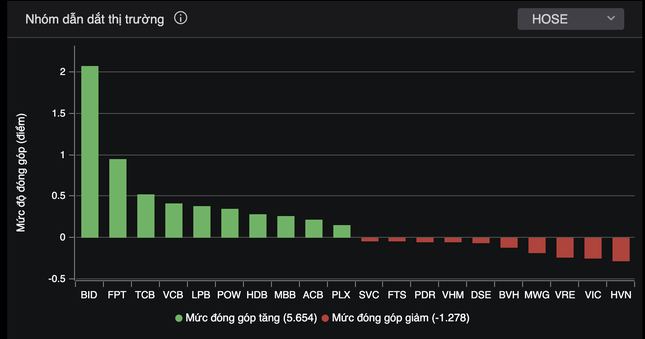

The VN30 basket saw 20/30 stocks rise, with FPT being the most active, trading over 1,000 billion VND. The main driving force for the market remained banking stocks, with BID taking the lead. BIDV shares contributed over 2 points with a 3.2% increase. BID’s liquidity surged, doubling or tripling the usual volume, with today’s matched orders reaching 214 billion VND.

Banking stocks dominated the market leaders.

TCB, VCB, LPB, HDB, MBB, and ACB dominated the market leaders, with banking stocks painting the board green, except for VIB, which fell slightly by 0.2%. This upward trend was observed on both the HNX and UPCoM exchanges.

LPB even hit a new peak of 30,200 VND per share. Since the beginning of the year, this stock has risen more than 90%, becoming one of the fastest-growing banking stocks. HDB’s rally extended to the seventh consecutive session, with a 9.6% increase in share price.

The current market recovery is significantly influenced by banking stocks, as the industry is expected to lead profit growth in the second quarter of this year. SSI Research has estimated the profits of listed banks in the second quarter, with many banks expected to show strong growth of tens of percent, with VPBank leading the pack (60%). On the other hand, VIB and OCB are projected to experience profit declines.

In addition to the pull from banking stocks, the market witnessed a consensus among technology and oil and gas stocks. However, the movement of the VN-Index still depends largely on the fluctuations of the VN30 group and banking stocks during this period.

Liquidity is expected to focus on large-cap stocks and those with positive second-quarter financial results. If the upward momentum continues, VN-Index may conquer the 1,280-point threshold in the coming sessions.

At the end of the trading session, VN-Index rose 7.08 points (0.56%) to 1,276.85 points. HNX-Index increased by 1.75 points (0.73%) to 241.43 points. UPCoM-Index decreased by 1.06 points (1.07%) to 97.84 points.

Liquidity edged higher, with matched orders exceeding 13,300 billion VND. Net selling pressure from foreign investors returned, with net selling of 530 billion VND, mainly in VRE.

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.