On July 4, Vietcap’s Board of Directors approved a plan to issue nearly 132.6 million shares to existing shareholders at a ratio of 10:3, or 30% (shareholders owning 10 shares will receive 3 new shares), all of which will be freely transferable.

The offering is expected to take place in the third or fourth quarter of 2024, following approval from the State Securities Commission (SSC). If successful, Vietcap’s chartered capital will increase from VND 4,419 billion to nearly VND 5,745 billion.

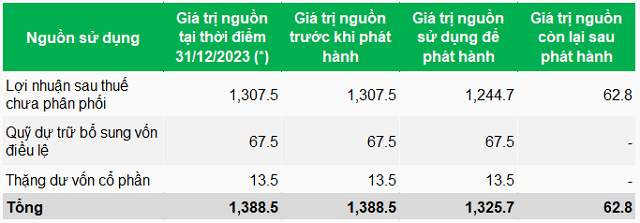

VCI will use its own capital according to the 2023 audited financial statements to implement this plan, mainly using undistributed post-tax profits of nearly VND 1,245 billion, with the remaining VND 67 billion coming from the supplementary charter capital reserve fund and nearly VND 14 billion from the capital surplus reserve, totaling nearly VND 1,326 billion.

|

Vietcap’s Capital Issuance Plan

Unit: Billion VND

Source: Vietcap

(*): According to Vietcap’s 2023 Audited Financial Statements

|

The nearly 132.6 million shares that Vietcap plans to issue are part of the capital increase package that was approved at the 2024 Annual General Meeting of Shareholders, which includes three different methods to be implemented in the following order: (1) issuance of 4.4 million ESOP shares, (2) issuance of nearly 132.6 million shares to existing shareholders as mentioned above, and (3) offering of more than 143.6 million shares in a private placement.

Previously, on June 19, 2024, Vietcap completed the ESOP share issuance plan for 142 employees, with the expected transfer of shares to take place in July or August 2024, after completing the registration procedures at VSD and supplemental listing registration with HOSE.

At a price of VND 12,000 per share, VCI raised approximately VND 53 billion to supplement working capital and reduce debt.

Going forward, investors will continue to await the final plan, which also has the largest number of shares and value among the three methods.

With this method, VCI will offer shares to domestic and foreign investors with financial capabilities, as well as professional securities investors. The privately placed shares will be restricted from transfer for a minimum of one year from the date of completion of the offering.

The offering price will not be lower than the company’s book value per share as of December 31, 2023, which was VND 16,849 per share (based on the 2023 audited financial statements). The total expected proceeds from the offering are at least VND 2,420 billion, of which VCI will use more than VND 2,100 billion to supplement capital for lending activities.

The issuance is expected to take place in 2024, after the completion of the ESOP share issuance and the share issuance to existing shareholders. If successful, VCI will have completed its planned capital increase, issuing a total of 280.6 million new shares and raising its chartered capital to VND 7,181 billion.

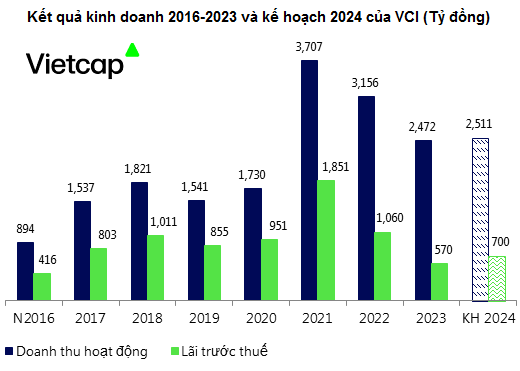

In terms of business plans, in 2024, Vietcap aims to achieve operating revenue of VND 2,511 billion and pre-tax profit of VND 700 billion, an increase of 2% and 23%, respectively, compared to the previous year. The expected dividend payout ratio is 5-10%.

The VCI Board of Directors proposed the 2024 plan based on the expectation that the global and Vietnamese macro-economy will remain variable and complex, with the VN-Index forecasted to fluctuate around 1,300 points by the end of 2024.

Chart: The Manh

|

In the first quarter of this year, Vietcap reported positive results, with total operating revenue of over VND 806 billion, up 62% year-on-year, and net profit of nearly VND 198 billion, an increase of 171%, driven by strong performance in proprietary trading and brokerage.

VCI Reports Q1 Net Profit Surge Thanks to Strong Performance in Proprietary Trading and Brokerage

Huy Khai

Vinamilk: Impressive nearly 20% growth in Q4/2023 export revenue

Vinamilk has announced its financial report for Q4 2023, recording a consolidated total revenue and after-tax profit of VND 15,630 billion and VND 2,351 billion, respectively. This represents an increase of 3.6% and 25.8% compared to the same period last year. For the full year, the consolidated total revenue and after-tax profit reached VND 60,479 billion and VND 9,019 billion, completing 95% of the revenue target and 105% of the profit target.

HAG’s approved plan to issue VND 1,300 trillion of private shares

During the 10-day sales period, HAGL is required to submit a report along with confirmation from the bank where the account is opened to verify the amount of money raised from the sales campaign to the State Securities Commission.