Kafi’s Profit Soars for the 6th Consecutive Quarter

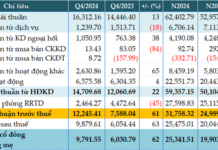

According to the recently announced results, Kafi Securities has achieved impressive business performance in the first half of 2024. The company’s pre-tax profit surged by over 135% year-on-year to VND 95 billion. Notably, this marks the 6th consecutive quarter of profit growth since the implementation of its new business strategy.

Kafi’s total net revenue also witnessed a remarkable increase, reaching VND 137 billion, almost a 100% jump from the previous year. This growth is attributed to the strong performance of its securities brokerage and proprietary trading segments, including margin lending and stock trading activities, which recorded a more than fivefold increase compared to the same period last year.

Despite a 47% rise in operating expenses, amounting to VND 42 billion due to investments in technology and expansion, Kafi effectively managed its costs. The cost-to-income ratio (CIR) improved from 42% to 31%, indicating enhanced operational efficiency.

“These results validate our development strategy,” said Mr. Trinh Thanh Can, CEO of Kafi. “With our current growth trajectory, we are confident that Kafi will soon achieve its goal of becoming a leading retail securities company in Vietnam.”

Margin Lending Soars, Innovative Product Suite

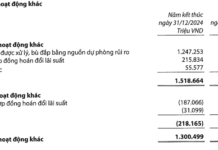

In the first six months of 2024, Kafi Securities experienced extraordinary growth in its loan balance, rising from VND 1,100 billion at the beginning of the year to nearly VND 4,000 billion as of June 30, 2024.

This success is largely attributed to the introduction of three new loan products, catering to the diverse needs of customers with competitive interest rates and convenient terms:

Margin-Zero: Offering a 0% interest rate for customers with a maximum debt balance of VND 100 million. This product provides an ideal financial solution for individual investors to access initial investment capital without incurring borrowing costs.

Margin-S25: Featuring a 7% interest rate for customers with an S25 portfolio ratio above 75%. Margin-S25 enables professional investors to optimize profits from highly-rated investment portfolios.

Margin-B10: With an 8% interest rate, Margin-B10 is designed for customers with debt balances above VND 10 billion, offering financial flexibility and significant investment opportunities for financially strong investors.

All three of Kafi’s new loan products offer competitive interest rates in the market, along with simple and inclusive eligibility criteria. This approach not only fuels the growth of loan balances but also underscores the company’s innovation and ability to cater to the diverse needs of investors.

Continuing the Capital Increase Journey, Aiming for VND 7,500 Billion

In the second quarter of 2024, Kafi successfully raised its charter capital to VND 2,500 billion. The company doesn’t plan to stop there, as it targets to increase capital to VND 5,000 billion this year and strives for VND 7,500 billion by 2025. This is a crucial part of Kafi’s detailed strategy to foster solid development and expand its business scale.

“The decision to raise capital demonstrates the trust and commitment of our shareholders to our company’s strategy,” affirmed Mr. Can. “We will utilize these resources to invest in technology, product development, and network expansion, enhancing our competitiveness and propelling Kafi towards its strategic goals.”

With these positive steps, Kafi is confident in continuing to achieve new milestones while delivering increased value to its customers and investors in the Vietnamese market.

|

At the beginning of 2024, Kafi represented Vietnam in receiving two prestigious global awards: “Best Fixed Income” from Global Brand Magazine and “Most Innovative Platform for Securities Trading – Vietnam 2023” from Global Business Outlook (UK). In June 2024, at the Vietnam Wealth Advisor Summit 2024, Kafi was honored with two more awards: “Outstanding Financial Brokerage Service” and “Typical Technology Product and Digital Transformation.” |

Bamboo Capital (BCG) surpasses 4,000 billion VND in revenue, reduces debt by 5,500 billion VND by 2023

The amount of debt to be paid has been reduced by more than 5,498 billion VND as the Group has actively settled all borrowings in order to lessen the cost of interest and ensure financial stability for the business.