Funds managed by Dragon Capital continued their buying spree by acquiring an additional 396,440 shares of NLG (Nam Long Investment Corporation) on June 26, pushing their collective ownership above the 7% threshold, equivalent to 27 million shares.

Previously, on May 16, Dragon Capital purchased 1.97 million NLG shares, becoming a major shareholder in the company. This was followed by another acquisition of 1.48 million NLG shares on May 22, bringing their total holdings to 6.03%.

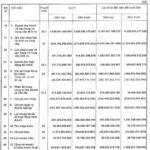

| Price movement of NLG shares from the beginning of 2024 to July 05 |

Dragon Capital’s consistent increase in ownership comes as NLG shares have risen 15% since the beginning of the year, reaching 41,600 VND per share (as of June 26). Based on this price, the investment fund is estimated to have spent more than VND 16 billion on this transaction.

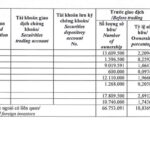

| Price movement of KDH shares from the beginning of 2024 to July 05 |

Following their purchase of NLG, Dragon Capital went on to acquire a total of 917,500 shares of KDH (Khang Dien House Trading and Investment Joint Stock Company) on June 27, pushing their collective ownership above 8%, equivalent to nearly 65 million shares.

At the close of the June 27 trading session, KDH shares were priced at 37,500 VND each. Based on this price, the investment fund may have spent more than VND 34 billion to increase its holdings in Khang Dien.

After reducing their KDH holdings below the 7% threshold in late April, Dragon Capital has returned to accumulate nearly 9 million KDH shares, pushing their ownership back above 8%. This move comes as KDH shares are on the rise, approaching their previous peak of 38,600 VND per share (as of March 26, 2024).

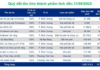

| Price movement of DGC shares from the beginning of 2024 to July 05 |

In addition to their increased holdings in these two real estate companies, Dragon Capital has also shown a keen interest in the chemical sector.

Specifically, the Dragon Capital group net bought 580,000 DGC shares, increasing their ownership in Duc Giang Chemical Group Joint Stock Company from 5.88% (22.3 million shares) to 6.03% (22.9 million shares).

On June 14, the Dragon Capital group purchased 650,000 DGC shares, pushing their holdings in Duc Giang above the 6% threshold. However, on June 18, the group sold 960,000 shares, reducing their ownership to 5.85%.

DGC shares have performed well on the stock market this year, rising nearly 33% to 125,000 VND per share as of the close of July 5, with an average trading volume of more than 3 million shares per session.

Source: VietstockFinance

|

Dragon Capital Acquires Additional 3 Million HSG Shares from Hoa Sen Group

Dragon Capital has recently acquired an additional 3 million shares of HSG, increasing its ownership stake in Hoa Sen Group to over 11.3%.