The method includes a comparison with data on the CCCD, electronic identity accounts, or the bank’s biometric database, as shared by Mr. Dao Trung Thanh (Master’s in Cyber Security and Law, Deputy Director of the Institute of Blockchain and AI).

Decision 2345/QD-NHNN of the State Bank on the safety of online payments and bank cards from 1/7/2024 has been attracting attention. Can you share your professional perspective on this matter from a technological/digital transformation angle?

I once moderated a workshop on protecting bank accounts in 2023, where this issue was extensively discussed. Decision 2345/QD-NHNN meets the expectations of many in implementing technological measures to safeguard accounts and minimize fraud.

From a professional standpoint, I believe the adoption of biometric authentication is the best solution at present. It not only enhances the security of each transaction but also serves as a catalyst for credit institutions to apply advanced AI technology, thereby reducing risks and improving overall operational efficiency.

Mr. Dao Trung Thanh, Deputy Director of the ABAII Institute

In your opinion, what are the challenges in implementing Decision 2345 of the State Bank?

Effective implementation requires close coordination between agencies. The State Bank has been collaborating with the Ministry of Public Security to connect with the National Population Database and with the Ministry of Information and Communications to clean and validate bank account information. The collection of biometric data creates pressure and increases costs for banks. To ensure progress, banks need to proactively deploy ahead of the 01/07/2024 deadline.

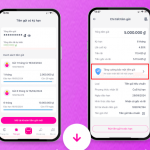

Many banks in the market have already applied biometric authentication quite early on. One example is MB Bank, which started deploying biometric authentication early on and gradually rolled it out to customers from late 2023 – when Decision 2345 was issued. According to the bank’s published data, as of the beginning of June, about 95% of interbank money transfers using facial data collected and stored at MB were successful. A small number of customers who were unsuccessful were invited to transaction points for direct support. Obviously, careful preparation will reduce pressure on the bank, enhance security, and provide convenience to customers.

What are your thoughts on applying these security measures in the context of the growing deepfake technology?

Although biometric authentication technology is not entirely immune to deepfakes, it still serves as an important security layer. While deepfakes can create fake videos or images, biometric authentication is harder to spoof than passwords or OTPs. It is part of a multi-factor authentication (MFA) system, creating a robust defense. Back to the example of MB Bank, their technology can prevent fraud, even with the use of deepfake technology, by detecting faces that do not match the registered person, rejecting recognition for those wearing masks, covering their faces, wearing sunglasses, or deliberately not showing their faces during transaction authentication.

MB Bank continuously deploys account protection layers to give users peace of mind when transferring money

Currently, there are concerns that biometric authentication will inconvenience customers, especially the elderly who are not tech-savvy.

As about 90% of interbank money transfers are below VND 10 million, the application of biometric authentication from this threshold will only affect 10% of customers. Banks are actively guiding and supporting customers in performing authentication. While it may pose challenges for some customer groups, this measure is necessary to ensure the safety of online transactions. Banks need to strengthen education on information security. Customers should be cautious and only update their information through official bank channels.

Thank you, Mr. Dao Trung Thanh, for your valuable insights today.

VMG eID-VMG Bio-2345: The Next-Gen Solution for Bank Account Protection

Despite constant warnings from banks, regulators, and the media, many people still fall prey to sophisticated online scams and lose their hard-earned money. This problem is becoming increasingly prevalent, and it is crucial to find effective solutions to protect citizens in the digital age.