In the report “Overcoming Challenges, Moving Forward” released by MB Securities (MBS Research), the analysis team assesses that the VN-Index has not yet peaked and could reach 1,350–1,380 points by year-end, supported by large-cap stocks. Market-wide earnings growth this year may reach 20%, with a target P/E of 12–12.5 times. The team also identifies several sectors with promising prospects for the second half of the year.

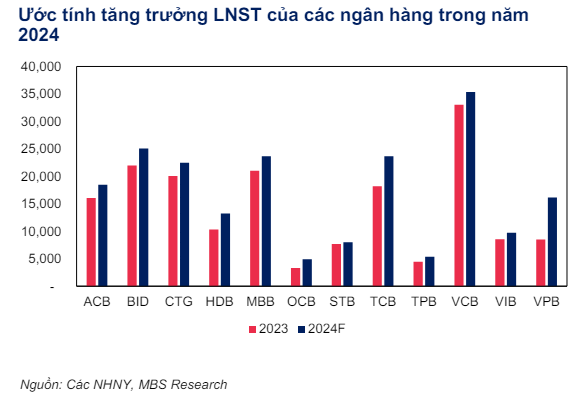

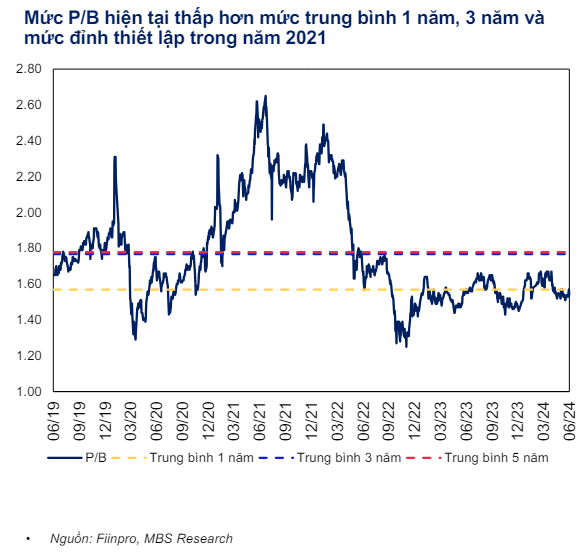

For the banking group, MBS forecasts improved profit growth from last year’s low base. Credit will focus on banks that can “sacrifice” NIM more than the industry average or have stronger asset quality. Meanwhile, asset quality is expected to deteriorate by the end of this year compared to Q1/2024. Profits for banks under coverage are expected to increase by 15.3%. In terms of valuation, MBS Research also believes that bank valuations are currently very attractive, with P/B currently below the 1-year, 3-year, and peak levels seen in 2021.

The residential real estate group is seen as having many positive recovery signals as supply recovers and interest rates become more attractive to stimulate market development. The improvement in the legal system will help the real estate market develop sustainably in both supply and demand. In addition, capital restructuring and M&A activities in real estate projects will be vibrant in the remainder of 2024.

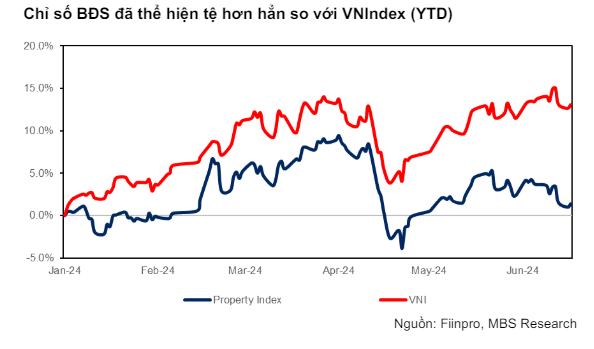

Although there are still some risks in bonds that need attention, MBS believes that there could be a re-rating for real estate stocks. Since the beginning of the year, the real estate index has underperformed the VN-Index, with gains of 1.4% and 13.1%, respectively. The P/B ratio of the residential real estate group is at 1.16 times, lower than the 5-year median of 1.6 times.

“We believe that the residential real estate group is trading at a relatively low valuation and as the business outlook continues to show positive signals, the market is likely to seek a leading sector with an attractive story and an appropriate risk-reward ratio in the near future. We do not rule out the possibility of a re-rating for the residential real estate group to bring it back to a more appropriate valuation”, the MBS Research report states.

For the industrial real estate group, MBS assesses that there are high expectations but also challenges in the second half of 2024. Stable land rental prices and high demand for rentals due to increased domestic and foreign investment, positive FDI, and the construction of new industrial parks will be bright spots for this sector. However, difficulties still lie ahead as there is increasing competition for FDI with other countries in the region, the risk of power shortages for production during peak seasons, and global minimum tax policies.

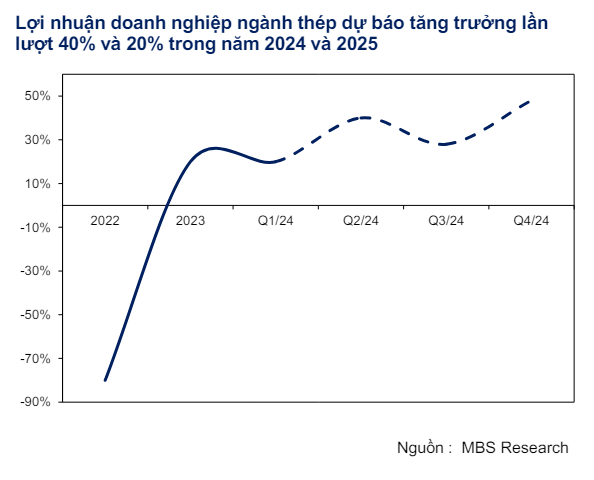

The steel group is expected to enter a “new growth cycle” by MBS analysts. Steel company profits are expected to grow by 40% in 2024 due to several factors: (1) The steel industry may recover due to positive signals from the real estate sector. Increased housing and infrastructure supply will contribute to both prices and volume. Revenue is expected to recover by 25% due to a 9% and 8% increase in volume and selling prices, respectively. (2) Gross profit margin recovers to 13% due to an 8% yoy increase in output prices and a 4% yoy decrease in raw material prices due to stable supply. Provisions will cool down due to rising output prices. Financial costs decrease by 30% as currency pressure and borrowing costs ease.

In addition, steel companies may have further opportunities to expand their market share due to anti-dumping duties. The Ministry of Industry and Trade has decided to investigate galvanized imports from China and South Korea from Q3/2024. MBS believes that this will contribute to domestic galvanized products such as (HSG, NKG) and by avoiding competition with cheap products, the market share of domestic enterprises may increase as the gap is narrowed.

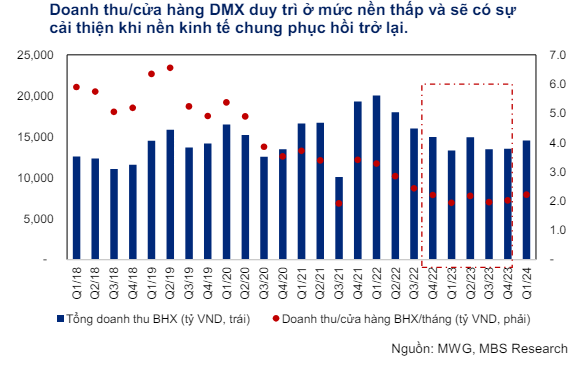

The retail group is also expected to benefit from the recovery in consumption. In particular, MWG is expected to benefit from the recovery of non-essential consumer goods from the low base in 2023, with total revenue for 2024 expected to reach VND 128,503 billion (+9% svck). MBS also expects BHX to break even by mid-2024 and generate profits of about VND 500 billion.

In addition, MBS assesses that some sectors such as electricity, oil and gas, new sectors related to data centers and semiconductors, and logistics will also have positive prospects in the second half of 2024.

In conclusion, the MBS team identifies several specific stocks with potential, namely VPB, ACB, BCM, POW, HPG, MWG, FPT, PVS, DCM, and DXG.