Foreign investors had a strong net selling session, the strongest since the beginning of the year, with a net selling value of up to VND 2,400 billion. Although foreign investors have been net sellers since the beginning of the year, with a net value of up to VND 53,000 billion, the sudden net selling sessions continue to “torture” domestic investors’ spirits.

However, data from VnEconomy shows that the selling situation of foreign investors is not as “dire” as the market reflects.

Most of the foreign investors’ net selling value was through agreements. This group net sold through agreements of VND 1,161 billion in today’s trading session.

The top stocks that were net sold through agreements include HDB with a net sell-off of VND 449 billion, SAB with a net sell-off of VND 192 billion, of which VND 176 billion was through agreements; MSN was net sold off by VND 161 billion, of which an undisclosed amount was through agreements…

Commenting on the net selling action of foreign investors in today’s trading session, Mr. Nguyen The Minh, Director of Analysis and Research of Yuanta Securities, said that this is simply a portfolio restructuring of some foreign investment funds from Thailand to a domestic fund, but it does not change the ownership.

In other words, instead of directly holding the number of stocks in the portfolio, these funds will transfer them to a domestic fund. “This is an agreed transaction, and the nature is that the fund still holds the shares, which does not affect the market,” said Mr. Minh.

The reason for this is that, since the beginning of 2024, Thailand has issued new regulations allowing competent authorities to tax the foreign income of individuals if they are Thai residents for a maximum of 180 days/year and earn income abroad from work or assets in the specific assessment year.

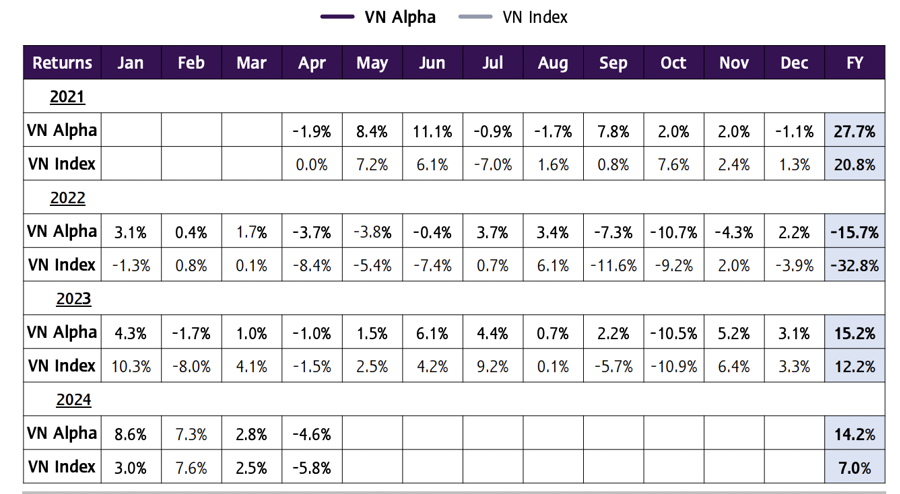

To avoid being affected by the new regulations, Thai private investment funds have sought to transfer the number of shares in their portfolios to domestic funds. For example, the large-scale Private Fund model VN Alpha – InnovestX with superior performance compared to VN-Index has “avoided tax” by this method.

Private Fund model VN Alpha – InnovestX has been investing in Vietnam since April 2021, with total assets of up to VND 4,705 billion. History shows that in 2021, the fund’s performance reached 27.7%; in 2022, when a series of foreign funds suffered heavy losses, VN Alpha also evaporated only 15.7% compared to the decrease of 32.8% of VN-Index.

In 2023, the fund’s performance was also outstanding at 15.2% compared to 12.2% of VN-Index. As of the end of April, the fund’s performance was 14.2% compared to the VN-Index’s increase of 7%.

The top 5 stocks held by Alpha include HDB with a weight of 21%; STB 14%; CTG 12%; CMG 8%. These are also the stocks with large net selling values through agreements today, including HDB net sold through agreements of VND 449 billion; STB net sold through agreements of VND 318 billion; CMG net sold through agreements of VND 11 billion;

“With such superior performance, there is no reason for this fund to sell and leave the Vietnamese stock market. This is purely a technical matter, transferring from a Thai fund to a domestic fund to avoid taxes,” said Yuanta’s expert.

The manager of the VN Alpha fund in Vietnam has just reassured investors about the sudden transactions of foreign investors in today’s trading session. He said, “We are just restructuring our fund to manage some foreign exchange tax issues for our clients.

Net selling value may continue to be higher in the next few weeks until we complete the transaction. But don’t worry, this is not a sell-off or withdrawal from Vietnam. I’m still here, running the fund to its full capacity, and I have no plans to retire in the near future,” he emphasized.

Regarding foreign capital, previously, foreign investors maintained strong net selling in June 2024, with a net selling value of more than VND 16,738 billion. The total net selling value accumulated in the first 6 months of 2024 by foreign investors was more than VND 49,700 billion. In June 2024, foreign investors net sold more than VND 16,591 billion on the HoSE and more than VND 220 billion on the UPCoM, while net buying more than VND 74 billion on the HNX.

The codes that foreign investors net bought the most in June 2024 included MBB, MSN, HAH, PC1, and IDC. Conversely, the codes that foreign investors net sold the most in June 2024 were FPT, CCQ FUEVFVND, VHM, MWG, and VRE.

According to SSI Research, in the last 2 months of strong net selling by foreign investors, the net selling value of ETFs accounted for only about 15% of the total net selling value of foreign investors. Therefore, it can be seen that the recent strong net selling by foreign investors is not mainly due to net selling by ETFs.

The reason for the strong net selling by foreign investors recently may be due to the strong US dollar, which continues to put depreciation pressure on the VND. And the second reason may be due to the global capital shift, in which net foreign capital is still being withdrawn from weak-growing markets such as China and Vietnam and allocated to more efficient markets such as the US market.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.