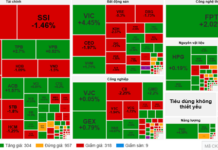

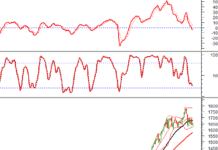

From a high of over 5 points, the VN-Index plummeted from its peak around 10:30 am, ending the morning session 1.76 points lower. This relatively small fluctuation was due to the support of several large-cap stocks, while the breadth showed that the number of declining stocks doubled the number of advancing stocks. HoSE’s liquidity also increased by 12% to a nine-session high, confirming a significant increase in forced selling pressure compared to previous sessions.

The VN-Index’s range of motion is currently mainly sliding down from its peak, while the decline below the reference level is not significant. Among the top ten largest stocks, six are still in the green: VCB up 0.8%, BID up 1.06%, FPT up 1.69%, GAS up 0.26%, VPB up 0.26%, and VNM up 0.6%.

The VN30-Index is down 0.13% with 6 gainers and 21 losers. This poor breadth is a result of a broad-based slide: at its strongest, this basket had only four red codes, BCM, SAB, TCB, and VJC. However, due to the upward momentum in the first half of the session, the intraday adjustment range of many stocks is now quite wide, causing significant damage. For example, GVR plunged 2.12% from its midday high and is now down 0.86% from the reference price. VRE tumbled 2.34%, ending 1.65% lower. Even strong stocks like FPT weakened by about 0.94% from its peak. GAS lost 1.13%, narrowing its gain to 0.26%. BVH, POW, HDB, HPG, and TPB reversed with a large amplitude of more than 1% and all fell below the reference price…

In the context of HoSE’s overall liquidity increasing, the trading volume of the VN30 basket decreased by more than 8% compared to the previous morning. This indicates a contrast with the general trend, as blue chips reversed course due to weak buying power. In contrast, the total market turned negative on higher liquidity, confirming increased forced selling pressure compared to previous sessions.

Indeed, the VN-Index’s breadth was still favorable in the first half of the session. At the index’s peak, there were 191 gainers and 164 losers. Earlier, the breadth was even better as the market was on an upward trajectory. For example, at around 10:00 am, there were 195 gainers and 138 losers. Around 10:45 am, the breadth began to balance out at 179 gainers and 178 losers, while the index remained in positive territory. However, by the end of the morning session, the situation changed, with 123 gainers and 261 losers. Thus, individual stocks fell first, and the index reflected the decline later, thanks to the support of some large-cap stocks.

However, HoSE currently has 76 stocks falling more than 1% from the reference price, and their liquidity accounts for only 13.7% of the floor’s total matching value. Small-cap, low-liquidity stocks seem to be falling faster. This could be an effect of going against the strong uptrend of previous sessions, where low-liquidity stocks were pulled up favorably and generated good profits. On the other hand, the breadth and index show that the market only really fell broadly in the last few minutes of the session. Most stocks took time to slide from the green zone.

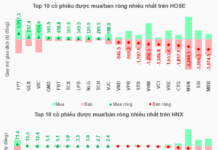

On the upside, 41 stocks have maintained a range of more than 1% from the reference price. This group includes many liquid stocks such as VOS, up 5.21% with VND156.3 billion in value; AAA, up 2.19% with VND100.2 billion; FPT, up 1.69% with VND546.8 billion; DPM, up 1.08% with VND117.5 billion; and BID, up 1.06% with VND124.8 billion. However, even in these very strong stocks, high liquidity indicates strong profit-taking pressure as prices have fallen significantly from their peaks. For example, VOS even hit its daily limit-up price but has since given back 1.46% of its gains, and AAA has fallen 2.1% from its high.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.