According to ABS Research, the stock market in July will be influenced by a multitude of factors. Globally, there are predictions that the Fed may start cutting interest rates from the September 2024 FOMC meeting.

Domestically, production, domestic consumption, and exports are witnessing a strong recovery, and policy and legal factors are being institutionalized to support businesses and individuals.

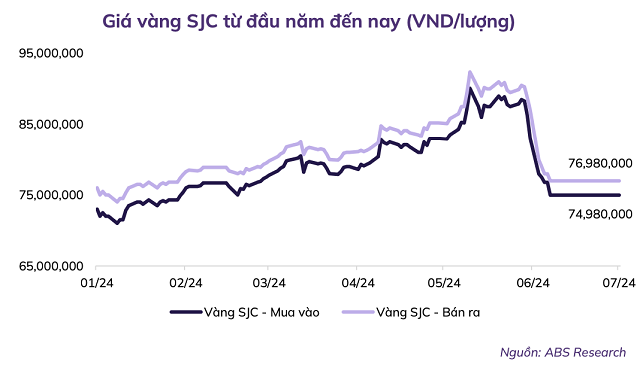

The price of SJC gold bars remained stagnant throughout June and is expected to continue at this level in July. This is a positive sign for the economy as money will no longer be flowing into gold hoarding but will instead circulate, contributing to overall growth.

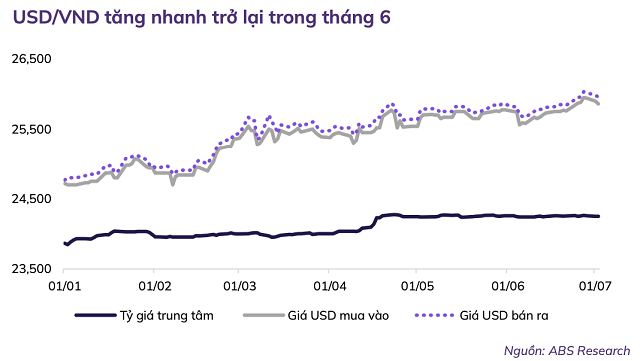

Regarding the USD/VND exchange rate, in July, the rate of increase is predicted to slow down or even reverse as the operating interest rate and the money market interest rate in VND have already started to rise again.

Considering these factors, ABS Research anticipates that the economy will continue to grow, market liquidity will gradually improve, and foreign investors will reduce their net selling.

“July will be the time for the market to absorb negative factors and create a sideways accumulation range with a large price range from 1,180-1,300, preparing for the wave of increases in the second half of 2024,” according to ABS’s forecast.

In the medium term, ABS maintains its expectation for the VN-Index to grow towards the range of 1,350-1,370-1,395 points. The threshold for confirming the market’s new increase is when the closing price of the weekly trading week exceeds 1,315 points.

Also, according to ABS Research, after the adjustment phases with a price range of around 60-100 points, there will always be a quick technical recovery with rising sessions thanks to large-cap stocks. For short-term traders, it is necessary to base decisions on the market’s support and resistance levels and the specific increase and decrease range of stocks.

For medium and long-term investors, this accumulation adjustment phase of the market will be an opportunity to participate in stocks that create medium and long-term buying points.

Based on the analysis, ABS prioritizes several sectors in July, including: Insurance; Energy; Industrial Real Estate; Residential Real Estate; Fertilizers; Textiles; Aviation; and Banking.

“Stocks should have positive business performance prospects, benefit from macro factors, have an appropriate accumulation model in terms of volume and time, and have room for price increases,” ABS Research recommends.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.