Money is flowing back into the market as earnings season approaches, with positive forecasts for Q2 2024 profits. The VN-Index fluctuated during the morning session but gained momentum in the afternoon as more funds poured in, pushing it towards the 1,300 mark. It closed at 1,293, up 10.15 points.

The market breadth was positive, with 295 gainers and 155 losers. Sector rotation was evident, with retail, information technology, and transportation adjusting by 1.31%, 0.21%, and 0.76%, respectively. In contrast, banks rose by 0.89%; securities increased by 1.63%; chemicals continued their upward trend with a 2.57% gain; oil and gas climbed by 1.24%; and real estate appreciated by 1.24%. Building materials and construction sectors also saw gains, with the former rising by 0.73% and the latter by 2.55%.

The top index contributors today were GVR, adding 1.48 points; VCB with 1.22 points; BID with 0.69 points; and VPB contributing 0.67 points. HDB, MBB, BCM, and VIC also had a positive impact. On the other hand, FPT was the biggest drag on the index, subtracting 0.75 points, followed by HVN, which took away 0.57 points.

Market liquidity surged to a new high of nearly VND 25,000 billion. Foreign investors sold a net VND 449.7 billion, and their net selling on the matching order transaction reached VND 1,190 billion.

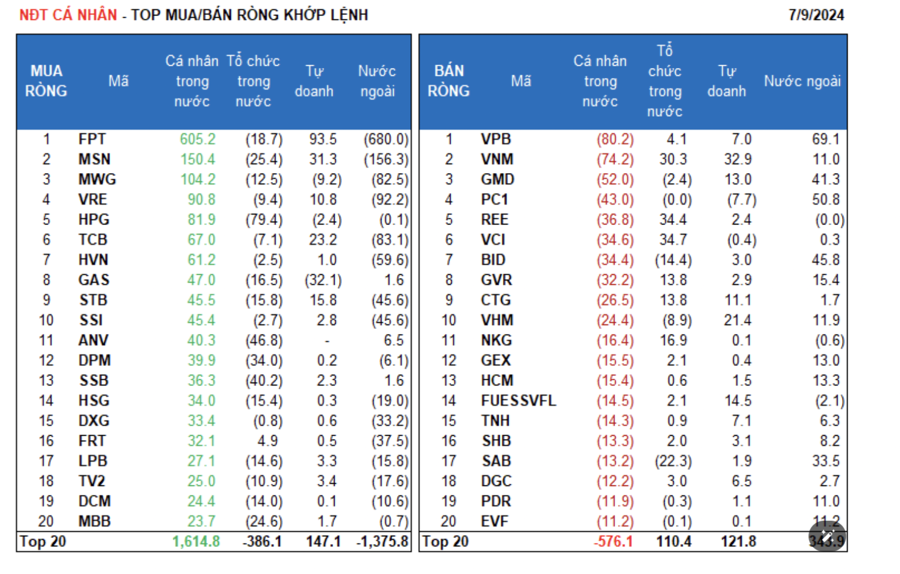

Foreign investors’ main net buying on the matching order transaction was in the construction and materials, and industrial goods and services sectors. The top stocks they bought were VPB, PC1, BID, GMD, SAB, GVR, KBC, HCM, and GEX. On the other hand, their main net selling was in the information technology sector, with FPT, MSN, VRE, TCB, MWG, SSI, STB, FRT, and DXG being the top sold stocks.

Individual investors net bought VND 438.9 billion, of which VND 1,213.4 billion was on the matching order transaction. They net bought 13 out of 18 sectors, mainly in information technology. Their top buys included FPT, MSN, MWG, VRE, HPG, TCB, HVN, GAS, STB, and SSI. On the selling side, they net sold 5 out of 18 sectors, mainly in financial services and industrial goods and services. Their top sells were VPB, VNM, GMD, PC1, REE, VCI, GVR, CTG, and VHM.

Proprietary trading accounts net bought VND 264.4 billion, and their net buying value on the matching order transaction was VND 271.4 billion. On the matching order transaction, they net bought 10 out of 18 sectors, with information technology and banking being the top sectors. Their top buys were FPT, VNM, MSN, TCB, VHM, VIC, STB, FUESSVFL, GMD, and VCB. Their top sells were in the electricity, water, and petroleum sector. The most sold stocks included DBC, GAS, MWG, PC1, ACB, FUEVFVND, BMI, VIB, MSB, and ELC.

Domestic institutional investors net sold VND 252.1 billion, and their net selling value on the matching order transaction was VND 294.7 billion. On the matching order transaction, institutions net sold 12 out of 18 sectors, with banking being the largest in value. Their top sells included HPG, ANV, SSB, DPM, KBC, MSN, MBB, SAB, FPT, and PPC. Their net buying was mainly in the financial services sector, with top buys being FUEVFVND, VCI, REE, VNM, NKG, E1VFVN30, GVR, CTG, HDG, and VJC.

Today’s negotiated transaction value reached VND 1,822.3 billion, down 33.9% from the previous session, contributing 7.3% of the total trading value.

Notable transactions today involved HDB and TNH stocks, with over 23.7 million HDB shares (worth VND 593 billion) and over 4.6 million TNH shares (worth VND 140.2 billion) sold by individual investors to foreign institutions.

There were also transactions of over 1.4 million shares (worth VND 88.4 billion) between domestic institutions in the SJS stock. Individuals continued to trade in large-cap stocks (MWG, VPB) and mid-cap stocks (SJS, KOS, CTR, KDC).

The money flow heatmap showed a decrease in allocation to real estate, steel, food & beverage, chemicals, retail, oil & gas production, and textiles. In contrast, there was an increase in allocation to banks, securities, software, construction, agricultural products, warehousing & logistics, electricity production & distribution, rubber & plastics, and electrical equipment.

Looking at the matching order transaction only, the money flow heatmap showed an increase in allocation to large-cap stocks (VN30) and small-cap stocks (VNSML) and a decrease in mid-cap stocks (VNMID).

Choose La Mia Bao Loc – Embrace a Fulfilling Life with an Ideal Green Living Standard

Not just a perfect blend of art and inspired Italian-style resort, La Mia Dalat also effortlessly brings each resident to the standards of peaceful living, well-being, and balanced body-mind-soul.