In a recent seminar on “Market and Price Developments in Vietnam in the First Half of 2024 and Forecasts for the Full Year,” Associate Professor Dr. Tran Kim Chung, former Vice President of the Central Institute for Economic Management, predicted that the real estate market in the second half of the year would improve from good to very good.

According to Dr. Chung, with the early enforcement of three laws related to the real estate market—the Land Law 2024, Housing Law 2023, and Real Estate Business Law 2023—starting August 1, five months ahead of schedule, the market will shift from a state of waiting to execution. Additionally, the stable economic development, accelerated public investment, and large amount of capital disbursement will positively impact the real estate market.

Dr. Chung also presented three scenarios for the market for the remainder of the year.

In the first scenario, the market moves sideways, extrapolating, and inching forward. This is the main scenario as the real estate market transitions from a waiting to an execution mode.

The real estate market is expected to see positive changes in the second half of the year.

“The fact that the three laws related to the real estate market are expected to take effect means that many businesses have oriented their operations for 2024 as a waiting period since production and business adjustments take time. Therefore, the real estate market in the second half of the year will not see significant changes but will mainly operate as expected with a positive trend,” said Dr. Chung.

The second scenario involves market growth without a boom. This scenario occurs if positive factors converge, such as a favorable global economic and geopolitical situation, continued macroeconomic stability, controlled inflation, well-managed minimum wage increases of 30% for basic salaries and 15% for retirees, and the attraction of one or several strategic foreign investors.

The third scenario is a market boom. This will happen if several special positive conditions are met, such as multiple strategic investors simultaneously investing and seeking investment opportunities in Vietnam, as in the 2004–2007 period; a strong revival of tourism; a macroeconomic boom; the emergence of financial derivatives such as real estate investment trusts and mutual savings funds; the formation of a re-mortgage system; the issuance of documents addressing condotel-officetel issues; the synchronized and comprehensive operation of the mechanism for expropriating land adjacent to infrastructure works; and the piloting of recognizing commercial housing project investors when they already have land but not residential land.

“The above scenario is considered to have too many expected factors, and while it is still possible, the likelihood is not high,” said Dr. Chung, expressing his personal opinion.

Sharing his views on the real estate market in the second half of 2024, Mr. Le Dinh Chung, CEO of SGO Homes JSC, said that the market would continue to witness positive developments.

The apartment segment is expected to continue rising. (Illustrative image: Cong Hieu)

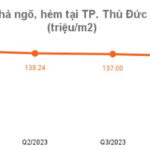

Regarding the apartment segment, Mr. Chung believed that apartment prices in Hanoi would continue to rise, with an average increase of 5-10% from now until the end of the year. This upward trend will continue into the next year due to the short-term lack of significant changes in Hanoi’s apartment supply.

In reality, Hanoi’s apartment prices are escalating, with average prices ranging from VND 50-100 million/sqm. For projects in prime central locations, selling prices and transactions can reach VND 100-150 million/sqm. Mr. Chung argued that as Hanoi apartment prices rise too high, investment demand for apartments will likely decrease significantly in the coming time. Investment capital will tend to shift and seek new segments and markets.

According to Mr. Chung, customers with a budget of VND 5-10 billion have started looking for new investment opportunities outside Hanoi as they have almost no chance of investing in the city due to the high prices of apartments, villas, and adjacent houses.

Therefore, since May, satellite and suburban provinces such as Hung Yen, Bac Ninh, Bac Giang, Hai Duong, Phu Tho, and Hoa Binh have become the focus of investors. For suburban products in these provinces, the market is witnessing signs of recovery for products priced below VND 10 billion.

Notably, in addition to investment purchases, there is a group of buyers who intend to live in the properties instead of using them for business purposes. “I notice a shift towards the suburbs as the proportion of buyers looking to occupy their purchases is higher than those looking to invest,” said Mr. Chung.

Mr. Chung also observed that, after a tumultuous period in the previous two years, the market has formed a generation of professional and well-versed investors. These investors favor products with houses on land and opt for projects in urban areas with essential utilities and services, valuing the sustainability of their investments.

Meanwhile, Mr. Nguyen Quang Huy, CEO of the Finance and Banking Faculty at Nguyen Trai University, forecasted that, along with the legal unblocking of real estate projects, the strong economic recovery in the second half of the year, and the price range of VND 2-4 billion/unit, the most interested and liquid segments would be apartments, land plots, townhouses, and condotels.

The industrial real estate segment will continue to attract FDI and domestic investment as it offers sustainable growth and aligns with the country’s development trend. However, this segment requires investors to be professional, have substantial capital, and be agile in attracting secondary investors, such as businesses investing in factories and warehouses.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.