|

VNM ETF’s Warrant Changes from 01-08/07

|

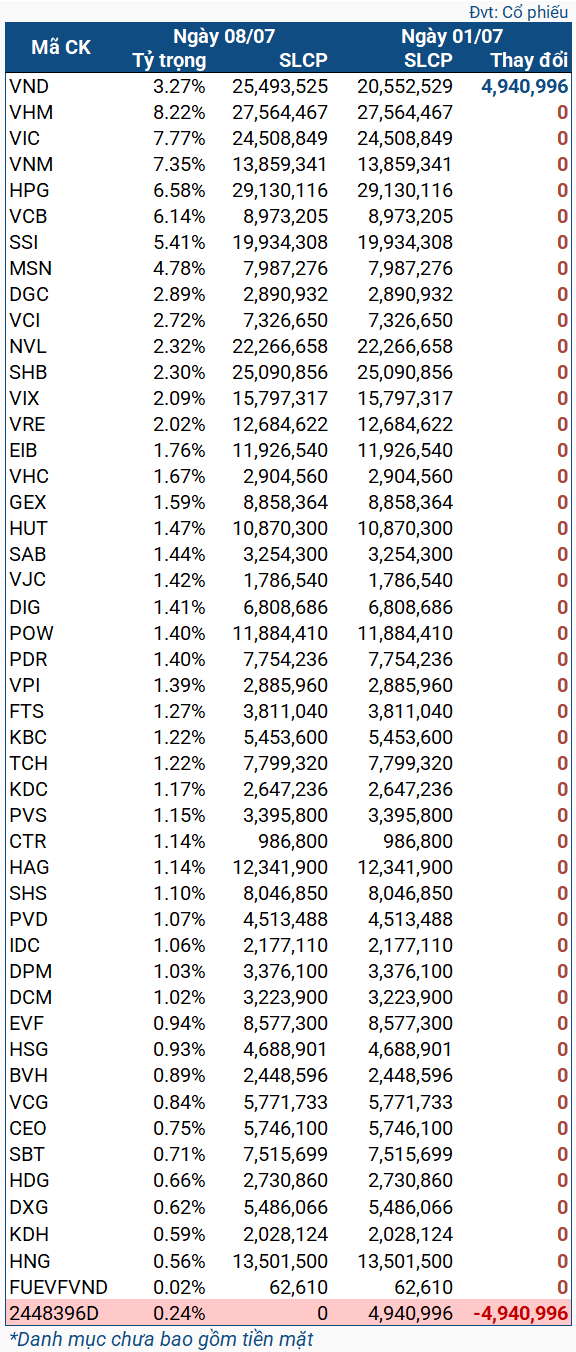

Specifically, all of the more-than-4.9 million VND stock warrants (2448396D) held by VNM ETF decreased to zero during the aforementioned period. Conversely, the number of VND stocks held by the fund increased, indicating that VNM ETF had exercised all of its warrants.

It is worth noting that these warrants were part of VND‘s share issuance to raise capital. The exercise ratio was 5:1 (for every 5 shares held, an investor received 1 warrant to purchase 1 new share). The issuance price was VND 10,000/share, 39% lower than the market price on the morning of July 10 (VND 16,400/share).

VND was also the only stock in the VNM ETF portfolio to experience a change during this period.

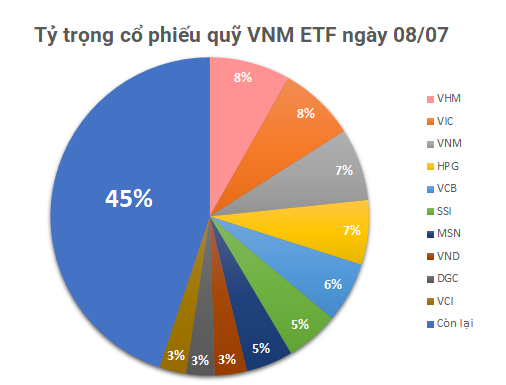

As of July 8, the net asset value of VNM ETF exceeded 501 million USD, up from 496 million USD on July 1. The portfolio consists entirely of Vietnamese stocks, with the top weights held by VHM (8.22%), VIC (7.77%), VNM (7.35%), HPG (6.58%), and VCB (6.14%).