Market liquidity decreased compared to the previous trading session, with the matched trading volume of the VN-Index reaching more than 678 million shares, equivalent to a value of more than 17.9 trillion VND; The HNX-Index reached more than 57.5 million shares, equivalent to a value of more than 1.3 trillion VND.

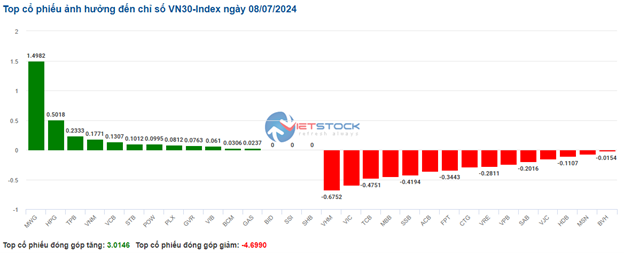

VN-Index opened the afternoon session on a negative note as selling pressure continued to mount, causing the index to weaken and plummet until the end of the session. In terms of impact, FPT, GVR, BID, and MWG were the codes with the most negative impact, taking away more than 3.4 points from the index.

On the other hand, VCB, REE, MBB, and PLX were the codes with the most positive impact on the VN-Index, with more than 1.2 points gained.

| Top 10 stocks with the strongest impact on the VN-Index session on 07/10/2024 |

The HNX-Index followed a similar trend, with the index negatively impacted by codes PVS (-1.81%), VCS (-2.04%), IDC (-0.98%), MBS (-1.18%), etc.

|

Source: VietstockFinance

|

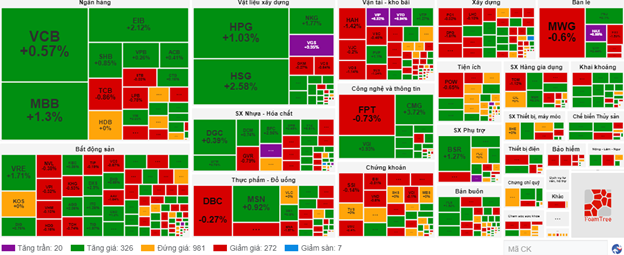

The consulting and support services sector recorded the largest decrease in the market at -2.44%, mainly due to TV2 (-3.29%), KPF (-3.65%), and TV3 (-1.53%). This was followed by the technology and information sector and the retail sector, with decreases of 1.95% and 1.67%, respectively.

In contrast, the wholesale sector was the industry with the strongest recovery, at 0.44%, mainly driven by PLX (+1.2%), HHS (+0.43%), VPG (+0.34%), and TLH (+2.41%).

In terms of foreign trading, they continued to sell a net of more than 1,097 billion VND on the HOSE, focusing on FPT (342.48 billion), VCB (159.84 billion), MWG (159.41 billion), and TCB (109.2 billion). On the HNX, foreigners sold a net of more than 3.5 billion VND, focusing on IDC (14.58 billion), MBS (4.35 billion), BVS (2.95 billion), and NTP (2.5 billion).

| Foreigners’ net buying and selling activities |

Morning session: VN-Index continues to fluctuate

At the end of the morning session, the tug-of-war sentiment was still present, leading to a volatile market around the reference level. The VN-Index increased by 0.98 points to 1,294.69 points; The HNX-Index increased by 0.07 points to 245.74 points.

At the end of the morning session, buyers and sellers were quite determined, with 919 codes standing still, and the sellers had a slight advantage as the number of decreasing codes was 340, while the increasing codes were 320.

The trading volume of the VN-Index recorded in the morning session reached nearly 302 million units, with a value of nearly 7.7 trillion VND. The HNX-Index recorded a trading volume of more than 27 million units, with a trading value of nearly 600 billion VND.

Most of the stocks in the seafood group decreased. Stocks such as VHC, ANV, FMC, IDI, and CMX decreased slightly by less than 1%; other stocks such as ASM, ABT, and TFC temporarily stood still at the reference price. Notably, DAT stock maintained its green color with a gain of 1.03%.

On the other hand, the utilities group was also supporting the market’s upward trend but was quite divided. For the buying side, GAS, PGV, SIP, and DTK maintained an increase of around 1.02% to 2.86%… Meanwhile, POW, IDC, and VSH were the major players with a negative performance, impacting the industry group.

A contrasting development with the rather negative red color in the retail group of stocks. Currently, this group is facing significant selling pressure as investors are quite focused on trading in 3 large-cap stocks, namely MWG down 1.05%, PNJ down 0.1%, and FRT down 1.7%.

The wholesale industry group contributed the most to the index’s growth at the end of the morning session. However, the only representative in this group that recorded positivity was PLX, with a gain of 2.07%. The remaining stocks in the group mostly showed unclear growth, and some even decreased below the reference price.

10:45 am: VN-Index fluctuates before the psychological threshold of 1,300 points

The buying and selling forces in the market were quite balanced, so the main indices could not break through. As of 10:40, the VN-Index slightly increased by 1.43 points, trading around 1,294 points. The HNX-Index increased by 0.11 points, trading around 245 points.

The stocks in the VN30 basket were performing with a slightly more dominant green color. Specifically, HPG, MBB, MSN, and VCB respectively contributed 1.19 points, 1.06 points, 0.53 points, and 0.39 points to the overall index. In contrast, FPT, MWG, TCB, and VNM faced strong selling pressure, taking away more than 2 points from the VN30-Index.

Source: VietstockFinance

|

The construction materials group led the recovery with a gain of 1.33%, although the performance was still quite divided. Specifically, the green color mainly came from the steel business group, with 3 major players: HPG up 1.55%, HSG up 2.98%, NKG up 2.17%, and some other codes such as VGC up 0.56%, HT1 up 0.37%, and VGS hitting the ceiling price…

Regarding the HPG code from a technical perspective, in the morning session, the stock price surged along with an increase in trading volume, and it was expected to exceed the 20-day average volume at the end of the session, reflecting the optimistic sentiment of investors. Currently, the price of HPG has rebounded after successfully retesting the old peak breached in March 2024, while MACD and Stochastic Oscillator have given buy signals again, further reinforcing the long-term uptrend.

Source: https://stockchart.vietstock.vn/

|

Following this was the wholesale group, which also maintained a green color from the beginning of the session, with a gain of 1.29%. The buying force was mainly concentrated in the PLX code, which increased by 1.74%, and some other codes such as SMC up 2.5%, VPG up 2.03%, and TLH up 3.37%… In contrast, the red color remained present in the DGW code, which decreased by 0.31%, HHS down 0.87%, and VFG down 1.08%… but the selling pressure was not too strong.

Meanwhile, the consulting and support services group continued to show negative developments and was putting pressure on the overall index, with a sharp decline of 2.07%. This decrease was mainly due to the TV2 code, which fell by 2.9%. After 3 consecutive floor sessions, this stock is currently balancing again at the old bottom of May 2024 (equivalent to the 34,000-36,200 range). In addition, the red color also appeared in the VNC code, which decreased by 0.26%, and the KPF code, which fell by 0.61%, but this was not significant.

Compared to the beginning of the session, buyers and sellers were quite determined, with more than 980 codes standing still, and the buyers had a slight advantage as the number of increasing codes was 326 (20 codes hitting the ceiling price) while the number of decreasing codes was 272 (7 codes hitting the floor price).

Source: VietstockFinance

|

Opening: VN-Index fluctuates

At the beginning of the session on July 10, as of 9:40 am, the VN-Index fluctuated around the reference level and increased by nearly 2 points to 1,295.32 points. Meanwhile, the HNX-Index slightly decreased to 245.57 points.

Previously, on July 8, Federal Reserve (Fed) Chairman Jerome Powell expressed concern that keeping interest rates too high for too long could endanger economic growth. Currently, the Fed’s overnight lending rate is at 5.25%-5.50%, the highest level in 23 years. This is the result of 11 consecutive hikes after inflation hit its highest level since the early 1980s.

The market expects the Fed to start cutting rates in September and may cut them further by 0.25 percentage points by the end of the year. However, FOMC members at their June meeting stated that there would only be a single cut this year.

As of 9:40 am, large-cap stocks such as VCB, BID, and MBB were pulling the market up, with a total increase of nearly 1.5 points. On the other hand, FPT, MWG, and BCM led the group with the most negative impact on the market, with a decrease of nearly 1 point.

The rubber products group maintained stable growth from the beginning of the session, with stocks such as DRC up 0.41%, CSM up 3.08%, and the remaining stocks standing still.

Choose stocks for “Tet” festival celebrations

Investors should consider choosing stocks in the banking industry with good profitability, healthy real estate, and abundant clean land reserves. In addition, the group of stocks in infrastructure investment, iron and steel, and construction materials should also be considered.