According to data aggregated by the Vietnam Bond Market Association from HNX (Hanoi Stock Exchange) and SSC (State Securities Commission), as of the information announcement date of June 30, 2024, there were 30 private corporate bond issuances valued at VND 40,147 billion and 3 public issuances valued at VND 2,000 billion in June 2024. Cumulatively, from the beginning of the year until now, there have been 102 private issuances valued at VND 104,109 billion and 10 public issuances valued at 11,378 billion.

Of the private issuances, rated bonds accounted for 4.2% of the value. In June, enterprises repurchased VND 13,336 billion of bonds before maturity, down 68% compared to the same period in 2023. In the second half of 2024, an estimated VND 139,765 billion of bonds will mature, with real estate bonds accounting for the majority at VND 58,782 billion, or 42%. Regarding abnormal information disclosure, there were 2 bond codes that announced late payment of principal and interest in the month, valued at VND 980 billion, and 13 bond codes that were granted extensions for interest and principal payments.

In the secondary market, the total trading value of private corporate bonds in June reached VND 99,469 billion, with an average of VND 4,973 billion per session, up 12.1% compared to the average in May.

According to statistics, the bond market in June unexpectedly became vibrant again as 5 real estate enterprises issued bonds. Specifically, Vinhomes JSC successfully raised VND 2,500 billion, Becamex IDC Corporation successfully raised VND 1,500 billion, Nam Long Investment Corporation successfully raised VND 550 billion, Trung Minh Urban Area Company Limited raised VND 200 billion, and Khai Hoan Land Group Joint Stock Company raised VND 250 billion.

Prior to this, in 2023 and the first half of 2024, the real estate corporate bond market was relatively quiet. In April and May, the market only witnessed bond issuances from a few large enterprises.

Notably, the average interest rate of real estate bonds is at the highest level in the market, ranging from 9% to 12.5%. Especially for some enterprises like Khai Hoan Land, the interest rate of issued bonds is as high as 12% to 13.5%/year. In contrast, the interest rate of bank group bonds is only 4.7% to 7.4%.

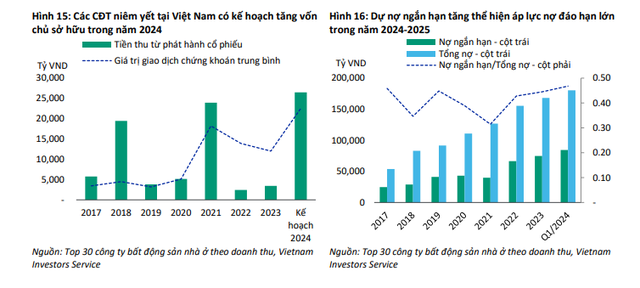

A recent report by Vietnam Credit Rating Joint Stock Company (VIS Rating) on the residential real estate market states that, thanks to the improved psychology of the bond market, the total new corporate bond issuance of real estate investors has recovered. In the first 5 months of this year, it reached VND 28,300 billion, up 13% over the same period. Improved access to new capital sources will help alleviate liquidity difficulties due to large debt maturities in 2024 and 2025.

In addition, listed investors have announced plans to increase equity during recent shareholder meetings, as stock market valuations have recovered since the beginning of 2024. VIS Rating estimates that if these capital increases are successful, about VND 26,000 billion of new equity will be raised for project development or to meet debt maturity obligations, respectively VND 75,000 billion in 2024 and more than VND 90,000 billion in 2025 at listed companies monitored by VIS Rating.

Bond Market: Investing in “Gold Bonds” despite interest rates lower than 0.5 – 1%

Positive actions from the issuing organization and policies from regulatory agencies have indicated that the most difficult period for the corporate bond market has passed. Despite challenges, the corporate bond market is reemerging as a highly promising investment product.