Mr. Ngo Dang Khoa – Director of Foreign Exchange, Capital Markets and Securities Services, HSBC Vietnam

|

What is your opinion on the rising trend of USD in the context of abundant foreign exchange reserves?

The USD has experienced a rapid decline in the fourth quarter of 2023 after expectations that the Fed would reduce interest rates early in 2024. However, positive signals from the US labor market and economy in recent times, along with statements from FOMC members about continuing to act based on actual data, have gradually reduced market expectations of an early interest rate cut by the FOMC. Therefore, US Treasury yields have slightly increased, causing the greenback to regain some strength in the international market. This is one of the fundamental reasons why Asian currencies, including the Vietnamese Dong, have weakened against the USD. In addition, with the interest rate differential still high, in the context of relatively ample VND liquidity even in the period before the Lunar New Year, the USD/VND exchange rate has rapidly increased in the first weeks of 2024.

What are HSBC’s forecasts for the USD exchange rate in the first quarter of 2024 and for the whole year?

We believe that the USD/VND exchange rate will face upward pressure in the first quarter of 2024 due to four main reasons:

First, the difference in monetary policies between the US Federal Reserve (Fed) and the State Bank of Vietnam (SBV) is likely to remain wide. The current priority of Vietnam’s monetary policy focuses on supporting growth, whereas in contrast, the US growth figures have still exceeded expectations and core inflation has gradually cooled, which has led the Fed to maintain a prolonged tight monetary policy.

Second, VND liquidity in the interbank market may continue to be maintained at a good level due to no significant changes in credit growth and disbursement speeds of public investment, at least in the first quarter of this year.

Third, while Vietnam’s trade surplus and FDI inflows may remain high, certain global and regional political uncertainties may have relatively negative impacts on the VND.

Fourth, the USD in general is expected to maintain its strength in the early months of 2024, while the CNY continues to weaken amid slower-than-expected Chinese economic recovery.

However, exchange rate prospects for the whole year 2024, especially in the second half of the year, will improve as the above factors reverse, especially when the USD peaks and the domestic economy and credit gradually recover. We currently forecast that the USD/VND exchange rate will end the year around 24,400 VND.

The current dong interest rates are quite low. What are your forecasts for interest rates in the near future?

We believe that the Vietnamese economy is still on a path of recovery, with growth forecasted to reach 6% in 2024. FDI capital continues to flow into manufacturing and export sectors, benefiting from the global economic recovery, which will be the main factors to accelerate economic recovery. As for inflation, Vietnam’s Consumer Price Index (CPI) was well controlled in 2023, lower than the target average of 4.5%. We expect inflation to remain stable in 2024, with a forecast of 3.4%, much lower than the target of 4-4.5%. However, inflation risks from energy and food still remain, especially in the context of Vietnam’s sensitivity to these commodities, as reflected in the significant weight in the inflation basket. Despite that, we expect the SBV to maintain its policy interest rate at a stable rate of 4.50% until the end of 2024.

|

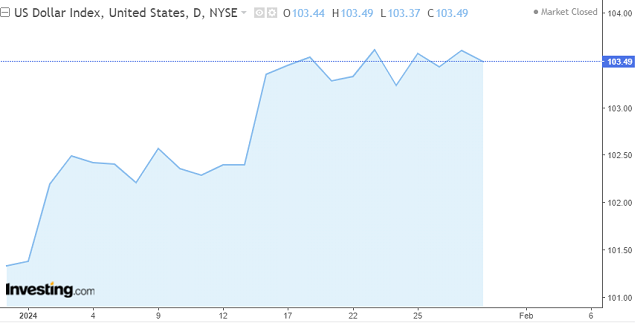

Last week (22-26/01/2024), the USD continued to rise on the international market after data showed that the US economy remains strong and inflation is heading towards the target of 2%, increasing expectations that the Fed will not rush to lower interest rates. The USD-Index is around 103.5 points as of January 30th, 2024, up 0.23 points in one week and has increased by 2.1 points (equivalent to 2%) since the beginning of the year.

|