KBSV has lowered its forecast for the Fed to cut interest rates once this year instead of three times as previously reported due to more persistent inflation. As other major central banks such as Switzerland, Sweden, Canada, and the EU have cut interest rates, while the Bank of Japan maintains an aggressive easing policy, the Fed’s delay in cutting interest rates will keep the DXY index anchored at a high level.

“Combined with the large interest rate differential between USD-VND, exchange rate pressure will continue in the second half of 2024, leading to an upward trend in interest rates and putting pressure on the Vietnamese stock market,” KBSV emphasized.

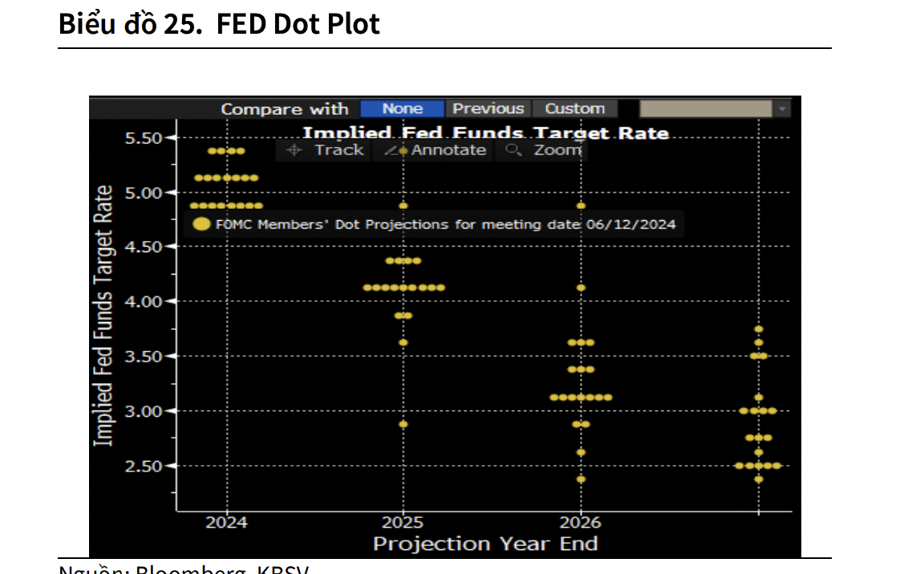

After the late May meeting, the Fed changed its plan to cut interest rates only once this year by 25 bps, lower than the previous forecast of three times in March. At the beginning of June, the CME FedWatch interest rate tracking tool showed that investors were betting that the Fed would cut rates for the first time in September (the highest) at more than 59%.

The number of rate cuts has decreased from three to one compared to market expectations a few months ago: First, inflation cooled in May but was more persistent than expected. After reaching 3.5% in March, US CPI data for May rose to 3.3%, down 0.1 percentage points from April and exceeding the market’s previous expectation of 3.4%. CPI weakened as oil prices fell throughout May.

Second, housing and accommodation costs are slowing the decline in inflation. This component, which accounts for more than 30% of the CPI structure, has increased by 0.4% for three consecutive months, equivalent to a 5.4% increase in May. Although this is the lowest level since April 2022, the data still shows that it is more “stubborn” than expected, as accommodation costs are higher than the pre-COVID-19 pandemic average and have not cooled significantly.

Third, energy could continue to be a factor to watch that could put pressure on CPI. Although oil prices showed a significant decline throughout May, contributing positively to the cooling of CPI, June witnessed a significant return of this commodity. Mid-June WTI oil prices rose nearly 6% to $82 per barrel from an average of $77 per barrel in May.

Oil prices continue to be threatened by geopolitical conflicts and OPEC+ production cuts, which affect global supply, while demand remains relatively high. Therefore, oil prices are likely to remain high from now until the end of the year, raising concerns about inflationary pressures.

Fourth, the US labor market remains stronger than expected. In terms of wages, the growth rate of hourly wages was also higher than expected, reaching 0.4% month-on-month and 4.1% year-on-year. The expected forecast was 0.3% and 3.9%, respectively. The strong growth of wages is seen as a sign that inflationary pressures in the economy persist. If we include those who are in the working age range but do not intend to look for a job and those who only work part-time for economic reasons, the US unemployment rate for May remained at 7.4%, unchanged from the previous month.

With the current US economic data, the Fed could delay rate cuts until after September this year. In addition, the expected first rate cut of 25 bps (not too large) means that interest rates will remain relatively high.

As a result, the US dollar maintains its strength, and the interest rate differential between the USD and VND puts strain on the exchange rate. The low-interest rate environment is likely to face upward pressure to reduce stress. This will have a relatively negative impact on the performance of the domestic stock market.

In addition, investors’ expectations of an early Fed rate cut this year were disappointed, which could lead to selling pressure in the short term.

KBSV also mentioned factors that could influence the Fed’s decision to cut interest rates, including a cooling housing component, which is crucial for bringing inflation back to the 2% target path.

Looking at the current US real estate market data, homes for sale increased by 9% month-on-month to 1.21 million in May. Home sales are slightly down, and the number of building permits in May was 1.38 million, lower than the 2023 average. The real estate market situation does not show many signs of rebounding.

The housing and accommodation component in CPI has a certain lag compared to the actual market. Therefore, KBSV continues to expect that the housing and accommodation component will gradually be reflected and cool down in the coming period, reducing inflationary pressure.

Waiting for a weakening signal from the job market. According to the US Department of Labor report, the initial unemployment rate rose to 4%, the first time since January 2022, slightly up from 3.9% in April. The labor force participation rate fell 0.2 percentage points to 62.5% in the previous month. Hourly wages rose 0.4% month-on-month and 4.1% year-on-year. Both figures were higher than expected at 0.3% and 3.9%, respectively.

Meanwhile, annual wage growth also increased from 4% to 4.1% and has fluctuated around 4% since Q3 2023. Although the data shows stronger-than-expected market performance, the unemployment rate has returned to 4% since February 2022.

Overall, the US labor market remains stronger than expected, but rising unemployment is a sign of weakness. If this indicator increases significantly, it signals a weakening US economy and a risk of recession, which puts pressure on the Fed to cut rates to support the economy.

CPI in January 2024 rises by 0.31%, core inflation increases by 0.21% compared to the previous month

According to a report from the General Statistics Office, the average retail electricity price and domestic rice price continued to increase in January 2024, following the export rice price. These are the main reasons for the Consumer Price Index (CPI) in January 2024 to increase by 0.31% compared to the previous month. Compared to the same period in 2023, the January CPI increased by 3.37%; the core inflation in January 2024 increased by 2.72%.