The stock market witnessed a tug-of-war during the week of July 8-12, with the VN-Index fluctuating within a narrow range. It approached the 1,280-1,290 point region before strong selling pressure halted its ascent. The overall market liquidity has been shrinking, indicating investors’ cautious sentiment. Consequently, the VN-Index ended the week with a slight decline of 2.29 points (-0.18%) to close at 1,280.75 points.

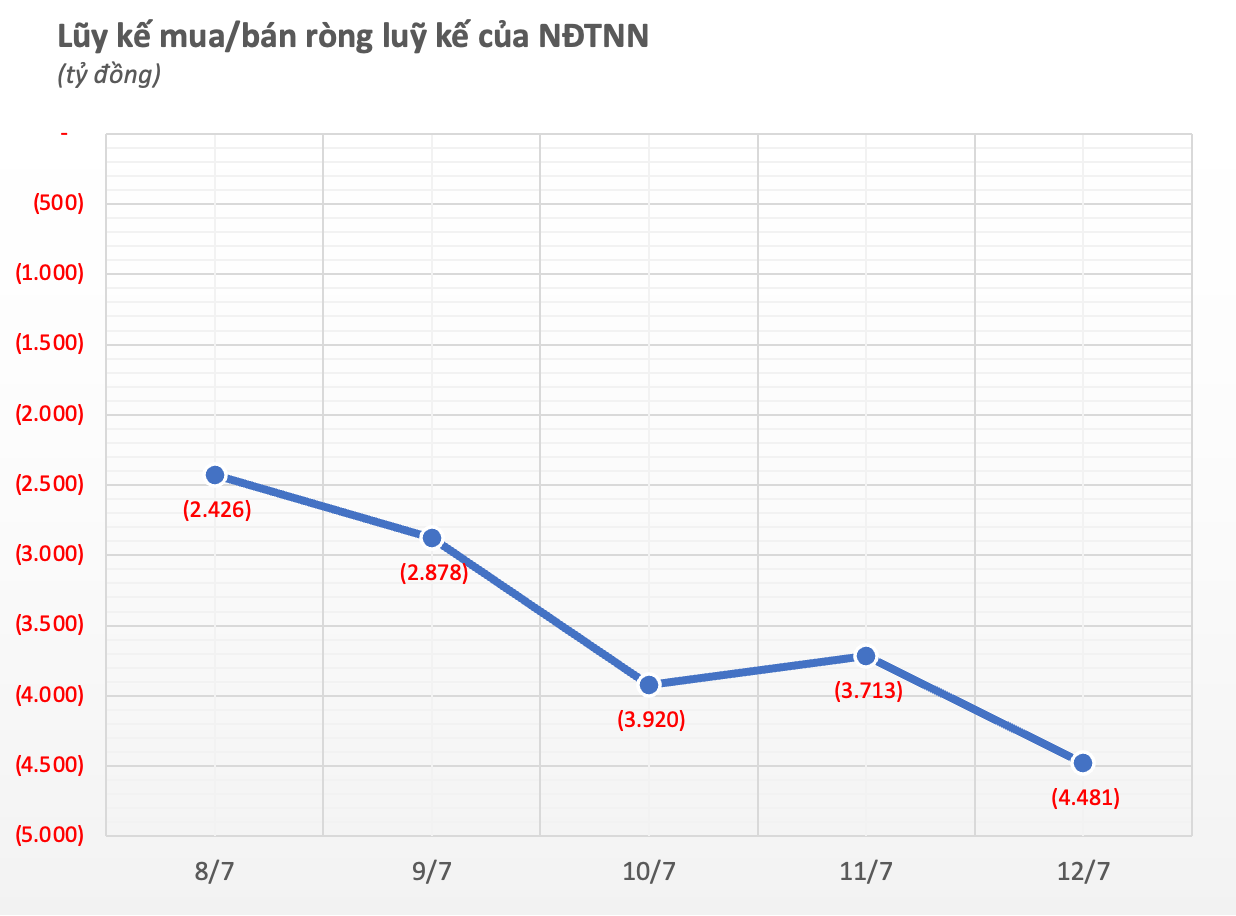

Foreign investors remained a significant drag on the market as they continued to sell more than they bought. Notably, they abruptly shifted from a substantial sell-off at the beginning of the week to net buying on July 11. In the five sessions, foreign investors net sold VND4,481 billion on the entire market, including net selling of VND4,931 billion in the matching orders but net buying of VND450 billion in the negotiated deals.

Breaking down by exchange, foreign investors net sold VND4,501 billion on HoSE, net sold VND5 billion on HNX, and net bought VND25 billion on UPCoM.

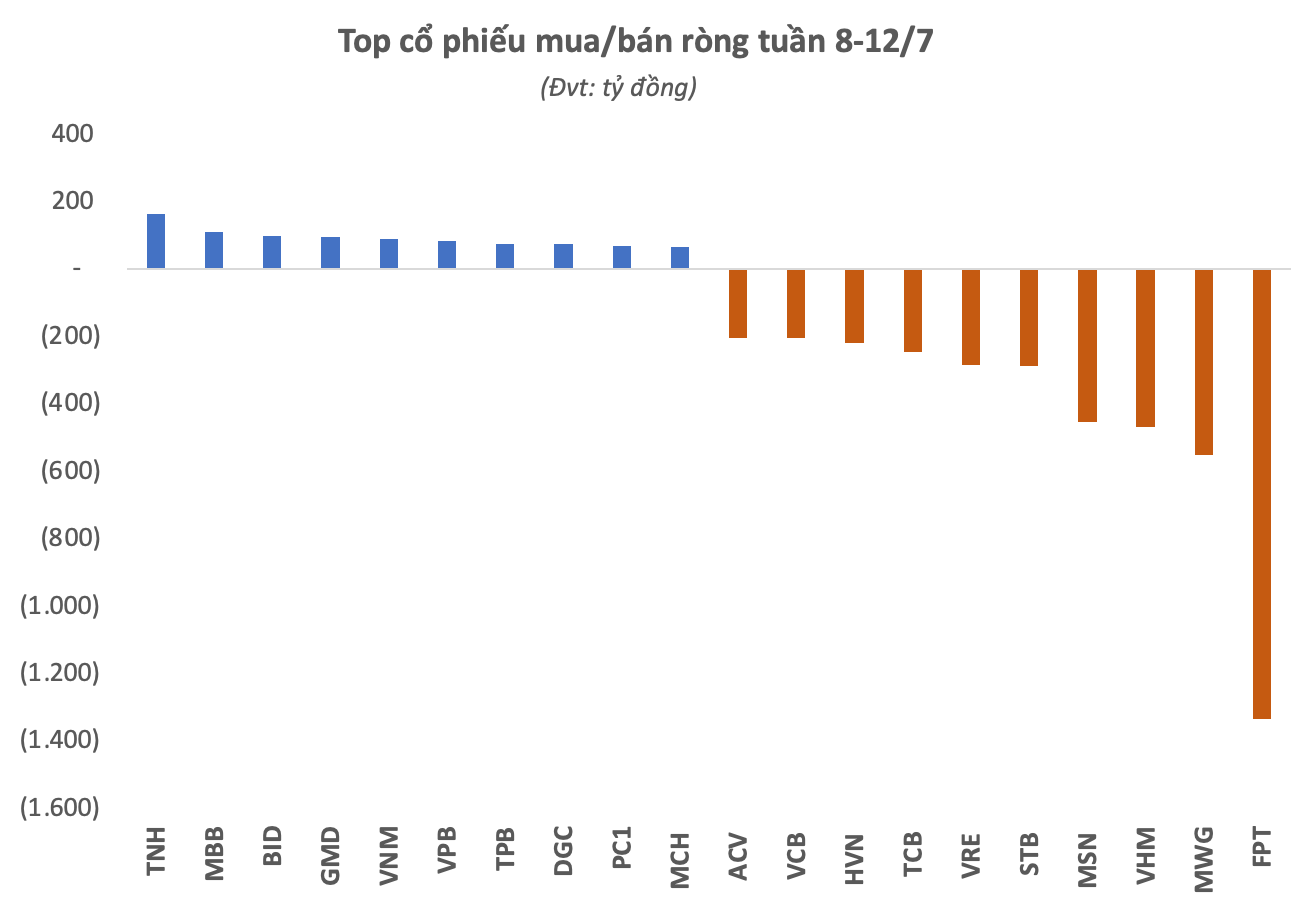

Looking at individual stocks, FPT was the top net sold stock, with a net sell value of VND1,334 billion, mainly through matching orders. MWG and VHM were also among the top net sold stocks, with net selling values of VND551 billion and VND467 billion, respectively. MSN and STB followed suit, with net selling values of VND453 billion and VND288 billion, respectively.

Additionally, VRE, TCB, HVN, VCB, and ACV were among the stocks that foreign investors net sold over VND200 billion each during the past week.