This information was reported by Nguyen Van Hai, Member of the Board of Directors and General Director of Hoa Tho, at the Conference on the first six months of the year, which was held last week.

Hoa Tho Garment Factory. Photo: HTG

|

In the first six months of 2024, Hoa Tho estimated consolidated revenue of VND 2,286 billion, achieving 51% of the yearly plan. Export turnover reached USD 113 million, accounting for 46% of the yearly plan, while profit was estimated at VND 142.7 billion, achieving 65% of the yearly plan.

According to General Director Nguyen Van Hai‘s estimation, in the last six months, consolidated revenue could reach VND 2,225 billion, and consolidated profit is expected to be VND 120 billion. Regarding prospects, Mr. Hai noted that the situation towards the end of the year has not shown much improvement. The Fed’s plan to cut interest rates remains unclear, competing exporting countries may devalue their currencies to support exports, sea freight rates continue to rise, the regional minimum wage increased from July 1st, and electricity costs and financial expenses are likely to increase in the coming months.

Looking back, HTG experienced a rather gloomy 2023, with pre-tax profit decreasing by 41% year-on-year to VND 211 billion, mainly due to reduced demand for clothing from customers.

|

HTG’s Business Results over the Past Decade |

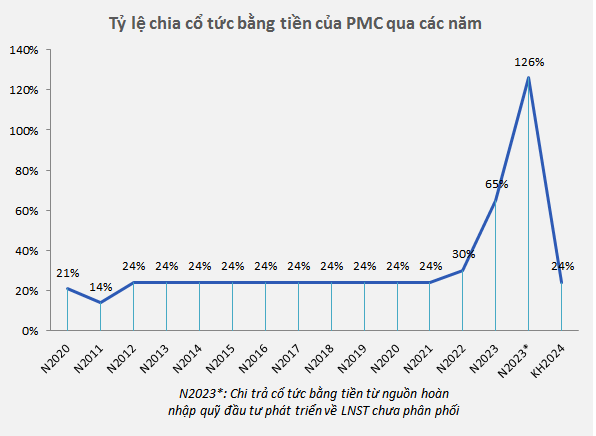

Despite the results falling short of expectations, Hoa Tho still decided to adjust the 2023 dividend ratio to 35% in cash (amounting to over VND 126 billion), as opposed to the initially planned ratio of 25%. Of this, the first tranche of 20% was paid on January 16, 2024, and the remaining 10% was paid on June 7, 2024.

Furthermore, HTG will pay over VND 36 billion in advance for the 2024 dividend ratio of 10% in cash on July 26, 2024, based on the list of shareholders as of June 27, 2024. According to the resolution of the Annual General Meeting of Shareholders, the dividend ratio for 2024 is expected to range from 20-40% of charter capital.

Hoa Tho is a company with a tradition of paying dividends since 2013, with a stable ratio ranging from 20-30%, peaking at 60% in 2022 (including 40% in cash and 20% in stocks). The major beneficiary is its parent company, the Vietnam Textile and Apparel Group (Vinatex, UPCoM:VGT), which holds nearly 62% of its capital.

Supported by this attractive dividend policy, HTG‘s share price on the stock exchange surged by nearly 25% in a quarter to VND 38,200 per share (as of July 15, 2024), which is 2.5 times higher than its low in mid-November 2022 and marks a historical peak since its listing. Average trading volume since the beginning of the year has been less than 28,000 shares per day.

|

Price Movement of HTG Shares since the Beginning of 2024 |

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.