Illustrative image

Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank – code: HDB) has just announced its second public offering of bonds. Accordingly, HDBank plans to issue to the public the bond code HDBC7Y202302 with a par value of VND 100,000/bond, with a total issuance value of VND 1,000 billion.

This type of bond is non-convertible, non-warrant, unsecured, subordinated debt, and meets the conditions to be considered as Tier 2 capital for HDBank.

The bonds issued by HDBank have a floating interest rate applied for the entire term of the bond according to the formula: Interest Rate = Reference Rate + 2.8%/year. Interest is paid annually in arrears, on the day falling one year from the issue date.

The reference rate for each interest calculation period is the average interest rate of individual term deposits in Vietnamese Dong, with a term of 12 months and interest paid at maturity, as published on the official electronic information page (website) of the reference banks on the interest rate determination date. Reference Banks include the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV), Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank), Vietnam Joint Stock Commercial Bank for Industry and Trade (VietinBank), and the Bank for Agriculture and Rural Development of Vietnam (Agribank).

The bonds are offered by HDBank at a par value of VND 100,000/bond. The registration period for purchasing is from July 17, 2024, to August 07, 2024.

The bonds will be sold directly to investors at the head office/branches/transaction offices of HDBank and distributed through the issuing agent, Saigon – Hanoi Securities Joint Stock Company.

To avoid confusion, investors can only register to purchase a number of bonds that is a multiple of 500 for individual investors and a multiple of 1,000 for institutional investors.

According to the plan, HDBank expects to offer three bond issuances to the public with a total of 50 million bonds. In the first issuance, the bank offered 30 million bonds to the public, and the second and third issuances will each offer 10 million bonds.

The expected timeline for the third bond issuance of HDBank is in the second quarter to the fourth quarter of 2024. The purpose of the bond issuance is to supplement Tier 2 capital, improve the capital adequacy ratio, and meet the lending needs of HDBank’s customers.

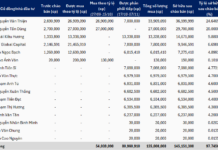

In terms of business performance, in the first quarter of 2024, HDBank recorded a consolidated operating income of VND 7,752 billion, up 37% over the same period in 2023. Pre-tax profit reached VND 4,028 billion, up 46.8% over the same period last year. Return on equity (ROE) reached 26.7%.

As of March 31, 2024, HDBank’s total assets reached VND 602,552 billion. Total capital mobilization reached VND 534,936 billion, of which customer deposits reached VND 378,829 billion, up 2.2% compared to the end of 2023.

In 2024, HDBank targets a pre-tax profit of up to VND 16,000 billion, an increase of 21.8% compared to 2023. The ROE ratio is expected to reach 24.6% while maintaining a low non-performing loan ratio of below 1.5%.