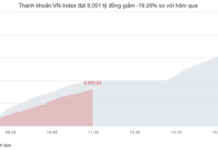

The VN-Index fluctuated around the reference threshold in the afternoon session after an initial upward trend, as cautious sentiment prevailed. The cautious domestic money flow, combined with persistent foreign selling pressure, resulted in a slight decline of 0.93 points for the index, closing at 1,279 points on July 15th. Trading liquidity on HOSE decreased to a low level, reaching 13,800 billion VND.

Foreign investors’ trading activities were a downside factor as they net sold sharply, with a value of 1,914 billion VND in the entire market.

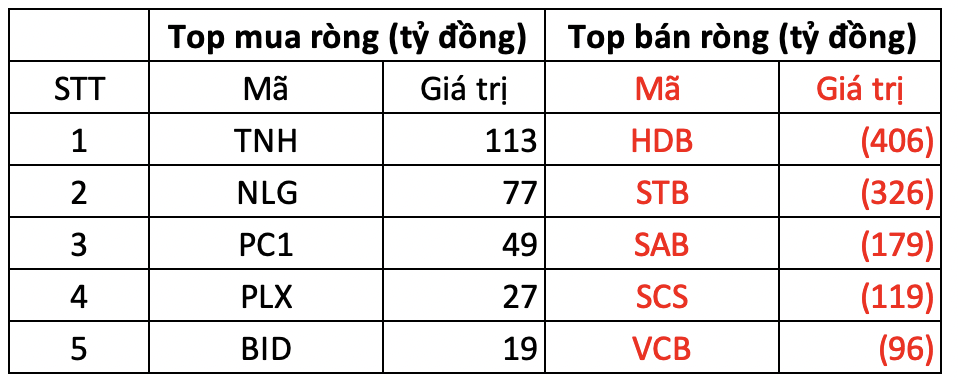

On the HOSE, foreign investors net sold 1,670 billion VND.

In the buying side, TNH shares were the focus of foreign investors’ net buying with a value of 113 billion VND. Following that, NLG and PC1 were the next two codes that were accumulated with values of 77 billion VND and 49 billion VND, respectively. Additionally, PLX was also bought for 27 billion VND.

On the opposite side, HDB and STB, two banking stocks, experienced the strongest selling pressure from foreign investors, with values of 406 billion VND and 326 billion VND, respectively. SAB and SCS also witnessed net selling of 179 billion VND and 119 billion VND.

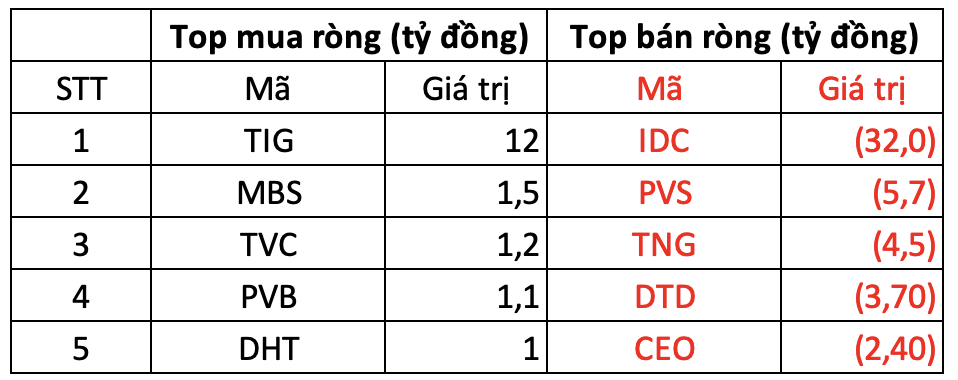

On the HNX, foreign investors net sold 43 billion VND

In terms of net buying, TIG was the most prominent, with a value of 12 billion VND. Additionally, MBS was the second most net-bought stock on the HNX, with a value of 1.5 billion VND. Foreign investors also spent a few billion VND to net buy TVC, PVB, and DHT.

On the selling side, IDC faced the most significant net selling pressure from foreign investors, with a value of nearly 32 billion VND. PVS, TNG, and DTD also experienced net selling pressure of a few billion VND.

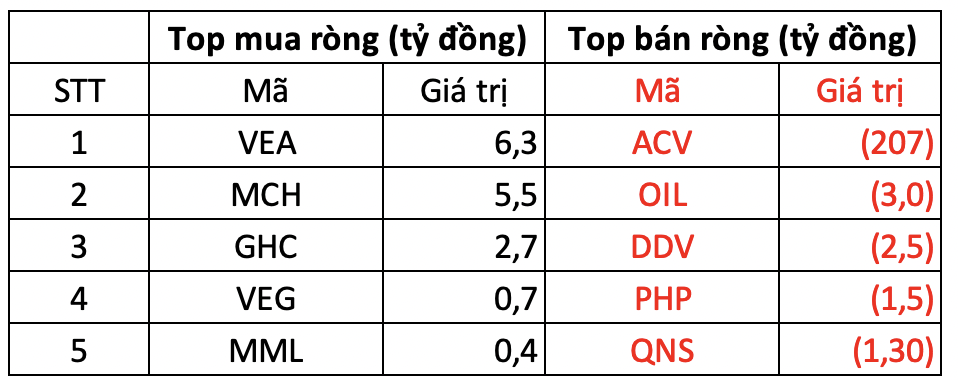

On the UPCOM, foreign investors net sold 201 billion VND

In contrast, ACV faced net selling pressure of nearly 207 billion VND from foreign investors. Additionally, they also net sold OIL, DDV, and other stocks.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.