The main index struggled to maintain its range-bound state, with adjustment dips appearing more frequently in the afternoon session as the VN30 group faced increased pressure. Individual efforts from GVR, VIC, and others were not enough to counter the dominant downward trend in the market. The HoSE saw nearly 300 declining stocks, with 16 decliners in the VN30 basket and only 9 gainers. HDB, VCB, HPG, and MSN were among the most negatively traded stocks.

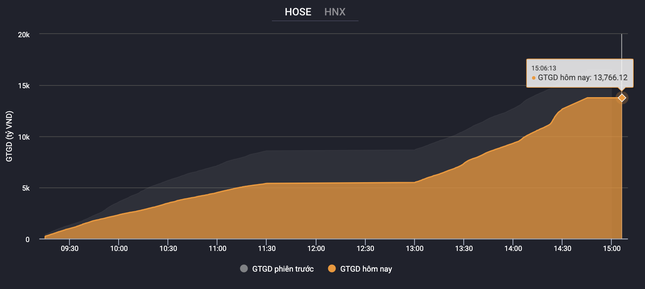

A significant decline in liquidity.

The market lacked consensus among large-cap sectors such as banking and real estate. The entire banking sector saw only three gainers, with MSB and TPB representing the HoSE. HDB reverted to red after yesterday’s net foreign buying of over 500 billion VND. Today is the ex-dividend date for HDB, as it prepares to pay a 2023 cash dividend of 10% (1,000 VND per share). The payment date is set for July 26. Just before the shareholder record date, HDB shares climbed to a historical peak of 25,300 VND per unit.

In the real estate group, VIC went against the market trend, rising as much as 3% at one point before narrowing to a 1.6% gain by the end of the session. The Vingroup also saw VRE and VHM slightly above the reference price. Meanwhile, the remaining stocks in the sector experienced strong differentiation, with HDG, DIG, GEX, KDH, and KBC among the decliners.

Liquidity plummeted, with MWG topping the trading list at just over 565 billion VND, followed by HPG at 517 billion VND. Investors remained cautious after the VN-Index failed to breach the previous peak, lacking a strong enough catalyst to lead the market.

The Hanoi Stock Exchange (HNX) recently published a list of stocks subject to warning, delisting, suspension, and trading restrictions. SD6 of Song Da 6 Joint Stock Company is at risk of mandatory delisting due to three consecutive years of losses (2021-2023). Earlier this year, Song Da 10 Joint Stock Company (SDT) was delisted for the same reason.

Hoa Phat Textbook Printing Joint Stock Company (HTP) will be delisted from July 29, with the last trading date on HNX being July 26, as the company fails to meet listing requirements due to enterprise restructuring.

At the close, the VN-Index fell 3.05 points (0.24%) to 1,280.75. The HNX-Index lost 0.37 points (0.15%) to 245.02, while the UPCoM-Index dropped 0.18 points (0.18%) to 98.14.

Liquidity declined, with HoSE’s matched orders reaching just over 13,700 billion VND. Net foreign selling resumed, exceeding 760 billion VND, focusing on VHM (304 billion VND) and MWG (124 billion VND), among others.

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”