In a recent hearing before Congress, the Chairman of the Federal Reserve, Jerome Powell, stated that the Fed will not wait for inflation to fall back to its 2% target before starting to cut interest rates. “We don’t want to wait until inflation is back down to 2%. If we wait that long, inflation could go back down and be well below 2%. That’s not what we want,” said Powell.

Following this statement from the Fed Chair, PSG.TS. Dinh Trong Thinh, an economic expert, shared that the Fed’s rate cut would have both positive and negative impacts on Vietnam’s economy, but the impact would not be significant as it has been anticipated.

Additionally, Mr. Thinh believed that the Fed might only lower interest rates by around 0.5% this year, resulting in a minimal impact on global interest rates and the overall landscape.

Firstly, the US dollar will depreciate, reducing the pressure on the VND-USD exchange rate.

Secondly, foreign investment inflows into Vietnam are expected to increase. Vietnam is a rapidly developing country, and with its stable exchange rates, it becomes an even more attractive destination for foreign investors.

Thirdly, the stock market may also witness an upward trend as foreign investors seek opportunities in emerging and rapidly developing markets like Vietnam. This leads to an influx of investors in both the direct and stock markets.

Fourthly, the State Bank of Vietnam has consistently maintained stable exchange rates, typically depreciating by just 2-3% annually against the US dollar. This mitigates negative impacts, ensuring that exports to the US remain largely unaffected. Conversely, imports from the US become more advantageous with the depreciation of the US dollar.

Overall, Mr. Thinh assessed that the early reduction in Fed interest rates has been anticipated and is unlikely to significantly impact Vietnam’s socio-economic landscape.

PGS.TS. Nguyen Huu Huan, a lecturer at the University of Economics in Ho Chi Minh City, opined that even if the Fed cuts rates earlier, it would likely happen towards the end of Q3 2024, with September being the earliest. Therefore, the impact on Vietnam’s economy would be minimal. He explained that policy shifts take time and that any reduction in Fed rates would be modest, ranging from 0.25% to 0.5%. As a result, there would be little impact this year, and any noticeable effects would likely occur next year.

The transmission of US policies to Vietnam takes time. Initially, it influences the sentiment of foreign investors. If the Fed is expected to reverse its policy, foreign capital flows may stabilize, reducing outflows from Vietnam as observed in the past, thereby supporting better exchange rates. Secondly, it impacts consumption abroad, leading to stronger economic recovery and increased consumption.

Fed’s Good News: US CPI Cools More Than Expected, Bolstering Rate Cut Prospects

Chairman Powell: Fed Won’t Wait for 2% Inflation Before Cutting Rates

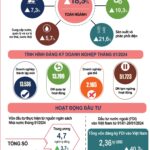

Vietnam’s Economic Landscape in the First Month of 2024

In January 2024, the country witnessed the reactivation of nearly 13.8 thousand businesses, which is 2.2 times higher than December 2023 and represents an 8.4% decrease compared to the same period in 2023. This resulted in a total of over 27.3 thousand newly established and reactivated businesses in January 2024, marking a 5.5% increase from the previous year.