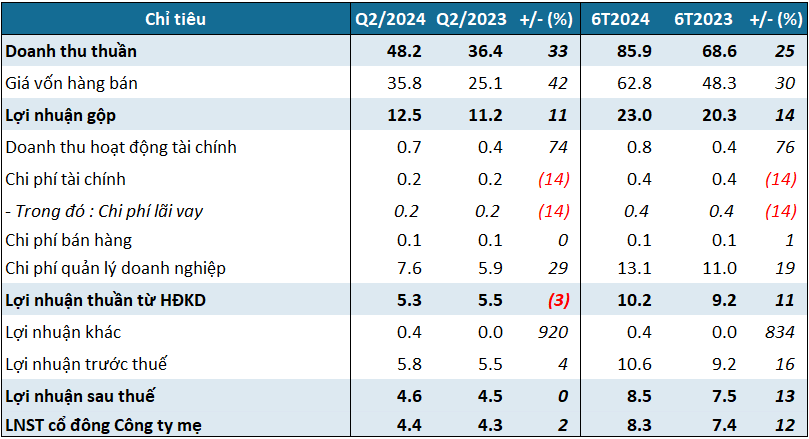

In Q2 2024, CCR’s net revenue increased by 33% year-over-year to over 48 billion VND. However, the cost of goods sold increased at a higher rate, causing a 5.1-percentage point contraction in gross margin. As a result, CCR’s gross profit increased by only 11%, reaching nearly 12.5 billion VND.

Operating expenses also put pressure on the company, with a 29% increase in selling and administrative expenses, totaling 7.6 billion VND.

Ultimately, CCR reported a net profit of over 4.4 billion VND for Q2, a modest 2% increase. For the first six months of the year, the company recorded nearly 86 billion VND in net revenue, a 25% increase year-over-year, with a 16% rise in pre-tax profit to over 10.6 billion VND and a 12% increase in net profit to nearly 8.3 billion VND.

For the full year 2024, CCR aims to achieve 170 billion VND in revenue and 20 billion VND in pre-tax profit, representing an 18% and 8% increase, respectively, from the previous year. The company has accomplished 51% of its revenue target and 53% of its profit goal for the year so far.

|

CCR’s Q2 and YTD 2024 Financial Results

Unit: Billion VND

Source: VietstockFinance

|

As of June 30, 2024, CCR’s total assets amounted to nearly 319 billion VND, a 4% increase from the beginning of the year, mainly comprised of fixed assets valued at nearly 262 billion VND (accounting for 82%).

In terms of capital structure, current liabilities accounted for only about 11%, equivalent to nearly 36 billion VND, despite a 20% increase from the beginning of the year, mainly due to short-term debt.

In the stock market, CCR’s share price closed at 13,900 VND per share in the latest trading session (July 12), representing a gain of over 25% since the beginning of the year. The average daily trading volume was nearly 2,800 shares. Notably, most of the fluctuations occurred during June and July.

| CCR Share Price Performance in 2024 |

Huy Khải

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.

Cen Land’s annual profits plummet to 2.5 billion VND, with nearly 60% of assets being accounts receivables.

Although the fourth quarter saw a reversal in profits, declining revenue resulted in Cen Land’s net profit for the entire year of 2023 only reaching 2.5 billion VND. It is worth mentioning that nearly 60% of the company’s assets consist of receivables from partners, with a total value of approximately 4,100 billion VND.