The State Securities Commission has officially published a draft circular amending and supplementing a number of articles in the circulars regulating securities trading on the securities trading system, securities settlement and payment, securities companies’ activities, and information disclosure in the securities market (referred to as the Draft Circular).

The amended draft circular introduces new regulations to facilitate foreign institutional investors by removing the requirement of having 100% pre-funding in their accounts before purchasing securities and ensuring equal access to information for foreign investors.

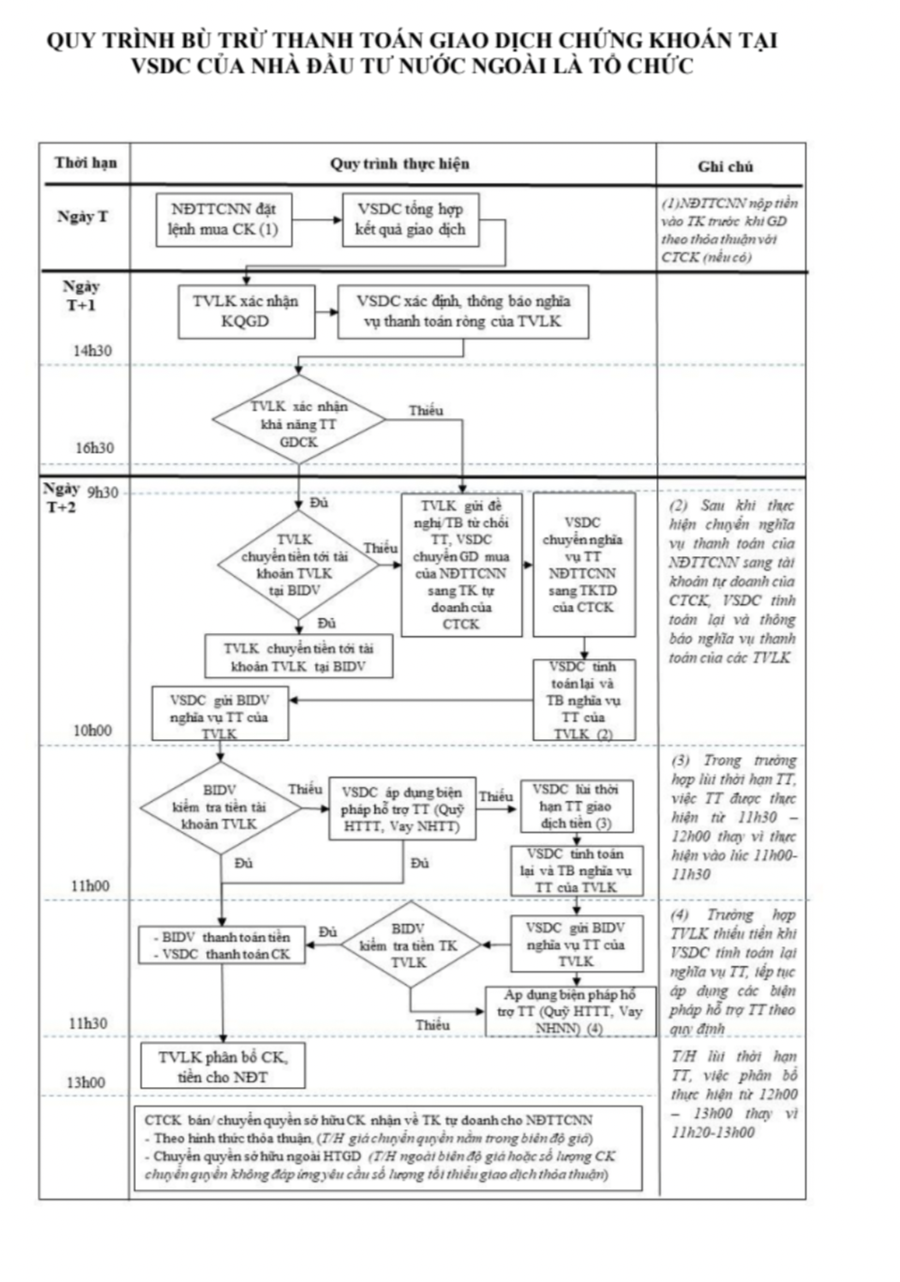

Accordingly, securities companies will assess the payment risks of foreign institutional investors to determine the amount of money required when placing buy orders for stocks, based on an agreement between the securities company and the foreign institutional investor.

In cases where the foreign institutional investor fails to make full payment for the purchase of stocks, the remaining payment obligation will be transferred to the securities company where the foreign institutional investor placed the order through its proprietary account, except in certain cases as specified in the draft.

The securities company is allowed to sell by agreement on the securities trading system or transfer ownership outside the system for the number of shares that have been transferred to its proprietary account for foreign institutional investors who lack funds to settle the stock purchase. This should be done by the next trading day after the shares are booked into the securities company’s proprietary account, provided that such transactions do not exceed the maximum foreign ownership limit prescribed by law for those shares.

Except for the above-mentioned transaction, the securities company shall sell the shares on the securities trading system. Any financial arrangements arising from the transaction shall be made in accordance with the agreement between the securities company and the foreign institutional investor or its authorized representative.

In cases where the foreign institutional investor placing a buy order fails to make full payment as prescribed, the Vietnam Securities Depository and Settlement Corporation will transfer the remaining payment obligation for the stock purchase to the securities company where the investor placed the order (through its proprietary account) on the payment date. The securities company must ensure sufficient funds for settlement.

Additionally, the draft circular proposes changing the deadline for foreign organizations to have sufficient funds in their accounts from 2:30 pm on T+1 (the day after the transaction) to 9:30 am on T+2. This reduces the time between when the foreign organization has to fulfill its payment obligation and when the securities are transferred to just a few hours, from 9:30 am to 1:00 pm on T+2.

Regarding equal access to information, the Draft Circular stipulates that the language for information disclosure in the securities market shall be Vietnamese. Listed companies, public companies, stock exchanges, and the Vietnam Securities Depository and Settlement Corporation shall simultaneously disclose information in English.

The information disclosed in English must be consistent with the content of the information disclosed in Vietnamese. In case of any discrepancy or difference in understanding between the Vietnamese and English information, the Vietnamese information shall prevail.

Listed companies and public companies shall simultaneously disclose periodic information in English according to the following roadmap: Large-scale listed companies and public companies shall disclose periodic information in English from January 1, 2025;

Large-scale listed companies and public companies shall disclose irregular information, information disclosed upon request, and information on other activities of the public company in English from January 1, 2026;

Public companies that do not fall under the above categories shall disclose periodic information in English from January 1, 2027;

Public companies that do not fall under the above categories shall disclose irregular information, information disclosed upon request, and information on other activities of the public company in English from January 1, 2028.

According to domestic and foreign experts, the solutions and new regulations in the draft circular are appropriate and feasible. The State Securities Commission expects that the issuance of this circular will positively impact the process of upgrading Vietnam’s securities market.

Speaking at the annual July Dialogue Forum on the theme “Upgrading, Capital Calling, and Developing Institutional Investors,” Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission, said: “Up to this point, there are still some opinions, but basically, there is a consensus on the main content among international investors. In the September review, we expect a positive outcome.”

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.