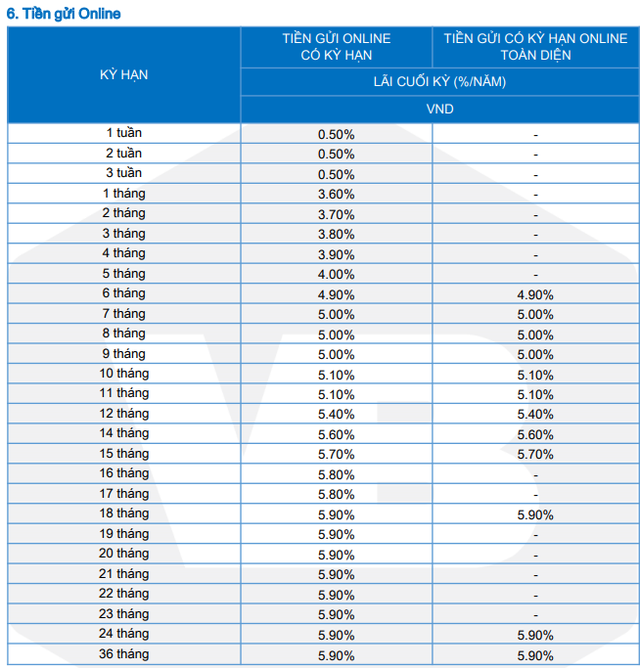

VietBank, or the Vietnam Commercial Joint Stock Bank, has made its third hike in savings interest rates this month. The bank has increased interest rates for several fixed deposit terms.

Specifically, according to VietBank’s online deposit interest rate table, the interest rate for 4-5 month terms has increased to 3.9% and 4.0% per annum, respectively. A 0.2% increase from before.

For the 7-9 month term, the interest rate has been adjusted to 5.0% per annum, a 0.3% increase. The 12-month term now offers an interest rate of 5.4% per annum, a 0.1% increase from the previous rate.

The interest rates for 1, 2, 3, and 6-month terms remain unchanged at 3.6%, 3.7%, 3.8%, and 4.9% per annum, respectively. The 18-36 month term also remains the same, offering an interest rate of 5.9% per annum.

VietBank’s latest savings interest rates.

After this adjustment, the 7-9 month term at VietBank officially reaches the 5% per annum mark. For the 18-36 month term, VietBank’s interest rate of 5.9% per annum is lower than that of NCB, OceanBank, HDBank, and BVBank. This rate is applicable for regular deposits.

Even though VietBank is not the bank with the highest deposit interest rates in the market, it consistently offers competitive and attractive rates to its customers.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

4 Factors Putting Pressure on USD/VND Exchange Rate in Q1/2024

With the currency exchange rate fluctuating in the first few weeks of 2024, Mr. Ngo Dang Khoa, Director of Foreign Exchange, Capital Markets and Securities Services at HSBC Vietnam, highlights four factors putting pressure on the USD/VND exchange rate in Q1/2024…