Illustration

According to the State Bank of Vietnam, as of May 31, 2024, credit outstanding in the real estate sector increased by 4.61% compared to the end of 2023, accounting for 21.51% of the total outstanding credit in the economy. Of this, the majority was real estate credit for self-occupied purposes, accounting for about 60% of total real estate credit outstanding, up 1.15% compared to the end of 2023. Credit outstanding for real estate business also grew by 10.29% over the same period, accounting for about 40% of the total outstanding credit.

With the total outstanding credit in the economy reaching over VND 14,034 trillion as of the end of May, the credit outstanding for the real estate sector stood at about VND 3,019 trillion, an increase of more than VND 133,000 billion compared to the beginning of the year. This marks the first time the real estate sector’s outstanding credit has surpassed the VND 3 quadrillion mark, setting a new record high.

Specifically, credit outstanding for self-occupied real estate reached VND 1,811 trillion, up VND 20,600 billion, while credit outstanding for real estate business exceeded VND 1,207 trillion, an increase of VND 112,700 billion.

Analysts attribute this growth to the recovery of the real estate market and low lending interest rates, which have fueled borrowing demand from both investors and home buyers.

In its recently published update on the real estate industry, Vietnam Credit Rating Joint Stock Company (VIS Rating) noted that the leverage ratio of real estate investors is expected to remain high as they increasingly rely on debt to finance new projects. In the first quarter of 2024, the leverage ratio of listed real estate investors, as measured by the debt-to-EBITDA ratio, increased to 3.4 times, up from less than 2 times before 2022, due to weak profits and rising debt.

“Real estate investors often utilize advance payments from customers during project launches to fund development. However, as many investors have not been able to launch projects yet, they will have to resort to new borrowing,” the company explained.

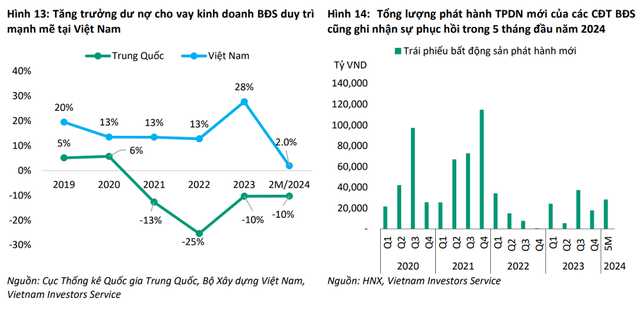

VIS Rating further added that improved access to new capital will help real estate businesses alleviate liquidity challenges stemming from significant bond maturities in 2024 and 2025. Analysts expect bank lending to the real estate business to increase by 16-18% in 2024.

Previously, leaders of many banks also affirmed that even when the economy is facing difficulties, banks are still not afraid to lend to the real estate sector if the projects have full legal grounds. Moreover, lending in this field is still considered to have great potential as the real estate market is gradually recovering.

At a meeting with analysts and an update on the first-quarter business results of 2024, CEO Jens Lottner shared that Techcombank’s real estate disbursement in the first quarter of 2024 was equivalent to that of the first or third quarter of 2022, before the market faced difficulties.

“This is a very good result, so at least from our perspective, the demand for real estate is huge….And the reason for Techcombank’s good business results is that we are financing a lot of projects with clear legal grounds that are ready for sale,” said Mr. Lottner.

According to the CEO of Techcombank, there are many investors who are customers of the bank and are in the process of handing over projects or in the pre-sale stage, which has led to an increase in the number of mortgage loans.

Regarding the issue of supply, Mr. Lottner said that there need to be more new projects. He pointed out that in the Ho Chi Minh City real estate market, only one housing project has been approved so far this year. Meanwhile, the northern market seems to be doing better, with projects like Vinhomes Hai Phong and Vinhomes Ocean Park currently being sold…

However, he noted that the demand for real estate remains strong. At the same time, Techcombank’s customers can still develop projects thanks to flexible pricing policies (offering preferential interest rates so that customers can choose payments that suit their financial situation).

“We believe that this trend will continue and the second half may be better. We believe that some projects with legal issues funded by other banks will also be resolved and the market will have more supply,” Mr. Lottner predicted. “Developers with clear and well-defined projects will be well-positioned in the market.”

“In terms of demand, investor confidence, readiness, and supportive factors such as low-interest rates and rising real estate prices” will continue, he added.

At the 2024 Annual General Meeting of Shareholders, VPBank CEO Nguyen Duc Vinh also stated, “Real estate is a potential field that brings great benefits to the bank.”

According to VPBank’s leader, although non-performing loans in real estate increased rapidly, almost 100% of the principal was recovered when the market recovered, and the rate of principal loss in real estate lending is much lower than in other fields.

The real estate market has seen many positive changes

According to recent information from the Ministry of Construction, the real estate supply, which has been limited for some time, is showing positive signs of improvement. Although the recovery is slow, the market is witnessing the return of many old projects that are being restarted and new projects that are being launched.

In the first half of the year, 18 commercial housing projects were completed, and 23 projects were newly licensed. For projects constructing infrastructure for land-use rights transfer for building houses, 32 projects were completed, and 16 projects were licensed. In the social housing segment, eight projects were completed in the past six months.

In terms of demand, the market recorded approximately 253,000 successful transactions, a 10% increase compared to the same period last year.

The Ministry of Construction assessed that the real estate market has reacted positively to various signals, including increased attention and information searches by customers and investors.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Impact of Overseas Vietnamese Remittances on Real Estate in Vietnam

The real estate market is expected to boom as the Land, Housing, and Real Estate Business Laws come into effect, opening the doors for overseas Vietnamese to purchase houses.