Market liquidity increased compared to the previous session, with the matched trading volume of the VN-Index reaching over 1.06 billion shares, equivalent to a value of more than 25 trillion VND. The HNX-Index also witnessed a trading volume of over 87 million shares, with a corresponding value of 1.9 trillion VND.

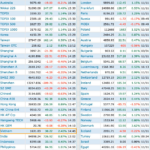

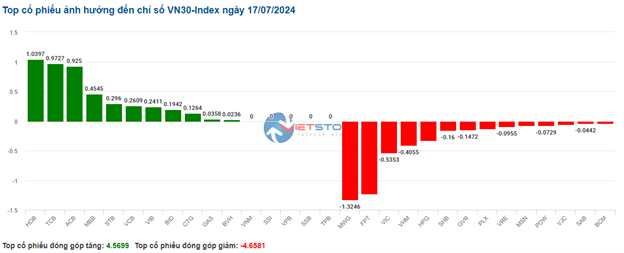

The VN-Index opened the afternoon session with a tug-of-war between buyers and sellers, and a strong selling force suddenly emerged, causing the index to plunge and remain in the red until the end of the session. In terms of impact, GVR, HVN, MSN, and FPT were the stocks with the most negative influence, taking away more than 5 points from the index. On the other hand, TCB, MBB, BID, and CTG were the stocks with the most positive influence on the VN-Index, contributing over 3.9 points.

| Top 10 stocks impacting the VN-Index on July 17, 2024 |

The HNX-Index followed a similar trajectory, influenced negatively by PVS (-3.49%), IDC (-2.66%), HUT (-2.86%), and VCS (-2.53%), among others.

|

Source: VietstockFinance

|

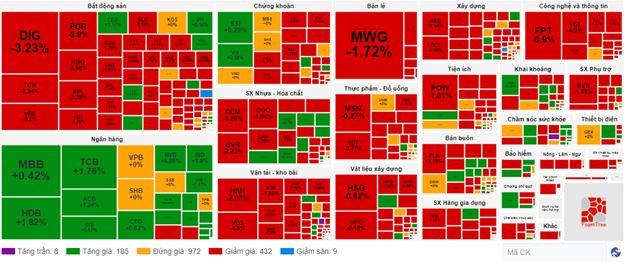

The plastics and chemicals manufacturing industry witnessed the sharpest decline in the market, falling by 5%, mainly due to the performance of GVR (-6.94%), DGC (-1.28%), DCM (-5.37%), and DPM (-4.99%). This was followed by the rubber products industry and the wholesale industry, which decreased by 3.62% and 3.42%, respectively. Conversely, the banking industry was the only sector to witness a strong recovery, rising by 1.32%, driven primarily by VCB (+0.11%), BID (+1.8%), CTG (+1.54%), and TCB (+4.41%).

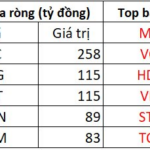

In terms of foreign trading, foreign investors net bought over 396 billion VND on the HOSE exchange, focusing on stocks such as MWG (126.29 billion), VCB (137.06 billion), FPT (111.75 billion), and TCB (101.72 billion). On the HNX exchange, foreign investors net sold over 14 billion VND, mainly offloading MBS (19.47 billion), NTP (4.59 billion), PVS (4.25 billion), and TNG (3.75 billion).

| Foreign Trading Net Buying and Selling |

Morning Session: “King” Stocks Support the Market

At the end of the morning session, a tug-of-war between buyers and sellers persisted, resulting in the market fluctuating around the reference level. The VN-Index decreased by 1.51 points, settling at 1,279.77 points, while the HNX-Index dropped by 0.68 points to 244.23 points. Bearish sentiment prevailed, with 466 declining stocks compared to 218 advancing stocks.

The trading volume of the VN-Index surged in the morning session, surpassing 409 million units and reaching a value of over 10.3 trillion VND. The HNX-Index recorded a trading volume of nearly 34 million units, with a corresponding value of over 759 billion VND.

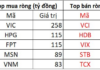

Amid multiple pressures, only two sectors managed to stay in the green: banking (up 1.1%) and insurance (up 0.13%). The remaining 23 sectors were dominated by red, with 15 sectors recording declines of less than 1% and the other 9 sectors experiencing drops of over 1%.

The banking group contributed the most to the index’s growth compared to other sectors. It was the only group with a majority of advancing stocks, providing crucial support to prevent a steep decline during the morning session.

Stocks such as VCB, BID, CTG, TCB, MBB, ACB, HDB, STB, VIB, SSB, TPB, EIB, OCB, MSB, NAB, and NVB all maintained their positive momentum. Meanwhile, VPB and LPB temporarily halted with slight losses at the end of the morning session.

Additionally, the insurance sector also made a positive contribution, driven by the strong performance of industry giants BVH and PVI.

On the other hand, the plastics and chemicals manufacturing industry experienced the most negative performance, declining by 1.94%, influenced by GVR (-3.14%), DGC (-1.36%), and DCM (-1.53%). This was followed by the rubber products industry, consulting services industry, and wholesale industry, which decreased by 1.84%, 1.66%, and 1.28%, respectively. The real estate sector also dipped into the red, falling by 1.26%, with notable declines in VHM (-1.06%), VIC (-1.34%), and BCM (-1.02%)…

Performance of Industry Groups at the End of the Morning Session on July 17. Source: VietstockFinance

|

At the end of the morning session, red dominated the market across sectors. The banking sector recorded the most positive performance, increasing by 1.1%. Conversely, the plastics and chemicals manufacturing industry experienced the sharpest decline, falling by 1.94%.

10:40 AM: Selling Pressure Intensifies

The sudden emergence of selling pressure reflected investors’ cautious sentiment, causing the major indices to narrow their early gains and turn negative. As of 10:40 AM, the VN-Index decreased by 4.52 points, hovering around 1,276 points, while the HNX-Index dropped by 1.13 points, trading around 243 points.

The VN30 group continued to witness mixed performance, with green and red stocks interspersed. However, the red stocks slightly outnumbered the green ones. Notably, MWG, FPT, VIC, and VHM subtracted 1.32 points, 1.23 points, 0.54 points, and 0.41 points from the index, respectively. Conversely, bank stocks continued their efforts to prop up the index, with HDB, TCB, ACB, and MBB maintaining their positive momentum and contributing over 3.3 points to the VN30-Index.

Source: VietstockFinance

|

The healthcare sector continued its upward trajectory in recent sessions, rising by 0.86%. However, the sector began to show signs of divergence, with some stocks turning red. While companies like DHG (+1.24%), DBD (+2.8%), and TRA (+0.36%) maintained their positive momentum, others such as IMP (-4.6%), DP3 (-2.47%), and TNH (-2.15%) dipped into the red.

Surprisingly, the banking sector re-emerged as a supporter of the index, with a majority of stocks trading in the green and the sector recording the second-highest increase of 0.79%. Notably, VCB (+0.57%), BID (+1.8%), CTG (+0.62%), and TCB (+1.54%) attracted strong buying interest since the market opened.

In contrast, the real estate sector continued to face headwinds, with most stocks trading in negative territory. Specifically, VHM (-0.92%), VIC (-1.1%), BCM (-1.61%), and VRE (-0.74%) witnessed declines. On the other hand, a few stocks showed signs of recovery, including LGL (+0.33%), PTL (+0.53%), and RCL (+1.6%).

Compared to the opening, the sellers gained the upper hand. There were 432 declining stocks versus 185 advancing stocks.

Source: VietstockFinance

|

Market Open: Healthcare Stocks Continue Their Uptrend

At the start of the July 17 session, as of 9:40 AM, the VN-Index gained over 2 points to reach 1,283.71 points. Similarly, the HNX-Index edged higher, climbing to 245.74 points.

Green dominated the VN30 basket, with 18 advancing stocks, 10 declining stocks, and 2 stocks trading flat. Notably, HDB, BID, VIB, and BVH were the top gainers. On the other hand, GVR, VIC, and PLX led the declining stocks.

As of 9:40 AM, healthcare stocks continued their upward momentum from the previous session and led the market higher. Stocks such as DHG (+1.41%), IMP (+4.39%), DHT (+8.21%), DBD (+4.25%), and DMC (+3%) recorded solid gains.

Following closely was the securities sector, which also contributed significantly to the market’s rise. Notable gainers in this sector included VND (+0.63%), SSI (+0.44%), SHS (+0.57%), VIX (+0.89%), BSI (+0.21%), MBS (+0.29%), and VCI (+0.1%)…