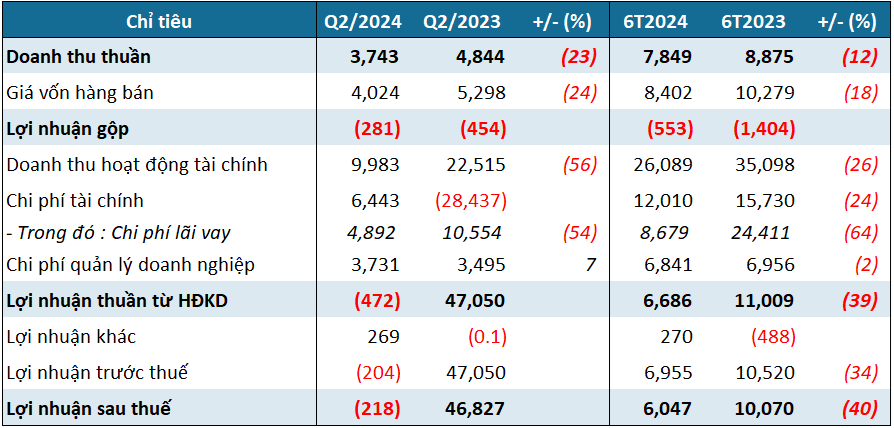

In Q2 of 2024, MHC reported a gross loss of over 281 million VND from its sales and service operations, primarily due to the inefficiency of its transportation services. Compared to the same period last year, MHC’s gross loss has decreased.

On the other hand, its financial activities generated a profit of over 3.5 billion VND. The company primarily earns profits through financial investments and securities.

However, the company’s administrative expenses remain high, totaling more than 3.7 billion VND, putting significant pressure on profits.

After deducting all expenses, MHC reported a net loss of 218 million VND, a significant decline from the nearly 47 billion VND profit it made in Q2 2023. During that period, the company benefited from high financial activity revenues, while recording a negative financial expense of over 28 billion VND due to the reversal of provisions for impairment of trading securities, investments, and others, amounting to nearly 39 billion VND.

The Q2 results slightly dragged down MHC’s cumulative pre-tax profit for the first half of 2024 to approximately 7 billion VND. Compared to the target pre-tax profit of 35 billion VND set for 2024, MHC has achieved less than 20% so far.

|

MHC’s Q2 and cumulative 6-month business results for 2024

Unit: Million VND

Source: VietstockFinance

|

As of June 30, 2024, MHC’s total assets exceeded 782 billion VND, a 9% increase from the beginning of the year. The majority of the company’s assets consist of financial investments and short-term receivables.

Specifically, the value of financial investments amounted to nearly 427 billion VND, accounting for 55% of MHC’s total assets, and representing a 15% increase from the beginning of the year.

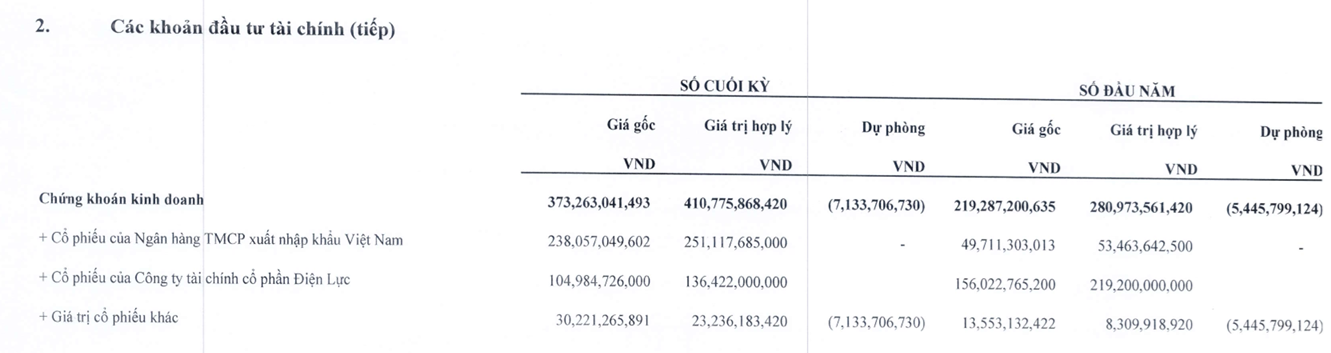

MHC’s primary investments are in short-term channels, mainly in stocks, valued at over 366 billion VND, a 25% increase from the start of the year. The largest proportion of the portfolio is an investment of over 238 billion VND in the shares of the Joint Stock Commercial Bank for Foreign Trade of Vietnam (HOSE: EIB), followed by an investment of nearly 105 billion VND in the shares of Electric Power Finance JSC (HOSE: EVF). MHC is currently holding provisions of over 7 billion VND for its investments in other stocks, totaling more than 30 billion VND.

At the end of Q1 this year, MHC’s stock investment portfolio included 105 billion VND in EVF shares, over 55 billion VND in shares of Long Son Petroleum Industrial Park Investment JSC (UPCoM: PXL), nearly 50 billion VND in EIB shares, and approximately 40 billion VND in other stocks.

Compared to the portfolio at the beginning of the year, the company has significantly shifted its focus by increasing investments in EIB and other stocks, while reducing its holdings in EVF and “surfing” PXL shares.

Source: MHC’s Q2/2024 Financial Statements

|

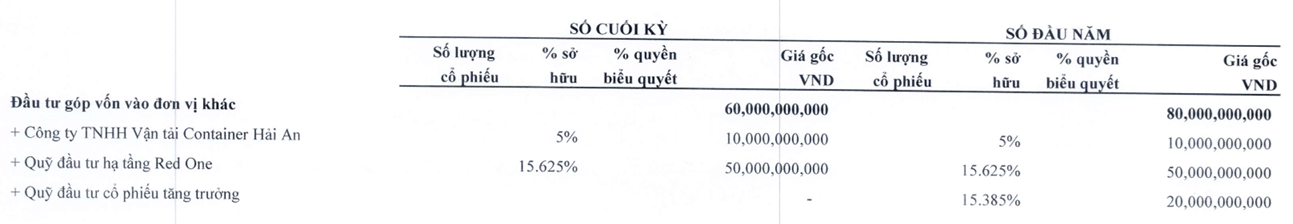

In terms of long-term investments, totaling nearly 61 billion VND, the majority is allocated to a 50 billion VND investment in the Red One Infrastructure Investment Fund (R1F) and 10 billion VND in Hai An Container Transport Co., Ltd. Compared to the beginning of the year, MHC no longer holds a 20 billion VND investment in the Red Stock Growth Investment Fund (R2F). Both R1F and R2F are member funds of Red Capital Investment Fund Management JSC (Red Capital).

Source: MHC’s Q2/2024 Financial Statements

|

Short-term receivables, valued at nearly 275 billion VND, also account for a significant proportion of total assets, approximately 35%. The majority of this amount, over 183 billion VND, is attributed to short-term lending.

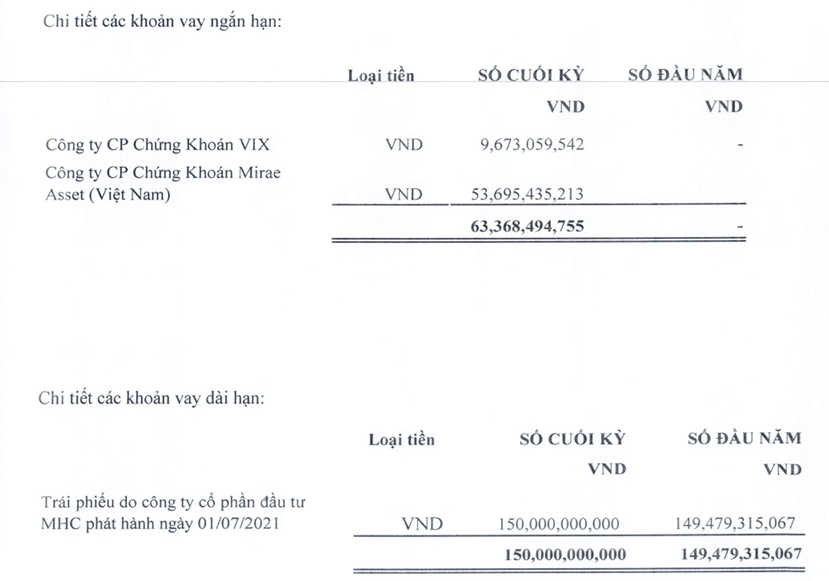

On the other side of the balance sheet, MHC has over 234 billion VND in payables, a 31% increase from the beginning of the year, representing 30% of total capital sources. The rise in debt is mainly due to the company’s new short-term borrowings of over 63 billion VND, including nearly 54 billion VND borrowed from Mirae Asset Securities (Vietnam) and almost 10 billion VND from VIX Securities.

Additionally, MHC has long-term debt of over 153 billion VND, of which 150 billion VND is attributed to bonds issued on July 1, 2021. These bonds are expected to mature on July 1, 2026, and are secured by a portion of the company’s investment in EIB shares and over 525,000 shares of Viglacera Ha Long JSC (HNX: VHL), as stated in the audited financial statements for 2023.

Source: MHC’s Q2/2024 Financial Statements

|

The actual total face value of the issued bonds is 300 billion VND, listed and traded on HNX since October 27, 2023, under the code MIV12101. The bonds carry a fixed interest rate of 9.4% per annum for all terms, and MHC has repurchased 150 billion VND of these bonds before maturity.

At the 2024 Annual General Meeting of Shareholders, MHC representatives shared that the company has been effectively utilizing the bond debt, while ensuring compliance with legal regulations regarding bond issuance, usage, and repayment. At the meeting, MHC’s focus on financial investment activities was also discussed by shareholders, who raised questions about the company’s recent involvement in the financial sector and its connections with VIX Securities, Red Investment Fund, and other partners.

Addressing the shareholders’ concerns, MHC representatives affirmed that there is no ownership relationship between MHC and the mentioned companies, and that all collaborations with partners are conducted transparently and in compliance with legal regulations. They also emphasized that the financial investments have yielded better profits compared to bank deposits.

MHC representative denies ownership ties with VIX Securities and Red Investment Fund

Huy Khai